Table of Contents

Bitcoin bull MicroStrategy has once again demonstrated its unwavering commitment to Bitcoin, announcing the acquisition of an additional 7,420 BTC for approximately $458.2 million between September 13 and September 19.

This latest purchase brings the company's total Bitcoin holdings to 252,220 BTC, valued at roughly $15.8 billion, founder Michael Saylor said in a post on Twitter/X.

MicroStrategy has acquired 7,420 BTC for ~$458.2 million at ~$61,750 per #bitcoin and has achieved BTC Yield of 5.1% QTD and 17.8% YTD. As of 9/19/2024, we hodl 252,220 $BTC acquired for ~$9.9 billion at ~$39,266 per bitcoin. $MSTR https://t.co/JUtgztpzBu

— Michael Saylor⚡️ (@saylor) September 20, 2024

The company has consistently been at the forefront of institutional Bitcoin adoption, having made significant investments in the cryptocurrency since late 2020. This latest purchase further solidifies MicroStrategy's position as one of the largest corporate holders of Bitcoin.

To fund its Bitcoin purchases, MicroStrategy has also been actively raising capital. In September, the company completed an upsized $1.01 billion private offering of convertible senior notes due 2028. The proceeds from this offering will be used to redeem existing debt and potentially acquire more Bitcoin.

As recently as last week, Microstrategy announced that it was raising $700 million to buy more Bitcoin, mirroring a similar move it made in March.

The tech giant said it plans to use proceeds from its sale to redeem $500 million in senior secured notes due in 2028, with a total cost of $523.8 million, including interest. Any remaining funds will be used to buy more Bitcoin and for general corporate purposes.

MicroStrategy made a similar move in March when it raised $700 million through convertible senior notes to buy more Bitcoin.

As of September 23, 2024, MicroStrategy's stock price (MSTR) is $144.78, or up $7.91 (5.78%) in the past five days. The company's share price has generally been correlated with the price of Bitcoin. As Bitcoin's value fluctuates, so too does MicroStrategy's stock price, which has grown 111.3% year-to-date.

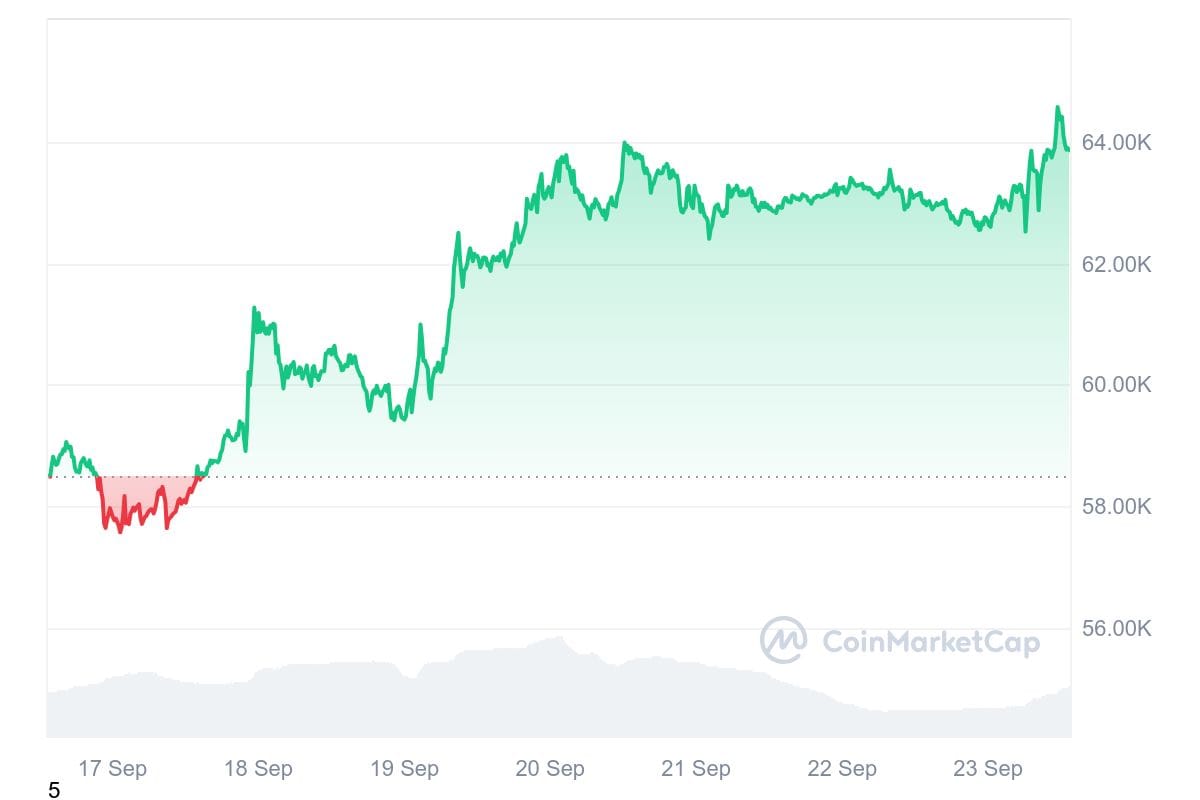

At the same time, the price of Bitcoin itself remains volatile. As of publication time, Bitcoin is trading at $63,859.42, per CoinMarketCap data, up 9.25% in the past week.