Table of Contents

- Top Stories (In No Particular Order)

- South Korea Recognizes Crypto as Divisible Asset in Divorce Case

- SEC Targets Cumberland DRW for Unregistered Securities Trading

- UAE Takes a Decisive Step Towards Being a Crypto Hub

- WisdomTree Launches "Earn-Until-You-Spend" Function for Tokenized Money Fund Debit Card Spending

- VanEck Launches New Crypto Fund to Fuel Innovation

- Hong Kong Plans to License More Crypto Exchanges By Year-End

- FBI Creates Crypto Token to Target Market Manipulators

- What China's Stock Market Rise & Fall Means for Crypto

- Taiwan's Financial Regulator to Launch Digital Asset Custody Pilot in 2025

- Crypto.com Files Lawsuit Against SEC After Receiving Wells Notice

- HBO Suggests Pete Todd is Bitcoin Creator Satoshi Nakamoto - He Unsurprisingly Denies It

- Tokenized Shares as Collateral Moves Closer to Reality

- No 'Crash Landing' Hopes Boost Cryptos' Appeal

- Coinbase Delists Unauthorized Stablecoins Amid EU's MiCA Rules

- Court Approves FTX's Bankruptcy Plan for Customer Repayments

- HKVAX Secures Cryptocurrency Exchange License in Hong Kong

- Blockcast

- Events

- It's All Happening on LinkedIn

Crypto has established a notorious reputation as the seedy underbelly of finance. Understanding the industry often requires digging deep into the rabbit hole, uncovering mysteries and oddities along the way. For investigators and journalists alike, story opportunities are rife but more than often, answers to questions incur even more questions.

The true identity of Bitcoin founder Satoshi Nakamoto is the industry's biggest enigma. HBO director, Cullen Hobak, was the latest brave soul to take a stab at solving the puzzle once and for all. Famed for correctly identifying the person behind the QAnon conspiracy theory in his previous HBO documentary, Q: Into The Storm, Hobak had the industry on a knife edge, waiting for his latest documentary to drop.

Len Sassaman and Nick Szabo were pundits' picks for Nakamoto's identity ahead of the documentary's release. However, when Money Electric: The Bitcoin Mystery eventually dropped midweek, viewers were disappointed to learn that Hobak's money seemed to be on Pete Todd, who wasn't even among the names on Polymarket's list of candidates. Seasoned industry participants have long dismissed Todd as the person behind Nakamoto, and despite Hobak's best efforts, the mystery remains unsolved.

A more successful form of investigatory crypto work came in the guise of the FBI. In a plot that seemed lifted straight from The Blacklist, the FBI went undercover and infiltrated the crypto industry. Posing as a token lister, the FBI had secret meetings with market makers who generously offered to artificially pump the price of their tokens. The FBI's hard work resulted in eighteen individuals facing criminal charges from the Department of Justice.

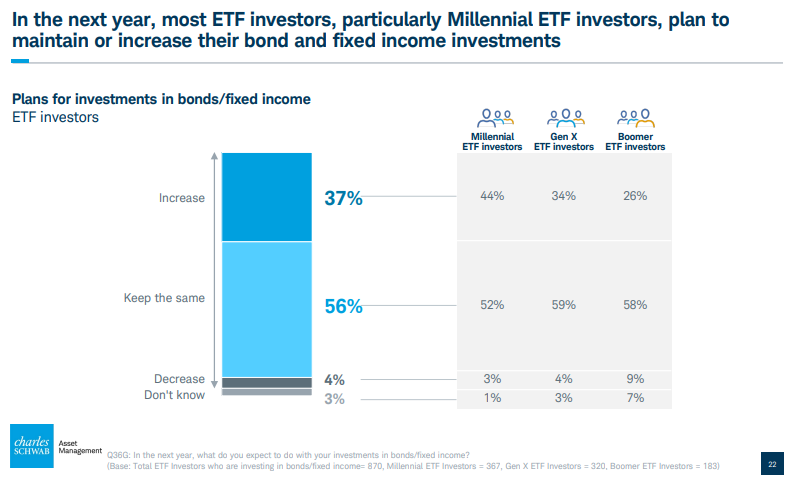

It seems you simply can't trust anyone in the crypto industry, which might be a bit too much for millennials. Instead of diving into the deep end of staking, memecoins, and DeFi option vaults, millennials are reportedly hot for crypto ETFs.

