Table of Contents

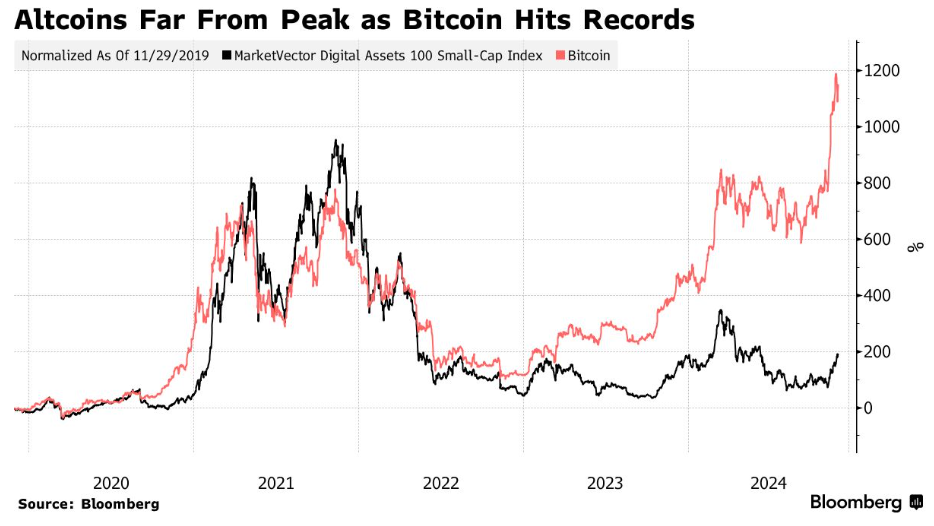

The chart-bursting rally in cryptos, which has over $1 trillion in market value, is still missing the pre-pandemic euphoria. Retail investors are on the sidelines, and Bitcoin is struggling to breach a historical and psychological level of $100,000.

The dramatic increase in Bitcoin trading activity demonstrates a strong uptick in interest from the retail sector.

Nevertheless, the levels observed in past cycles have yet to materialise, indicating that many individual investors are still observing from the sidelines.

When speculation over Bitcoin reaches a fever pitch, known as FOMO (Fear Of Missing Out), investors flee to lesser-known tokens or altcoins.

Despite President-elect Donald Trump's pro-crypto policy and Bitcoin's record-breaking run, several altcoins are trading lower than their highs during the pandemic.

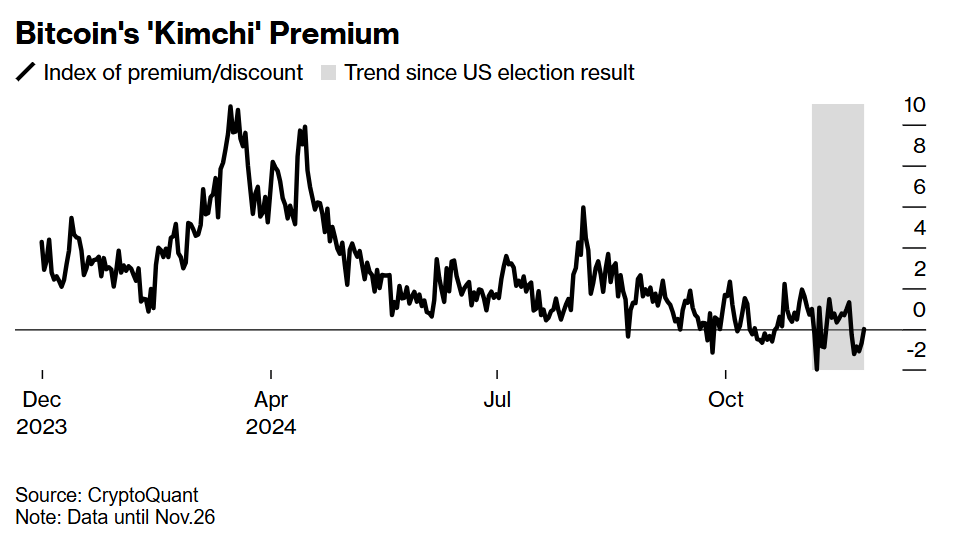

Another pertinent measure is the Kimchi premium in South Korea, which compares the local price of Bitcoin to its overseas counterpart.

The premium tends to balloon during market manias, but it's completely nonexistent right now.

Investor anxiety over missing out has not yet returned to levels seen in 2021. Only a small percentage of alternative cryptocurrencies are showing signs of success.

Separately, a worldwide measure of the demand for digital collectables based on blockchain technology known as nonfungible tokens (NFTs) is now hovering around 20% of its all-time high.

Attention is focused on the crypto market because momentum is crucial in a rally, and regular mom-and-pop investors have not yet fully embraced the new boom, as shown during the pandemic.

This may be due to traumatic recollections of the rapid implosion of the bubble in 2021, or the other way to look at it is that the rally has more venom left.

There are those who believe that regular investors are already getting involved, pointing to the record high of popular altcoin Solana, the surge in crypto exchange app downloads, and the explosion of meme-coins on social media as evidence.

