Table of Contents

As the US presidential race heats up, Bitcoin (BTC) has broken past its previous all-time high, briefly reaching $75,100, riding a wave of bullish sentiment and rate cut expectations.

The crypto big-daddy surged 7% overnight, reflecting market optimism around both a Donald Trump victory and anticipated Federal Reserve policy adjustments that could reshape the macroeconomic environment.

Trump Leads in Polls

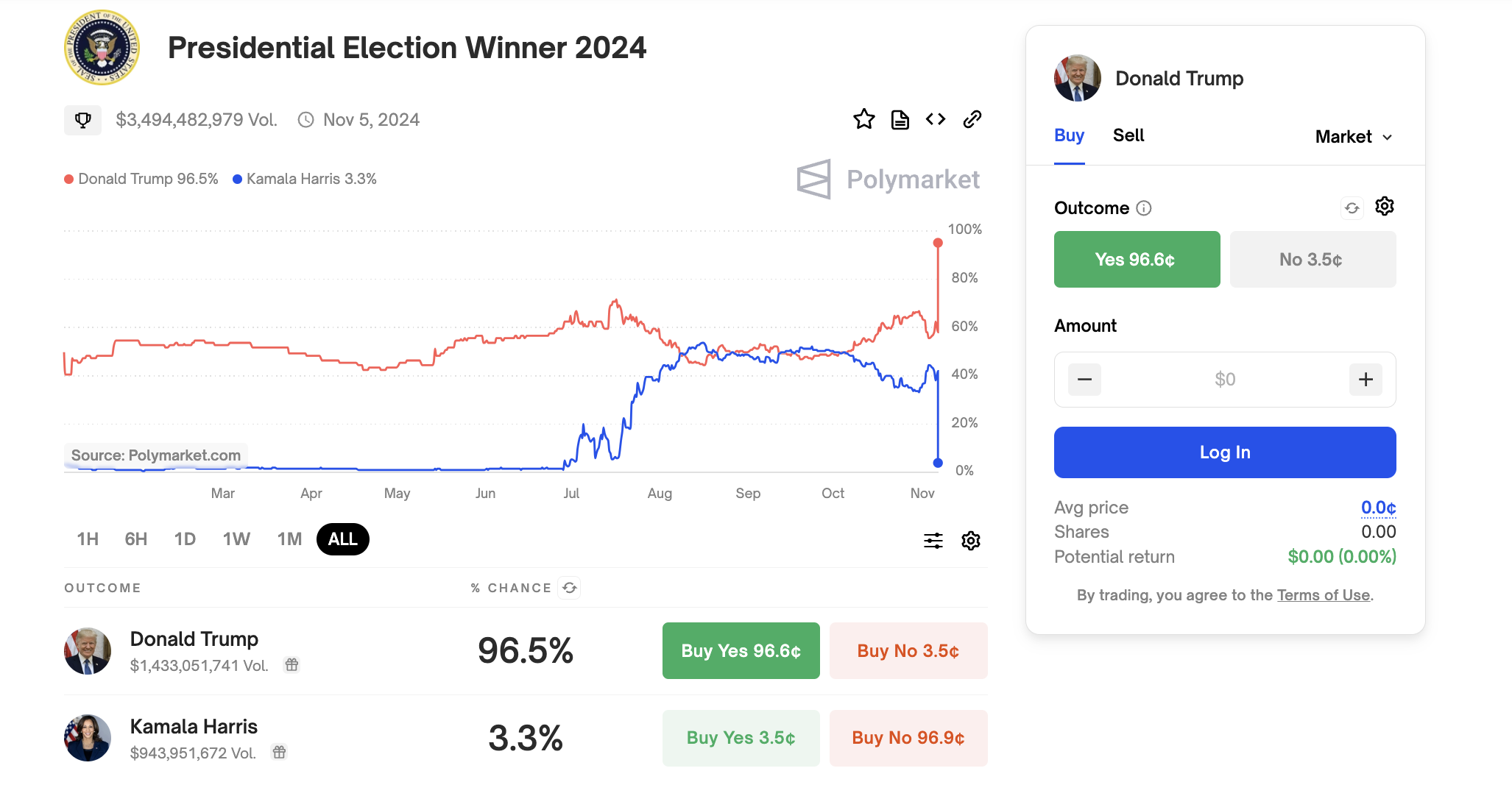

With election results pouring in, Trump has gained a significant edge over Kamala Harris, a factor driving heightened bullish sentiment across the digital asset space. Polymarket data reflects a strong 96.5% chance of a Trump victory, with around around $3.5 billion being wagered on the result, showcasing how heavily the election is influencing investor confidence.

Many Bitcoin investors see Trump’s poll lead as favorable for markets, banking on his pro-business stance that may support deregulation and a more crypto-friendly policy environment.

The lead in polls has fueled an active buying phase, pushing BTC beyond $75,000 for the first time ever, as investors eye the potential for regulatory stability and economic stimulus under a Trump administration.

That said, the situation remains fluid, with some volatility still anticipated until the final election results are confirmed. Though Trump’s lead currently seems unshakable, a comeback by Harris in swing states that are currently unaccounted for could momentarily unsettle markets, keeping volatility high for the day.

Rate Cuts Anticipated as Fed Adapts to Slower Growth

The Fed is expected to announce a 25-basis-point rate cut tomorrow, with CME projections suggesting a 95% likelihood of this move. While ongoing inflationary pressures make a larger 50 bps cut improbable, the expected rate reduction aligns with current macroeconomic signals, such as slowing GDP growth and weakening employment numbers.

"A rate cut could provide further fuel for Bitcoin’s bullish run, as a lower-rate environment typically enhances risk appetite, pushing more investors towards assets like Bitcoin," BRN lead analyst Valentin Fournier said in a note today.

The Fed’s anticipated rate cut will offer temporary economic relief and keep growth stable, providing an accommodating backdrop for continued asset price appreciation, he explained.

"If Trump is declared the winner, this environment could support an accelerated bull phase for Bitcoin, as investors interpret the policy direction as favorable for crypto and risk assets," Fournier added.

As the #ElectionDay results unfold, Trump has gained a significant lead over Kamala Harris, driving heightened bullish sentiment among #Bitcoin investors.

— BRN (@thebrn_co) November 6, 2024

Dogecoin’s Overnight Rally

Outpacing Bitcoin's rise overnight was Dogecoin (DOGE), which saw a substantial 30% rise to about $0.21, propelling it past Ripple (XRP) to become the seventh largest cryptocurrency by market cap, per Coingecko data.

This surge likely finds some influence from Elon Musk, a known advocate of Dogecoin, who is currently with Trump at Mar-a-Lago, presumably for what many believe will be a victory event. While Musk has not yet commented, his association with Dogecoin has previously spurred significant rallies, and speculation around his presence is likely adding to the meme coin’s upward momentum.

As the election outcome edges closer to resolution, the potential for regulatory stability and economic stimulus seems to set a promising stage for Bitcoin and the wider digital assets market.