A study by Schwab Asset Management titled "ETFs and Beyond" has found that around 62% of millennials plan to invest in crypto ETFs over the next year. Although this is higher than alternative ETFs (25%), fixed-income ETFs (47%) and smart beta ETFs (29%), it does suggest that the demographic might be less risk-averse than pure crypto investors.

Compared to the traditional 60/40 portfolio split, millennials are allocating 54% of their portfolios to equities and 46% to fixed income - a much less risky balance. It does, nonetheless, prove that crypto ETFs are sexier than traditional ETFs - not that anyone thought otherwise.

Meanwhile, in the markets, both Bitcoin and Ethereum experienced downward pressure throughout the week but managed to recover over the past 24 hours. Bitcoin ended the week around 0.5% higher while Ethereum scraped by at 0.1% higher.

Risk appetites have shifted from last week's 41, "Fear," to 73, "Greed."

The Fear & Greed Index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

But as always, fear not, because BRN analyst, Valentin Fournier, has you covered. This week, he maintains his recommendation for heavy exposure to Bitcoin, anticipating a strong rally as the year comes to a close.

"In the face of substantial selling pressure and escalating geopolitical tensions in the Middle East, Bitcoin continues to hold strong," he explains.

"Several bullish factors point toward optimism in the coming weeks: global interest rates are on the decline, China has launched a significant economic stimulus, the U.S. economy remains robust, unemployment is falling, and the upcoming U.S. presidential election could serve as a catalyst for risky assets."

Both headline #CPI (0.2% vs. 0.1% expected) and core CPI (0.3% vs. 0.2% expected) exceeded expectations, triggering a quick market reaction. $BTC fell back to its $59,000 support level in response. (1/8)

— BRN (@thebrn_co) October 11, 2024

Top Stories (In No Particular Order)

South Korea Recognizes Crypto as Divisible Asset in Divorce Case

Cryptocurrency can now be divided between married couples in South Korea during divorce proceedings.

South Korean law firm IPG Legal clarified the law, stating that both tangible and intangible assets, including crypto, can be divided during a divorce.

SEC Targets Cumberland DRW for Unregistered Securities Trading

The U.S. Securities and Exchange Commission (SEC) has filed a lawsuit against Cumberland DRW, a prominent crypto market maker, alleging that the company acted as an unregistered securities dealer by promoting and trading $2 billion in crypto assets that should have been registered as securities.

UAE Takes a Decisive Step Towards Being a Crypto Hub

Virtual assets and investment fund management are no longer subject to value-added tax, according to an updated version of the Executive Regulation of Federal Decree Law released on October 2 by the UAE Federal Tax Authority (FTA).

The adjustments made in response to a Cabinet decision are effective November 15 this year.

WisdomTree Launches "Earn-Until-You-Spend" Function for Tokenized Money Fund Debit Card Spending

WisdomTree has introduced a new feature that allows users to access its tokenised fund via their debit card.

According to an announcement, users can select the WisdomTree Government Money Market Digital Fund (WTGXX) as a source of funds for their WisdomTree Prime Visa debit card.

VanEck Launches New Crypto Fund to Fuel Innovation

Global investment management firm VanEck has announced the launch of a $30 million early-stage venture capital fund dedicated to supporting innovative startups in the fintech, digital assets, and artificial intelligence sectors.

The VanEck Ventures fund will focus on pre-seed and seed-stage companies, providing them with the capital and expertise needed to scale their businesses, according to an announcement on Wednesday

Hong Kong Plans to License More Crypto Exchanges By Year-End

Hong Kong’s financial regulator, the Securities Futures Commission (SFC), has revealed that it plans to issue more licenses to crypto exchanges and digital asset firms by the end of the year.

According to local media outlet HK01, SFC CEO Julia Leung said the regulator aims to “make progress” in approving licenses for eleven Virtual Asset Trading Platforms (VATPs).

FBI Creates Crypto Token to Target Market Manipulators

The US Federal Bureau of Investigation (FBI) has created its own cryptocurrency token to trap suspects in fraud schemes.

NexFundAI, which operated on the Ethereum blockchain, was created by the bureau to catch illicit market makers and manipulators. The token was presented as an opportunity to invest in early-stage artificial intelligence (AI) projects.

What China's Stock Market Rise & Fall Means for Crypto

Despite China's stock market's meteoric rise following the country's enormous stimulus, many international analysts and investment managers still need to be convinced. Its sharp decline over the past few days hasn't helped matters either.