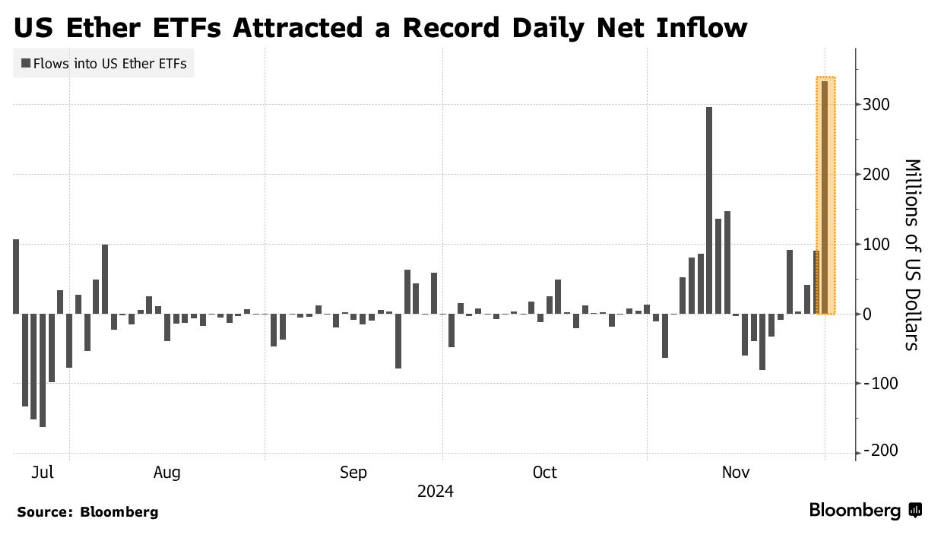

Trump's promise to free the cryptocurrency industry from regulatory constraints has boosted the demand for exchange-traded funds that invest directly in Bitcoin and Ethereum.

Clearly, institutional investors are on a tear with Bitcoin and Ethereum, with ETFs for both tokens logging record inflows in November as traders predict a friendlier regulatory stance under Trump 2.0.

Long-term investors' euphoria now seems to echo their enthusiasm right after the US SEC gave a green signal for Bitcoin ETFs in January this year.

Bloomberg reports that Bitcoin ETFs and Ether ETFs both had record monthly net inflows in November, at $6.5 billion and $1.1 billion, respectively.

Additionally, the number of daily Ether ETF subscriptions reached a record high on Friday.

With Trump's US election triumph on November 5, there is a growing speculative desire for cryptocurrency, as seen by the interest in Ether, the second biggest token after Bitcoin.

However, according to several measures, the demand for digital asset exposure among individual investors has not yet returned to the fever pitch of the bubble that occurred during the pandemic.

On November 29, the nine Ether ETFs had a net inflow of $333 million driven by the iShares Ethereum Trust and the Ethereum Fund from BlackRock and Fidelity Investments, respectively.

When looking at fund size, the top issuers of digital-asset portfolios are crypto specialists Greyscale Investments, BlackRock, and Fidelity.

Bitcoin was last changing hands at $97,880, having briefly approached a new record high of just about $300 shy of $100,000 last month.

Ether was trading at around $3,730.

Since Trump's victory, Ether has outpaced Bitcoin, although it has yet to reach new heights.

The fourth-largest digital asset, XRP, continued its meteoric rise, hoping that Trump would reverse the SEC's crackdown.

Several financial institutions are considering initial coin offerings (ICOs) for XRP.

With the promise of more accommodating regulators, Trump has pledged to reverse the digital asset crackdown enacted by the Biden administration.

The Republican also supports the establishment of a US strategic Bitcoin reserve.

Trump shifted his stance from scepticism to support for the cryptocurrency industry as it utilised its election campaign war chest to further its interests.

According to data compiled by CoinGecko, crypto market capitalisation has increased by about $1.2 trillion since Trump's victory.

A terrible implosion revealed fraudulent and risky activities at the core of the 2021 boom, but the latest rally is dulling those memories.

Elsewhere

Blockcast

In this episode, Takatoshi Shibayama sits down with Jason Choi, general partner at crypto prop shop Tangent, for a candid exploration of crypto markets. Choi discusses meme coin supercycles, navigating macroeconomic headwinds, and the evolution of project evaluation from speculative hype to real-world traction.

Previous episodes of Blockcast can be found on Podpage, with guests like Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

Events

BRN Goes Live on Money FM (Singapore, 4 December 5:10pm)

BRN analyst Valentin Fournier will be going LIVE with Hongbin Jeong on Money FM Singapore's "The Wealth Tracker" to discuss where Bitcoin is headed.

Tune in here at 5:10 pm on 4 December!

BRN analyst Valentin Fournier will be going LIVE with Hongbin Jeong on @moneyfm893's "The Wealth Tracker" to discuss where #Bitcoin is headed next!

— BRN (@thebrn_co) November 29, 2024

📅 5:10pm SGT, Wed 4 Dec

👉 https://t.co/yw1lmpJ3Vp pic.twitter.com/Rx20sloSod

Consensus (Hong Kong, 18-20 February)

Consensus is heading to Hong Kong, bringing together the industry’s most important voices from East and West for pivotal conversations and deal-making opportunities.

Consensus Hong Kong convenes global leaders in tech and finance to debate pressing issues, announce key developments and deals, and share their visions for the future.

Use promo code BLOCKDESK20 at checkout for a 20% discount on tickets here.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3!

There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers. So be sure to sign up!