Table of Contents

Bitcoin hits a new peak, continuing a rally that was ignited by support for digital assets and President-elect Donald Trump's ambitions to position the United States as the leading player in this industry.

Trump is progressing towards establishing a favourable regulatory environment for digital assets, reversing the restrictions implemented by President Joe Biden's preceding administration.

The boost to the crypto industry is clear and expected to remain at play next year.

At one time on Monday in Asia, the biggest token jumped over 3% to a record $106,493, surpassing its prior record on December 5.

Optimism in the cryptocurrency market as a whole was boosted by the advance in the OG token.

Apart from the largest crypto doubling in price this year, Ether, the second-ranked token, and Dogecoin, the meme-crowd favorite, have also seen their prices surge.

With Sunday's gains, Bitcoin extended its winning streak to seven weeks, its longest since 2021.

Gains, however, have slowed in recent trading sessions.

Since Trump's victory on November 5th, US exchange-traded funds (ETFs) investing directly in Bitcoin have received net inflows of $12.2 billion in the same time frame, and subscriptions for Ether's comparable products hit $2.8 billion.

What's helping Bitcoin is the spirit of speculators even as momentum has stalled somewhat in global stocks.

The post-election frenzy in big US stocks was ultimately muted last week by a five-day run-up in Treasury yields.

However, at the most extreme ends of the market, Bitcoin and its relatives continue to push the boundaries of speculation.

For the second time in over a month, gamblers on the periphery drove prices up, propelling Michael Saylor's MicroStrategy beyond $400 and sparking a surge in a crypto token called "fartcoin" that saw its market value soar above $700 million.

Bitcoin bounced back above $100,000.

During his visit to the New York Stock Exchange, Trump pledged to "do something great with crypto" during his presidency, which coincided with the surge.

These gains highlight the persistence of day traders during a week when the main US equity indexes had their lowest weekly movements since Trump's re-election.

Speculators were unfazed even when the US 10-year yield spiked 24 basis points — the largest of the year.

In addition to flooding the market with cryptocurrency, they kept pouring money into leveraged exchange-traded funds and anything associated with Elon Musk.

Meme traders were steadfast despite a rather gloomy week for traditional risk-taking, which witnessed numerous long-standing trades facing challenges.

During the five days, a momentum stock long-short basket tracked by Morgan Stanley fell about 3.5%, marking its third-worst week so far this year.

The Russell 2000 and an index of tech businesses that have not yet turned a profit recorded a 3% decline.

The 0.6% decline in the S&P 500 ended a three-week winning streak.

Less than half of the index's components were trading above their 50-day moving average, further diminishing the breadth of 2024's rally.

A more than 4% decline marked the worst week for the largest long-dated Treasuries ETF this year.

The market is still operating at full throttle outside of the more restrained areas. Following Tuesday's plunge below $95,000, which suggested weakness, Bitcoin swiftly recovered and posted its sixth consecutive weekly gain.

A plethora of questionable meme tokens rallied with the biggest digital asset.

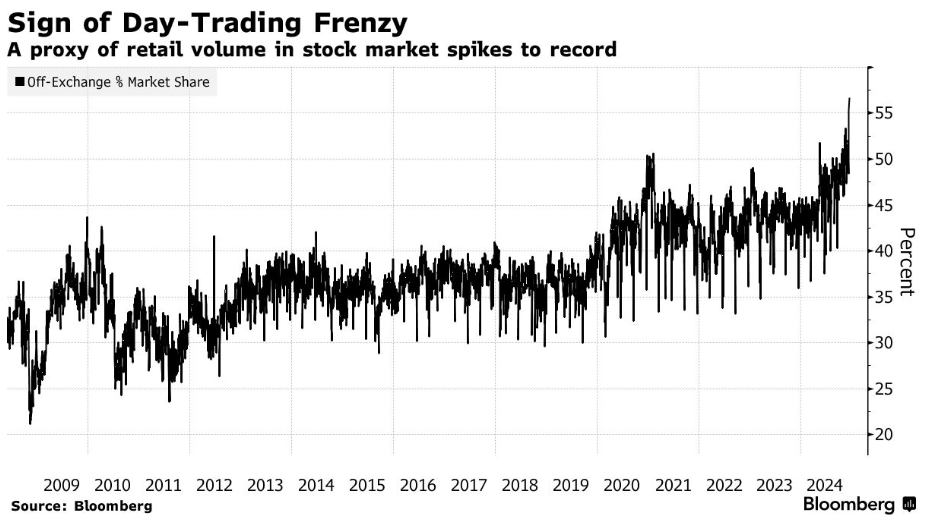

There has been no let-up in the market domination of small-guy investors.

As a stand-in, the number of trades conducted through non-exchange venues—those operated by equity wholesalers catering to clients like Robinhood Markets—has surged to over 50% and just reached an all-time high.

An indicator shows the market is stretched. Goldman Sachs Group tracks risk-on positioning and mood. It tracks flows to equities futures and optimistic stock options. More than half of those indicators are at significantly elevated levels, and the risk-on sentiment gauge has hit its highest since 2018. A reversal has followed comparable readings.

Elsewhere

Blockcast

In this episode, Takatoshi Shibayama sits down with CEO of Future DAO and Ethelo Decisions, Mathew Markman.

Blending Web3 with cutting-edge decision-making tools to empower communities and transform financial and governance systems, Markman has made significant strides in the Web3 space.

Previous episodes of Blockcast can be found on Podpage, with guests like Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

Events

Consensus (Hong Kong, 18-20 February)

Consensus is heading to Hong Kong, bringing together the industry’s most important voices from East and West for pivotal conversations and deal-making opportunities.

Consensus Hong Kong convenes global leaders in tech and finance to debate pressing issues, announce key developments and deals, and share their visions for the future.

Use promo code BLOCKDESK20 at checkout for a 20% discount on tickets here.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!