Table of Contents

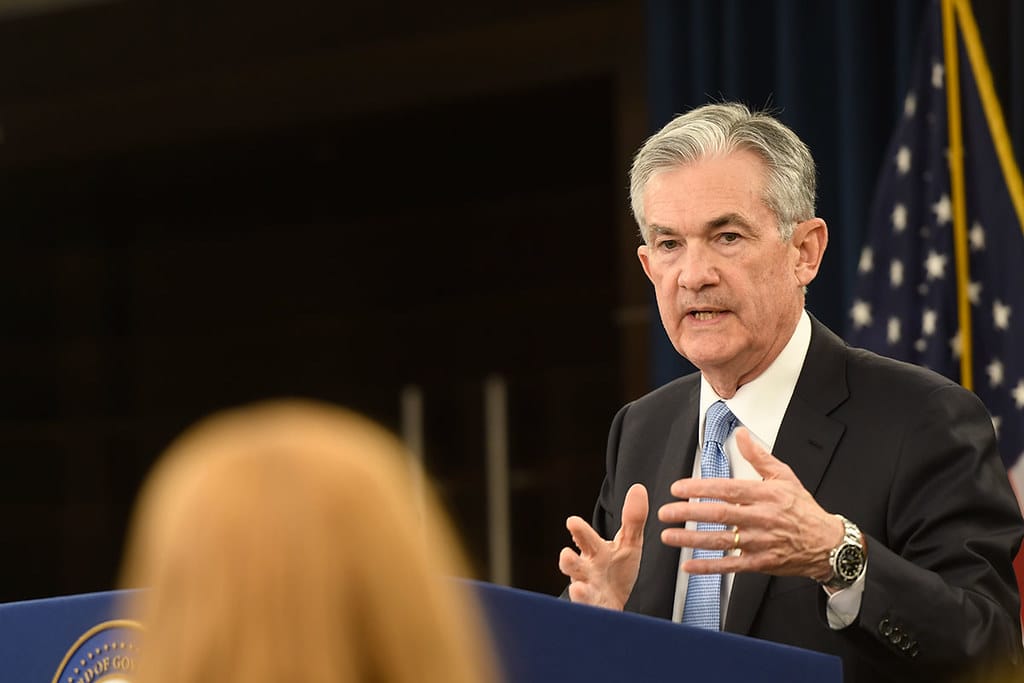

As markets brace for Jerome Powell's highly anticipated speech at Jackson Hole this Friday, the financial world is abuzz with speculation about potential shifts in Federal Reserve policy. Powell’s address will be pivotal, setting the tone for interest rate decisions as early as next month. Investors are eagerly awaiting signals on whether the Fed will initiate rate cuts, a move that could reshape the economic landscape and influence market sentiment.

The past two weeks have witnessed a significant upheaval in financial markets, yet investor confidence remains surprisingly robust. Despite the Fed’s dot plot projections suggesting otherwise, there is a prevailing belief that short-term interest rates will soon decrease significantly.

This optimism contrasts with the current economic uncertainty, as recession forecasts continue to oscillate between severe downturns and softer landings. Recent data, including a modest July producer price inflation reading, suggest that the economy isn't in dire straits, which might be contributing to this optimistic outlook.

While "core optimism on a soft landing (76%) and on US large cap growth stocks" has not wavered, "just that investors now think the Fed needs to cut harder to guarantee no recession," according to Michael Hartnett of Bank of America.

In fact, 60% of surveyed investors now anticipate four or more fed funds cuts in the next 12 months, in accordance with market-available implicit rates, reflecting the market’s strong expectations for easing.

Bitcoin's Rising Allure

Amidst these shifting economic sands, Bitcoin continues to capture attention. Originally envisioned by Satoshi Nakamoto as a decentralised digital asset that could operate independently of central banks. Their innovation was in perfect harmony with libertarian principles of protecting personal liberties against the capricious use of governmental power.

It would be a stretch to say that Bitcoin has achieved its goals.

Actually, the peer-to-peer network—the backbone of blockchain technology—is already up and running, and it has, at most, turned financial institutions into participants rather than facilitators.

