Table of Contents

MicroStrategy's large Bitcoin purchases and the associated debt load have brought the spotlight back on Michael Saylor's plan.

Some market watchers are cautioning on MicroStrategy's debt.

The software company from the dot-com era, now functioning as a Bitcoin proxy and whose shares are managed by a fund advised by SkyBridge, has captivated Wall Street this year with a share increase above 400%.

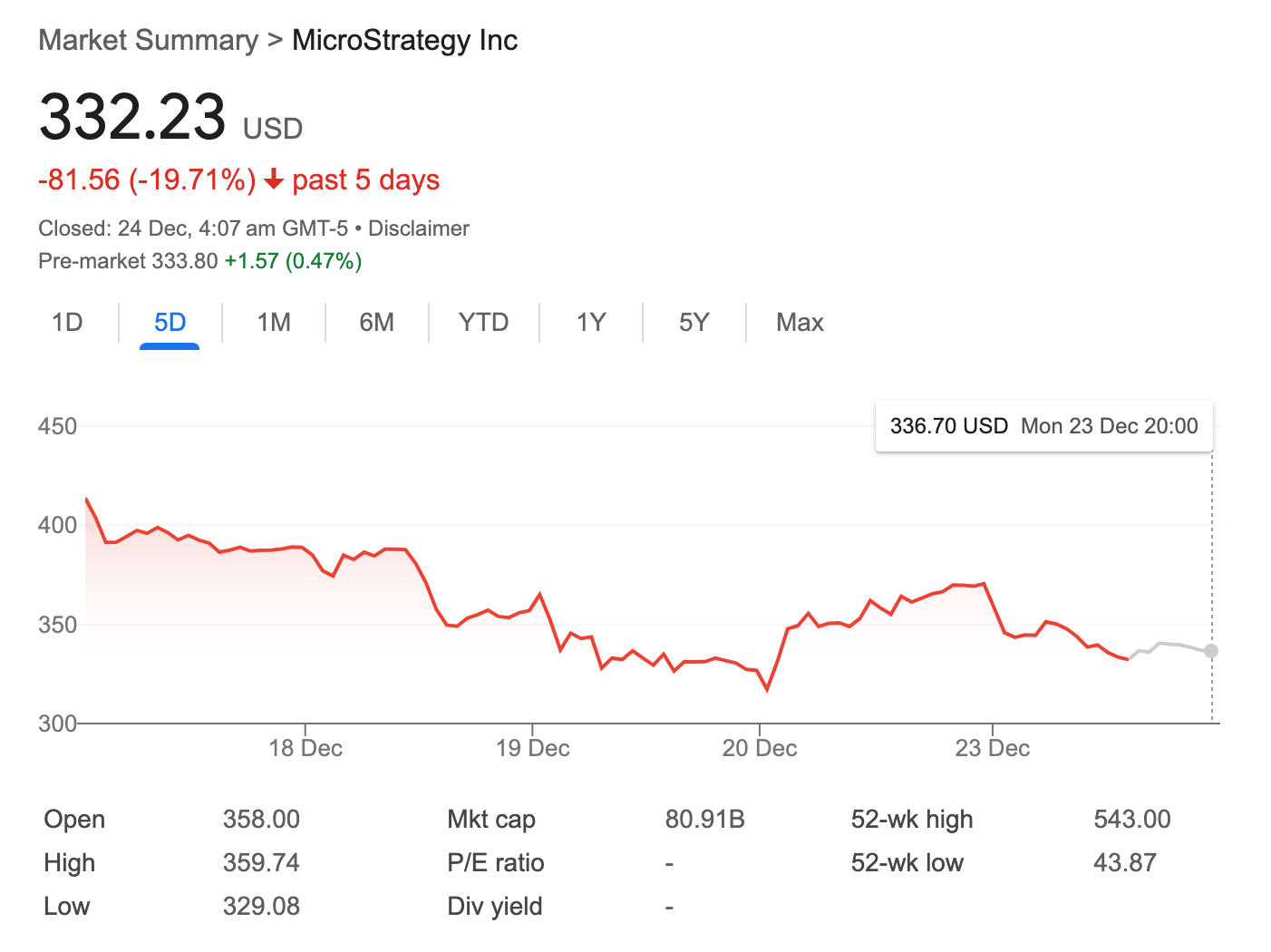

However, the Donald Trump euphoria-inducing straight-up trajectory of Bitcoin lost momentum, causing Michael Saylor's MicroStrategy to fall by almost 10% last week – a slide that continued this week.

