Table of Contents

Morgan Stanley Institutional Fund is very Bitcoin heavy according to a recent SEC filing.

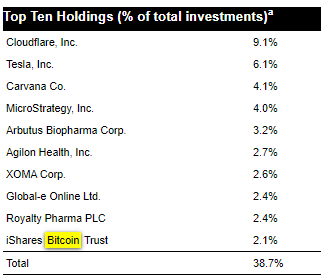

The fund reported total net assets of $10,042,729 as of June 30, 2024, consisting of 216 different positions, with the top 10 holdings including MicroStrategy (4.0%) and BlackRock's iShares Bitcoin Trust (2.1%).

Although a small fund, its positions in MicroStrategy, which holds over 226,500 Bitcoin, as well as its Bitcoin ETF exposure demonstrate the institution's broader interest in digital assets.

The news comes after major TradFi giants previously revealed their Bitcoin ETF positions.

According to Goldman Sachs' quarterly disclosure to the Securities and Exchange Commission (SEC), the firm stated it acquired $418 million worth of Bitcoin ETFs.

Likewise, Morgan Stanley revealed a strong position in IBIT, with 5.5 million shares valued at $187 million.

In a 13F filing today, Morgan Stanley reported owning 5,500,626 shares of iShares Bitcoin Trust as of June 30 (valued at $187,791,372 as of that date).

— MacroScope (@MacroScope17) August 14, 2024

The filing notes under "Investment Discretion" that all 5.5 million shares are allocated to Morgan Stanley Investment… https://t.co/SKL9AF2R3V

Bitcoin, however, has faced huge price challenges in recent weeks. Coinciding with a broader retreat in crypto values, Bitcoin marked its worst decline last week since the chaos engulfed global markets in early August, and its slide continues this week.

The world's leading crypto lagged behind traditional assets at the end of August due to declining liquidity and ongoing concerns that governments may sell their cryptocurrency holdings.