Table of Contents

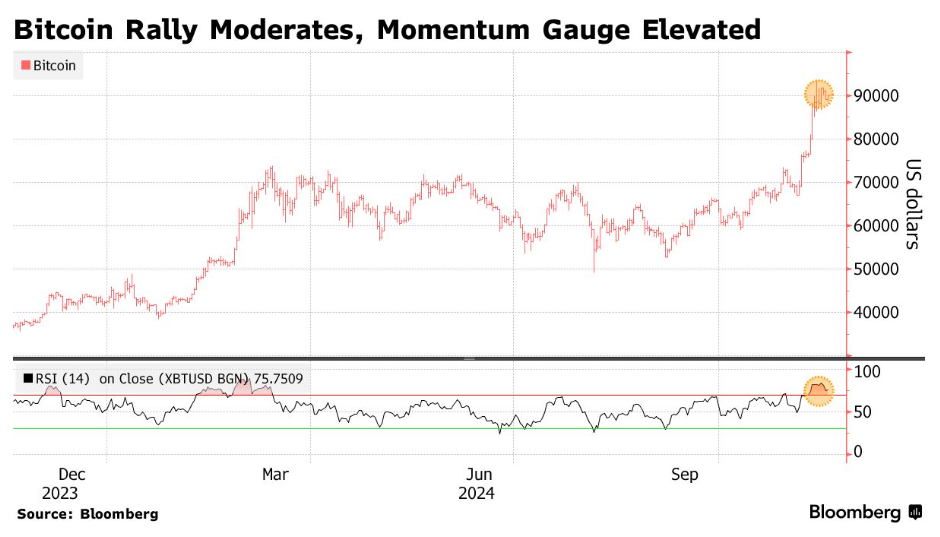

After the top crypto token climbed to a fresh all-time high last week in a chart-bursting rally anticipating a more crypto-friendly government, traders inspired by Donald Trump's election triumph are already looking ahead to a historic price of $100,000 by the end of the year.

However, the speculative fervor cooled since Thursday after Bitcoin hit a record of near $93,500.

The largest digital asset fell below $87,000 at one point on Friday as Federal Reserve Chair Jerome Powell said that there was no urgency for interest rate cuts when the economy was holding up well.

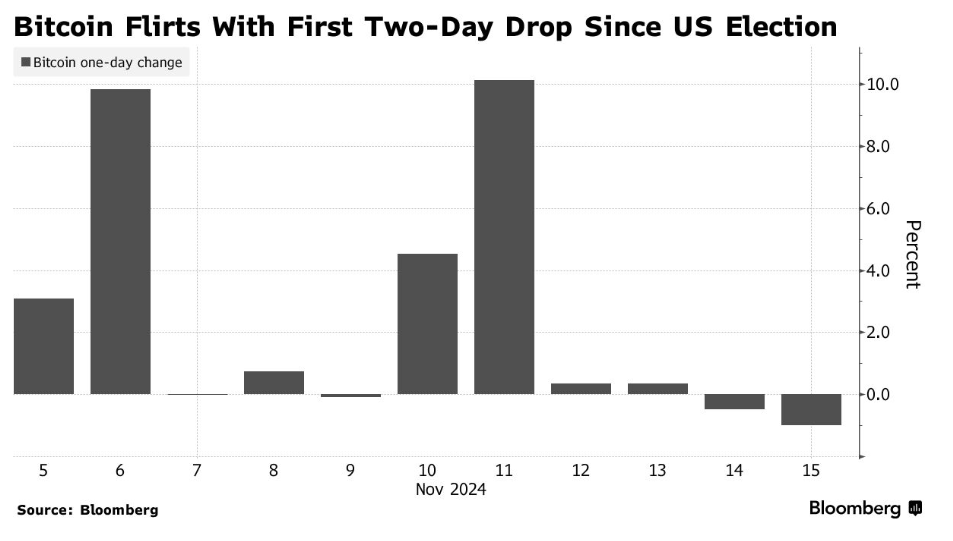

Over the weekend, Bitcoin had its largest two-day decline since the US election. Traders worldwide are being cautious as they evaluate the possible effects of President-elect Trump's policy program. The digital asset fell about 3% over the weekend.

Some unanswered questions include how soon Trump will fulfil his crypto promises and whether or not they are entirely realistic, such as creating a US Bitcoin reserve.

K33 Research indicates a decline in the premium for Bitcoin futures listed on CME relative to spot market pricing. American institutional investors leverage these contracts to establish a presence in the initial coin.

Amberdata indicates a rise in the number of contracts exhibiting open interest, especially for bearish options set at a $80,000 strike price.

However, the token pared some of those losses over the weekend to churn above $90,000 on Monday. In reaction to Trump's pro-crypto position, the price of bitcoin has increased by almost 30% since the US election on November 5. Speculators are questioning the rally's remaining power even as the digital asset is now part of a series of Trump trades.