This comes while the company acquired billions of dollars in Bitcoin financed through stock and convertible debt sales.

The acquisition has raised concerns that a decline in Bitcoin's price could hinder MicroStrategy's ability to service its debt, potentially necessitating the liquidation of its coin holdings and further weighing on the OG token's price.

Most recently, MicroStrategy acquired 5,262 BTC for $561 million – $106,000 per BTC. The company's Bitcoin holdings have grown to 444,262 BTC following its acquisitions, with an average purchase price of $62,257 per Bitcoin.

MicroStrategy has acquired 5,262 BTC for ~$561 million at ~$106,662 per bitcoin and has achieved BTC Yield of 47.4% QTD and 73.7% YTD. As of 12/22/2024, we hodl 444,262 $BTC acquired for ~$27.7 billion at ~$62,257 per bitcoin. $MSTR https://t.co/asDGerBV7q

— Michael Saylor⚡️ (@saylor) December 23, 2024

MicroStrategy owns over $7.2 billion in outstanding convertible debt, with roughly $6 billion issued this year.

Convertible securities have become favoured by hedge funds, which utilize the notes in market-neutral arbitrage strategies that capitalize on the increasing volatility of the underlying asset.

The First Trust SkyBridge Crypto Industry and Digital Economy ETF, sub-advised by SkyBridge Capital II, LLC, includes MicroStrategy among its top three holdings.

According to Benzinga, Anthony Scaramucci, founder and managing partner of the hedge fund SkyBridge Capital, has defended MicroStrategy's Bitcoin strategy.

He also forecasts sustained growth in cryptocurrency.

Benzinga reported that Scaramucci has downplayed apprehensions over Michael Saylor and MicroStrategy, asserting that predictions of a possible collapse owing to Bitcoin's volatility are overstated.

During a Friday interview, Scaramucci cited Saylor's long-term debt plan as a testament to MicroStrategy's resilience.

"People think if Bitcoin crashes, he is going to implode," Scaramucci said during the interview.

He added, "But if you really study his balance sheet, he has long, long-term debt, and he has rolling long-term debt. You'd have to have a systemic collapse in Bitcoin lasting six or seven years to flash him out."

The questions raised by some get into the specifics, to which Scaramucci said,

"The narrative of him being forced to sell hundreds of thousands of tokens into the market, I think it's a forced narrative."

He added, "But I base that on having been on Wall Street for 35 years, I understand what imploded Lehman Brothers," and that was their debt structure.

Bitcoin has declined following its peak of over $108,000 on Tuesday, driven by excitement regarding President-elect Donald Trump's pro-cryptocurrency policies.

Although numerous proponents anticipate that the OG token, valued at almost $1.9 trillion, will continue its unprecedented ascent, Scaramucci stated that forecasting price fluctuations is challenging.

Scaramucci said, "The big problem is, you can never really predict what it's going to be. But if you said to me, could we have a 30% to 40% correction in crypto next year, bring it back to $60,000-$70,000, — absolutely."

He asserted that the Bitcoin ETFs, along with anticipated favourable legislative measures, should maintain Bitcoin's price over $50,000. He stated that the coin is expected to appreciate over the long term.

On the market cap, he said, "Could it get to $18 trillion? We believe that it could."

"Is it a direct line to $18 trillion? No, he signed off."

Elsewhere

Blockcast

In this episode, host Takatoshi Shibayama speaks to Kain Warwick, founder of Infinex, and a renowned figure in the DeFi space, known for his work on the Synthetix protocol.

Warwick argues that the current crypto landscape, dominated by centralized exchanges, is unsustainable and hinders innovation. He outlines Infinex's vision to create a decentralized platform that rivals the convenience and accessibility of centralized exchanges while offering superior functionality and empowering users with true self-custody.

Previous episodes of Blockcast can be found on Podpage, with guests like Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

Events

Consensus (Hong Kong, 18-20 February)

Consensus is heading to Hong Kong, bringing together the industry’s most important voices from East and West for pivotal conversations and deal-making opportunities.

Consensus Hong Kong convenes global leaders in tech and finance to debate pressing issues, announce key developments and deals, and share their visions for the future.

Use promo code BLOCKDESK20 at checkout for a 20% discount on tickets here.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!