Table of Contents

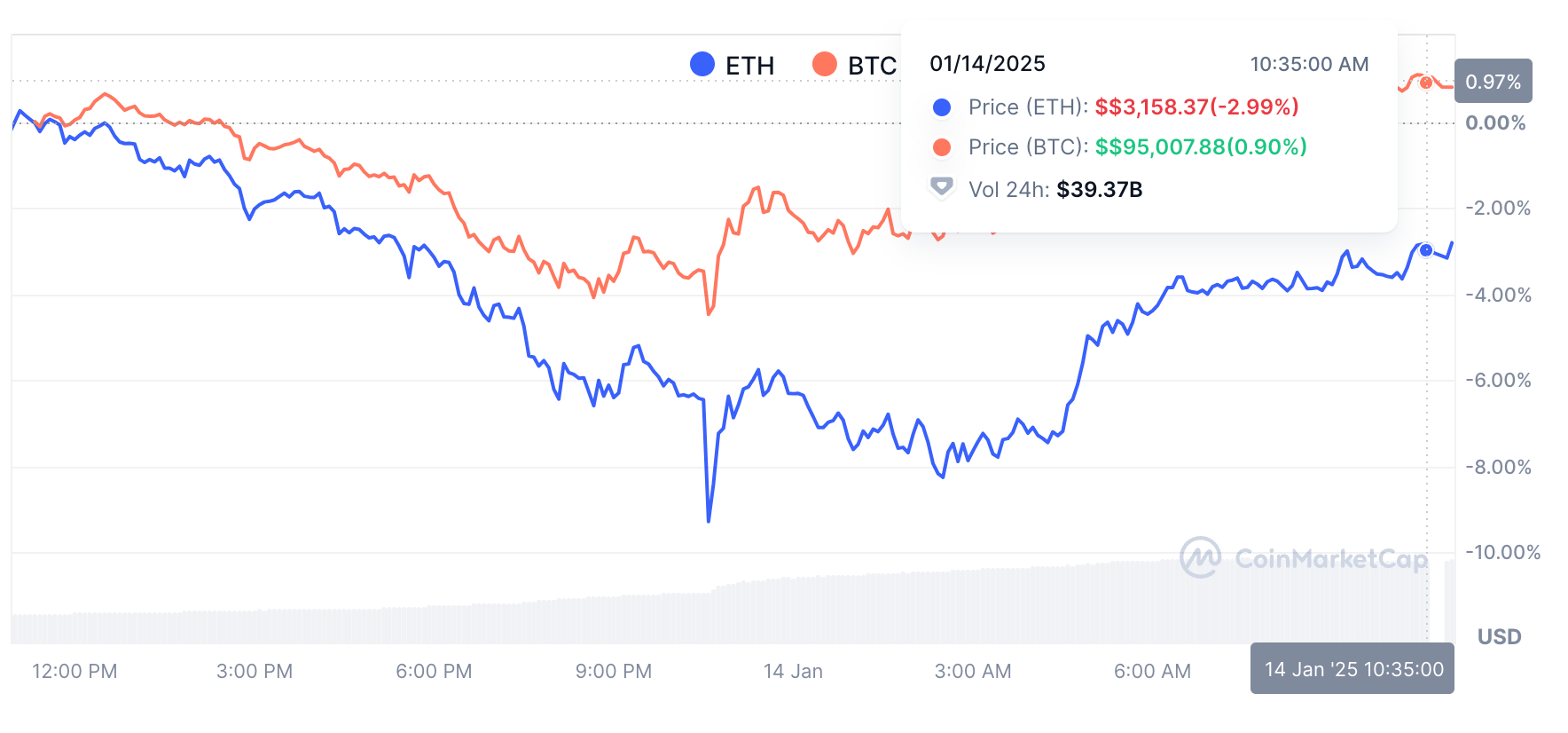

Bitcoin's price dipped below $90,000 on Monday, a level not seen since mid-November, before recovering to the $95K mark currently.

This decline follows a recent peak where the cryptocurrency traded above $108,000 and marks a notable shift in market sentiment. Ethereum, the second-largest cryptocurrency by market capitalization, also suffered, dropping below $3,000 – a roughly 20% decline from a month prior.

The downturn is largely attributed to growing doubts about the Federal Reserve's monetary policy, particularly regarding potential interest rate cuts in the face of a robust U.S. labor market.

Recent economic data, including a stronger-than-expected jobs report, has fueled speculation that the Fed may maintain or even increase interest rates rather than implement the anticipated cuts. This shift in expectations has put pressure on risk assets across the board, including both Bitcoin and Ethereum.

BRN analyst Valentin Fournier said that the resilient labor market has led to a reassessment of the Fed's likely course of action, with some now believing that the rate-cutting cycle may be over or significantly slowed.

The prospect of higher interest rates generally has a negative impact on riskier assets like cryptocurrencies. Lower interest rates tend to stimulate investment and spending, which can benefit assets like Bitcoin and Ethereum. Conversely, higher rates can dampen investor appetite for riskier ventures.

Crucially, market participants are now looking ahead to key economic data releases that will further shape expectations about the Fed's next moves. The Consumer Price Index (CPI) numbers, due on Wednesday, will provide a crucial snapshot of inflation.

"A higher-than-expected CPI reading could further solidify expectations of a more hawkish Fed stance, potentially putting even more downward pressure on crypto prices. Additionally, the central bank's Beige Book on economic activity, also due on Wednesday, will offer insights into the overall health of the U.S. economy and could influence the Fed's policy outlook," Fournier noted.

While the long-term impact of President-elect Trump's policies on the crypto market remains a topic of discussion, with his campaign promises of a more crypto-friendly regulatory environment, the immediate pressure on Bitcoin appears to be driven by these macroeconomic factors.

The decline in Bitcoin's price was also mirrored by a general downturn in technology stocks, particularly those popular with retail investors. Companies like Nvidia, Palantir, and Rigetti Computing experienced drops on Monday, reflecting broader market anxieties about rising bond yields and the potential for tighter monetary policy.

As of Tuesday morning, Bitcoin has slightly recovered to $95,000, while Ethereum remains down by approximately 5% to $3,161.