Table of Contents

Gold is being purchased by central banks at an unprecedented rate. ''Is it over for the USD or not?'' is a very simplistic and limiting question.

Investors ought to be more concerned with the "when" than the "if" quandary. In other words, it's quite unlikely that this will happen in the near future.

Reason number one why a controlled de-dollarization is a pipe dream.

To illustrate why a controlled de-dollarization is improbable, let's examine Brazil. Brazil accumulates US dollars when trading with nations like China or Japan, using the USD as the medium of exchange. These dollars are then used to purchase goods and services internationally.

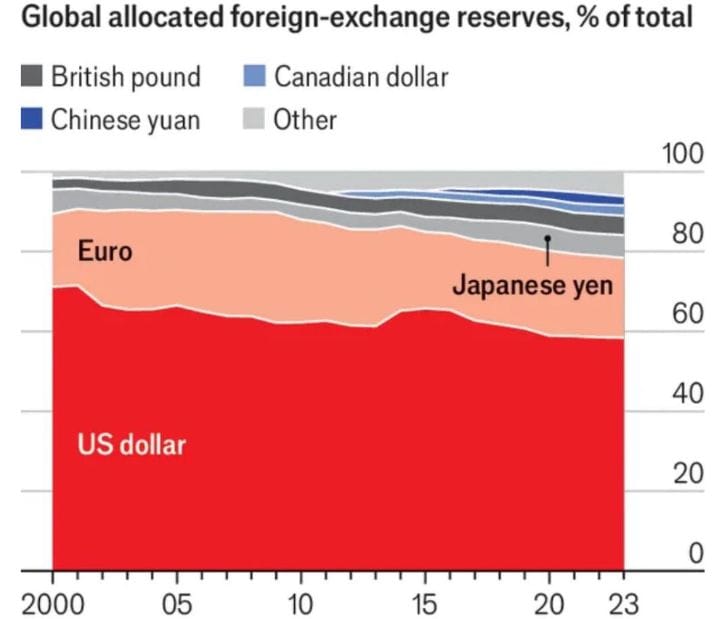

The US dollar remains the de facto reserve currency for international commerce and investment, accounting for more than half of all international payments and 80 percent of all foreign exchange transactions. This dominance is reinforced by its extensive use in global trade and finance, a position that gold, despite its historical significance, has yet to challenge effectively.

Gold vs. Bitcoin: The Battle of Safe Havens

Gold prices have surged past $2,500 per ounce, a notable leap that overshadows Bitcoin, which struggles to maintain its value above the $60,000 mark. This shift is partly due to the anticipation that the Federal Reserve might cut interest rates soon, boosting gold’s appeal as a safe haven.

Gold’s recent rally is not just a reflection of its traditional role as a store of value but also an indicator of shifting investor sentiment amid economic uncertainty. As gold hovers near record prices, it highlights its enduring allure compared to Bitcoin. Despite the digital currency's potential, it still grapples with volatility and regulatory uncertainties that undermine its status as a reliable store of value.

Why Hasn’t USD Supremacy Been Challenged?

The supremacy of the US dollar has remained unchallenged over the past 30 years for several key reasons. While the USD's role in global finance may seem advantageous from the outside, it is far from effortless.

Let's begin with the assets. The accumulation of USD FX reserves by countries like Brazil results from an excess of commodity exports over imports. These dollars are then managed by local central banks, focusing on maintaining the safety and liquidity of these reserves.

To invest in deep and liquid markets and maintain money "safe and liquid" according to our monetary system is to prevent credit risk. With a size of $20 trillion or more, plenty of liquid assets, and a robust repo ecosystem supporting it, the US Treasury market is clearly the best in the world. The absence of capital controls, combined with democratic governance and the rule of law, strengthens this position.

What the rest of the world needs is a liquid and secure asset to recycle the USD profits from their worldwide transactions, and the US Treasury offers just that. Notably, entities outside the US have amassed $12 trillion worth of USD-denominated debt. This debt complicates any move away from the dollar, as a transition could severely impact the ability of countries like Brazil to service and refinance their USD-denominated obligations.

Both Brazil's organic inflows of USD and the ability of Brazilian corporations to service and refinance their USD debt would be severely impacted if the country withdrew from USD-denominated trading.

Either the debt denominator, the US dollar, is rising in value or the international order is being disrupted by geopolitical events, such as wars, when a debt-based economy gets de-leveraged.

The idea of a controlled de-dollarization is pure fantasy.

So, for the crypto markets looking to dominate its expansion in global trade, there is a growing space.

However, as the reasons against de-dollarization suggests, cryptos too will find it difficult to dislodge the dollar trade as they face hurdles that gold does not, such as volatility and regulatory scrutiny.

Cryptocurrencies will definitely play an increasing part, though.