Table of Contents

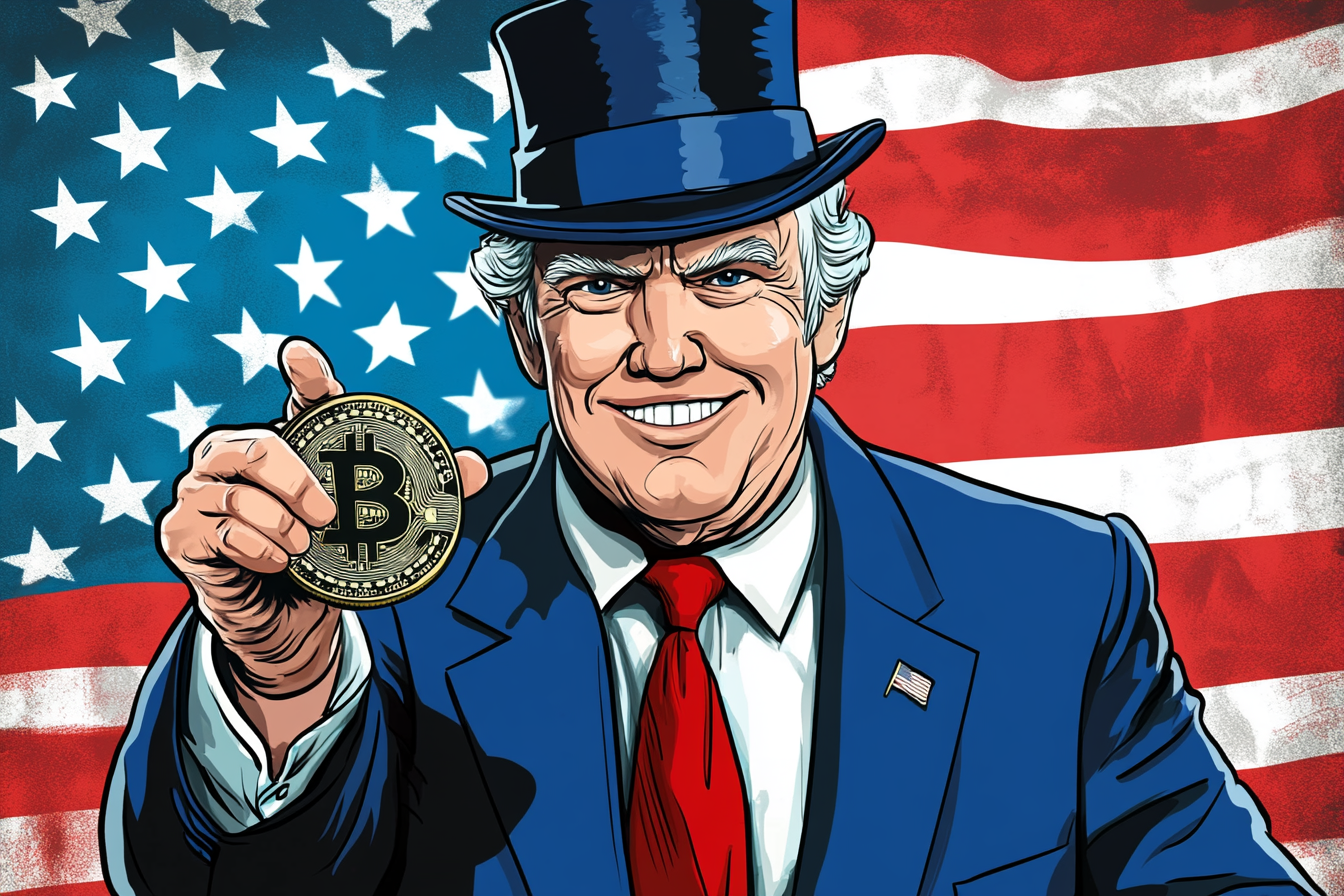

The cryptocurrency market is on fire, with Bitcoin (BTC) leading the charge as it continues to break new records daily, and altcoins following suit as institutional and retail investors flock to digital assets.

Over the past 24 hours, BTC surged by an impressive 8%, sitting at around $88,119, after hitting an all-time high of $89,518 earlier this morning, and continuing to move closer to the much-anticipated $90,000 mark. Over the past week, Bitcoin has climbed around 30%, pushing its year-to-date gains to more than 120%, per Coinmarketcap data.