An established strategic Bitcoin stockpile and a crypto-friendly United States are one of the goals of Trump's administration.

Trump, who had previously been sceptical of crypto, reversed course after receiving substantial campaign contributions from digital asset corporations.

The practicality and timeliness of his commitments are still up for debate.

According to Bloomberg data, US exchange-traded funds (ETFs) investing directly in Bitcoin received a net inflow of $4.7 billion between November 6 and November 13, the day the original cryptocurrency reached its all-time high.

However, during the course of Thursday and Friday, the ETFs saw outflows of almost $771 million.

Options traders, energized by Donald Trump's election victory, are setting their sights on a significant milestone of $100,000 for the OG crypto. This milestone follows its rise to a new record fueled by expectations of a more crypto-friendly administration.

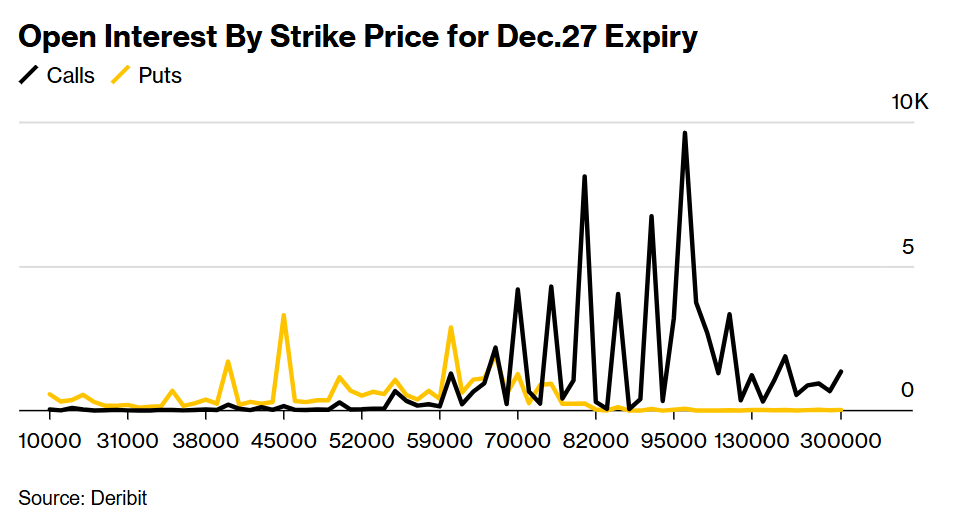

Data from the crypto options exchange Deribit indicates that investors are positioning themselves to help Bitcoin reach this significant milestone by the end of the year.

The $100,000 bets reflect a significant increase in institutional engagement with Bitcoin within the options market.

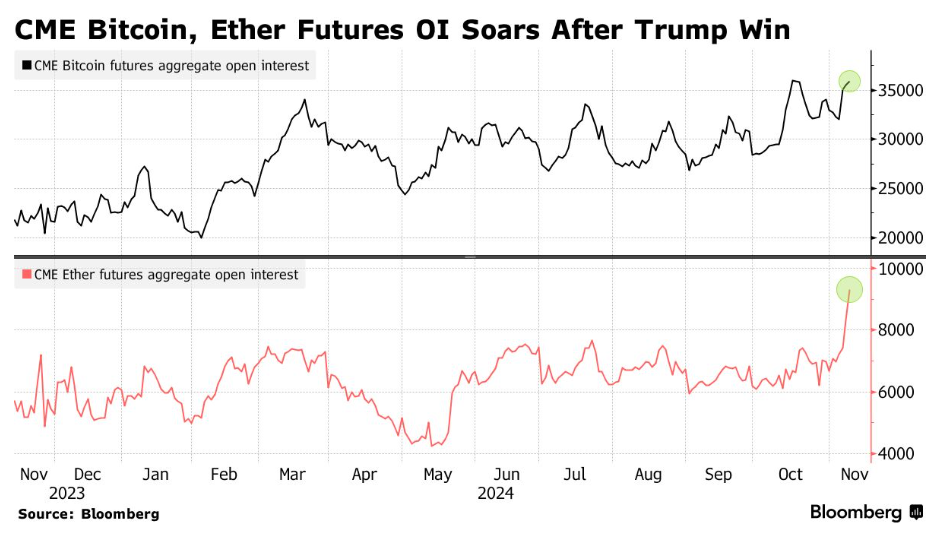

The Chicago-based CME Group has seen a significant increase in futures trading, with open interest on Bitcoin futures climbing 12 per cent since November 5. Meanwhile, Ether futures surged 29 per cent to reach an all-time high.

Although many investors adopt a more optimistic stance, a degree of caution is still present.

Since Trump's victory, the funding rate for Bitcoin, which reflects the premium for new long positions in perpetual futures, has slightly increased.