Taiwan's Financial Regulator to Launch Digital Asset Custody Pilot in 2025

Taiwan's Financial Supervisory Commission (FSC) is set to launch a pilot program for virtual asset custody services in early 2025, local media outlet Central News Agency reported this week.

The pilot program comes as part of the FSC's broader efforts to foster innovation in the financial sector while ensuring consumer protection and market integrity. The regulator has been working on a dedicated special law for the virtual asset industry, which is expected to be finalized by the end of this year.

Crypto.com Files Lawsuit Against SEC After Receiving Wells Notice

Crypto.com has filed a lawsuit against the US Securities and Exchange Commission (SEC) just over a month after receiving a formal warning from the regulator

In a statement, the crypto exchange said it is suing the SEC to "protect the future of the crypto industry in the US" following the receipt of a Wells Notice on 22 August.

HBO Suggests Pete Todd is Bitcoin Creator Satoshi Nakamoto - He Unsurprisingly Denies It

The mystery of Bitcoin creator Satoshi Nakamoto's identity has long plagued the crypto industry but more than a decade later, the truth is still beyond reach.

HBO is the latest to take a stab at identifying the pseudonymous crypto OG. In its new documentary, Money Electric: The Bitcoin Mystery, HBO suggests that Canadian software developer Peter Todd might be the man behind Nakamoto.

Tokenized Shares as Collateral Moves Closer to Reality

With the approval of rules for their use by a consortium of financial institutions, efforts to enable tokenised shares of money-market funds from Wall Street giants like BlackRock and Franklin Templeton as collateral in trading took a significant step ahead.

No 'Crash Landing' Hopes Boost Cryptos' Appeal

After strong US data cast doubt on bets that the Federal Reserve will cut interest rates significantly next month, stocks dropped, and benchmark Treasury bond rates climbed back over 4%.

The market's see-saw is likely to continue, driven by traders taking opposing positions on the news between large Fed rate cut bets and the resilience of the US economy.

Coinbase Delists Unauthorized Stablecoins Amid EU's MiCA Rules

Tokens like USDT, created by Tether Holdings, will likely suffer when Coinbase Global delists all unauthorised stablecoins from its EU crypto exchange before the end of the year.

By year's end, the European Union will have completely implemented MiCA, new regulations to regulate the cryptocurrency business.

Court Approves FTX's Bankruptcy Plan for Customer Repayments

FTX has received approval from a US court for its bankruptcy plan to repay customers. The ruling will allow the fallen cryptocurrency exchange to use the $16.5 billion it managed to recover.

US Bankruptcy Judge John Dorsey praised FTX's plan as a "model case for how to deal with a very complex Chapter 11 bankruptcy proceeding."

HKVAX Secures Cryptocurrency Exchange License in Hong Kong

Hong Kong Virtual Asset Exchange (HKVAX) has officially received Type 1 (dealing in securities) and Type 7 (providing automated trading services) licenses from the Securities and Futures Commission (SFC), alongside the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO) license, the exchange announced in a statement.

Blockcast

On this week’s Blockcast, we speak with Luca Prosperi, co-founder and CEO at M^0 Labs, whose man-bun and genial personality belies battle scars from almost 2 decades of traditional banking, helping to build MakerDAO and, a health scare. Luca dissects the concept of money creation and some of the foundations behind M^0’s quest to build infrastructure for a crypto dollar.

Events

GeckoCon (Bangkok, 11 November 2024)

GeckoCon returns, and this year we're diving into the revolutionary world of Web3 Gaming! Discover how the fusion of blockchain and traditional gaming is creating a whole new entertainment layer.Don't miss out—visit CoinGecko now to secure your spot in our first ever Hybrid Conference set to take place in Bangkok, Thailand. Or from the comforts of your home!

Get your tickets now with Blockhead's 40% code: BHGC24

[Limited to 30 redemptions, expires 31 October 2024]

[Redacted] (Bangkok, 9-11 November 2024)

The [REDACTED] conference is bringing together the brightest minds in technology for a transformative three-day event from November 9-11, 2024, at the Avani Riverside hotel. This gathering will take place just ahead of Devcon and promises to be a pivotal moment for the convergence of artificial intelligence and Web3.

Interested readers can apply for free tickets here, and sign up for the hackathon here.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3!

There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers. So be sure to sign up!