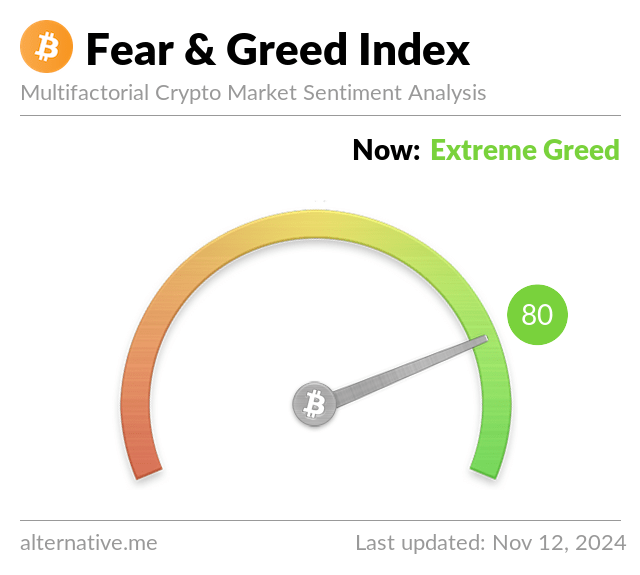

This bullish momentum is partly driven by global sentiment, which has reached "Extreme Greed" according to the Crypto Greed and Fear Index (currently at 80). A major factor behind the market’s optimism is the election of Donald Trump as the 47th president of the United States, as many see this as a signal for crypto-friendly policies, including favorable regulatory changes and potential market support for digital assets.

“While inflation pressures have eased with recent rate cuts globally, the Trump administration’s ambitious spending plans and potential tariffs could quickly reignite upward pressure on prices. This inflationary backdrop is encouraging investors to turn to Bitcoin as a safeguard against diminishing purchasing power,” Nigel Green, deVere Group CEO, said in a research note on Tuesday.

Green predicts Bitcoin could hit $100,000 by the end of January 2025 after Donald Trump takes office.

Market Cap Crosses Milestone

While the global cryptocurrency market cap crossed the $3 trillion mark earlier (currently at $2.95T), Standard Chartered bank has made bold projections for the crypto market's future.

In a recent research report, the bank suggested that with the right policy shifts under the new US administration, the global crypto market cap could rise fourfold from its current value to $10 trillion by 2026. According to Standard Chartered's head of digital assets research, Geoff Kendrick, this growth would be fueled by favorable regulatory changes, a shift in leadership at the US Securities and Exchange Commission (SEC), and greater institutional involvement.

The bank’s bullish outlook indicates that the overall digital assets market could continue its rapid expansion, with assets most closely tied to real-world use cases benefiting the most from this expected market growth.

MicroStrategy Continues Bitcoin Accumulation

MicroStrategy, the largest corporate holder of Bitcoin, is reaping the rewards of the ongoing rally. The company now holds 279,420 BTC, worth an estimated $22.95 billion, which represents a 91% return on its Bitcoin investment strategy, based on an average purchase price of $42,692 per Bitcoin.

MicroStrategy has acquired 27,200 BTC for ~$2.03 billion at ~$74,463 per #bitcoin and has achieved BTC Yield of 7.3% QTD and 26.4% YTD. As of 11/10/2024, we hodl 279,420 $BTC acquired for ~$11.9 billion at ~$42,692 per bitcoin. $MSTR https://t.co/uCt8nNUVqd

— Michael Saylor⚡️ (@saylor) November 11, 2024

The company's CEO, Michael Saylor, has been a vocal advocate for Bitcoin as a treasury asset, and MicroStrategy’s recent purchase further highlights its ongoing commitment to accumulating BTC.

On November 11, MicroStrategy announced the acquisition of an additional 27,200 BTC for approximately $2.03 billion, with an average purchase price of $74,463 per Bitcoin. This brings its total Bitcoin holdings to nearly 280,000 BTC.

The company’s Bitcoin portfolio has produced significant returns, with a 7.3% yield in the current quarter and a 26.4% yield year-to-date.

As Bitcoin continues to hit new highs, MicroStrategy stands to benefit enormously from its strategic allocation to the digital asset. The company's stock jumped over 25% overnight to sit at $340, and is trading at $358.06 after-hours.

Dogecoin, Solana, Other Altcoins Surge

The rise in Bitcoin’s price has also sparked a wave of bullish movement across the altcoin market. Ethereum (ETH) has climbed almost 40% in the past week to $3,373, maintaining its position as the second-largest cryptocurrency by market capitalization.

But the biggest surge has been in the meme cryptocurrency Dogecoin (DOGE), which has become one of the most talked-about digital assets in recent days.

The surge in Dogecoin’s price can be attributed to several factors, including its growing attention following Elon Musk’s recent comments amid the US presidential election. Musk, a long-time supporter of Dogecoin, has suggested that he would head the Department of Government Efficiency (D.O.G.E.) under President-elect Donald Trump. This announcement has sparked renewed interest in the meme coin, pushing it to new 52-week highs. However, it’s worth noting that Dogecoin’s all-time high of $0.7376, reached in May 2021, remains far above its current level.

Dogecoin’s price has skyrocketed 24% in the last 24 hours and surged by an astonishing 120% over the past week, reaching $0.363. This impressive rally has boosted Dogecoin’s market capitalization to $53.3 billion, making it the 428th largest company in the world, surpassing the market value of well-known global firms like Volkswagen, Ford, Adidas and Lululemon.

In addition to Dogecoin, other altcoins like Polkadot (DOT) and Solana (SOL) have also shown strong performance. Polkadot rose 6% in the past 24 hours to reach $5.57, while Solana gained 5% to reach $220.69, reflecting the broader altcoin market’s positive sentiment.

The market’s momentum shows no signs of slowing, and it will be interesting to see how these developments unfold over the coming months.