However, as indicated by data from CryptoQuant, it remains significantly lower than the peak observed in March 2024.

Some analysts have noted that it remains uncertain how much attention Trump will devote to cryptos upon assuming office in January, given the ongoing conflicts in Ukraine and the Middle East and escalating trade tensions with China.

The Fed's rate-cut restraint will be another factor weighing on the new administration.

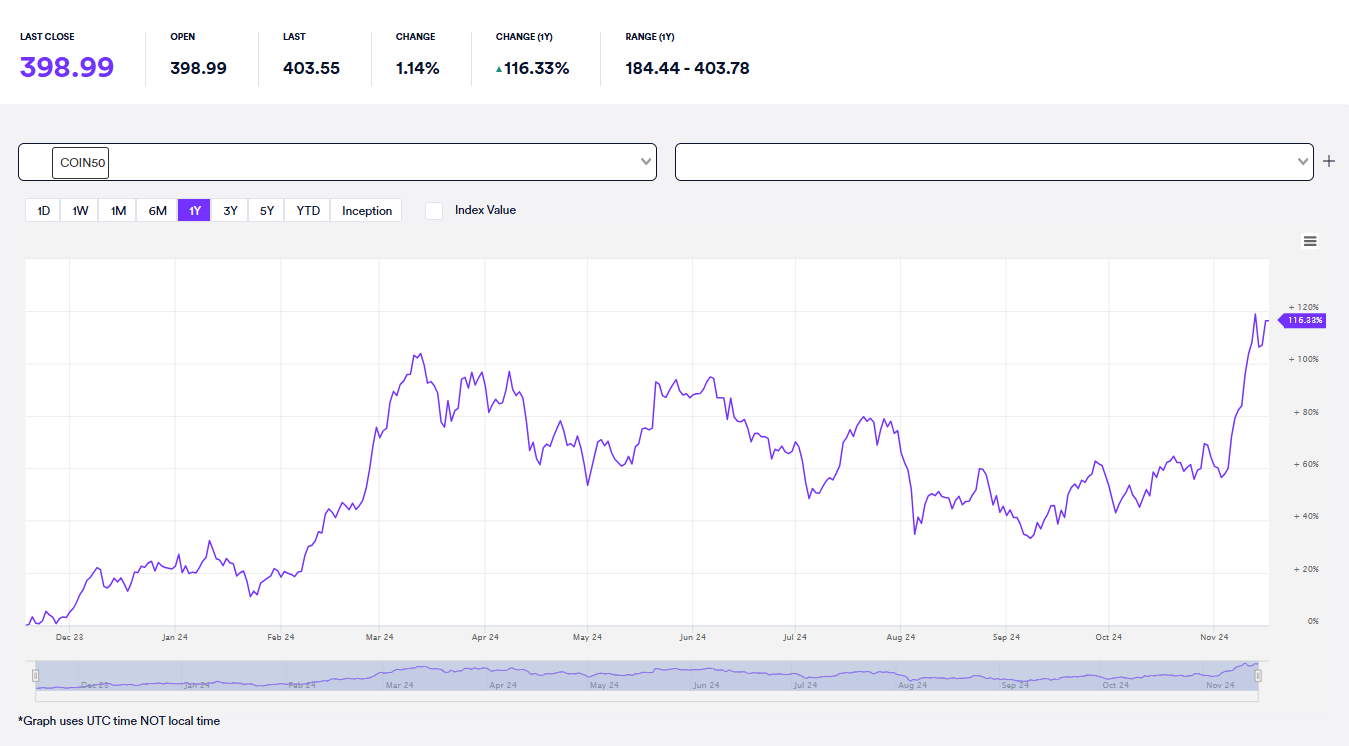

The overall digital assets market seems to show a rapid growth over the past year, according to the Coinbase 50 Index that tracks the performance of the 50 largest and most liquid digital assets by market cap.

Elsewhere

Blockcast

This week's Blockcast features Independent Reserve CEO Lasanka Perera, who reflects on his journey of volatility, difficulties, uncertainty, and ultimately, success.

Perera, who's also an avid golf fan, discusses how and why Independent Reserve sponsored accomplished Singaporean golfer Shannon Tan, and how the exchange is helping young people invest in crypto.

Additionally, as a seasoned crypto investor who's seen countless bull and bear markets, Perera shares his immediate reactions to the market's recent pump post-US election.

Events

Consensus (Hong Kong, 18-20 February)

Consensus is heading to Hong Kong, bringing together the industry’s most important voices from East and West for pivotal conversations and deal-making opportunities.

Consensus Hong Kong convenes global leaders in tech and finance to debate pressing issues, announce key developments and deals, and share their visions for the future.

Use promo code BLOCKDESK20 at checkout for a 20% discount on tickets here.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3!

There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers. So be sure to sign up!