With authorities intent on preventing a systemic danger, the adoption of digital assets in financial markets has not been a laissez-faire affair.

There have been many moves towards crypto's institutionalisation since the industry began 16 years ago.

Bitcoin has had an incredible year so far, thanks to a rise in January that was sparked by the long-awaited approval of Bitcoin ETFs by the Securities and Exchange Commission.

A KPMG report from five years ago argued that the so-called tokenised economy may benefit from more involvement from the wider financial services ecosystem in order to boost confidence in it, long before the regulator became involved.

Almost $6,600 was the price of Bitcoin when it was published; now it's around $60,000.

Despite the meteoric ascent, institutionalization is still in its infancy.

Bitcoin, nevertheless, is already changing its behaviour as an asset class due to its increasing use.

Crypto asset values are heavily influenced by traditional risk and monetary policy variables, according to a study conducted by Uniswap Labs' Austin Adams, Copenhagen Business School's Markus Ibert, and Circle Internet Financial's Gordon Liao.

That begs the question of whether cryptocurrency can serve as a store of value or a hedge against inflation.

The researchers' breakdown of Bitcoin returns into three structural shocks—conventional risk premium shocks, crypto-specific demand shocks, and conventional monetary policy shocks.

Still, while global stocks have recovered from the deep sell-off in early August, cryptos have been unable to breakthrough and are hovering below key levels for weeks now.

Bitcoin has struggled to stay above $60,000 and has languished between $52,000 and $60,000 for a while now, barring a couple of sessions breaching either side of those levels.

A lot of investors, though, seem to forget that Bitcoin above $50,000 is a good sign for the asset, especially as it has broken through the barriers of the so-called 'risky bet."

As we get close to a Fed rate cut and the start of an easing cycle as early as September, cryptos are likely to get the trigger for trading higher.

Ether ETFs' Debut Amid Chaotic Crypto Moves

To suit that narrative, let's take the example of Ether exchange-traded funds (ETFs), which made their debut during a chaotic period for cryptos.

The trading in cryptos got messier, but investments have found their way into Ether ETF funds.

Ethereum ETFs began during a time when the cryptocurrency market was quite unstable. However, they have continued to amass assets despite this.

A group of US-based exchange-traded funds (ETFs) that put money into Ether have been live for less than a month. The second-largest token in the world has lost around one-third of its value since then.

According to Bloomberg data, eight out of the nine funds that were established at the end of July have already received investments, totalling $2 billion for the cohort.

During that time, outflows occurred for peculiar reasons in just one of them—a product that became an ETF at the same time as the others.

The not-so-small number stands out since it covers the period since the ETFs' inception, which includes a mini-markets panic that sent down gold, credit, and shares.

Ether, which has fallen 27% since the funds' debut, was also entangled.

On the other hand, data collected up last week shows that Ether funds were able to record net inflows and are expected to continue receiving minor injections of capital this week.

The cryptocurrency sector had been at odds with authorities for years over the issuance of funds that are physically backed by Bitcoin and Ether, so the introduction of Ether ETFs in the US was widely anticipated as a turning point.

Debuting in January, the Bitcoin ETFs have already amassed $50 billion in assets, a sum so large that it has astonished even the most enthusiastic observers of the market.

Looking Ahead

As Powell prepares to address the Jackson Hole symposium, all eyes will be on his assessment of the current economic climate and his guidance on future Fed actions. The potential for a rate cut as soon as September, amid a backdrop of fluctuating market expectations and economic indicators, could influence both traditional financial markets and the evolving crypto sector.

Investors are keenly awaiting clarity on the Fed's policy direction, which could significantly impact asset values, including cryptocurrencies like Bitcoin and Ethereum. As we approach Powell's speech, the interplay between economic data, market sentiment, and central bank policies will remain a critical focus for financial markets worldwide.

Elsewhere

Events

Daemon Day (Singapore, 17 September 2024)

Join Blockdaemon on 17th September 2024 at Pan Pacific, Singapore for a day of groundbreaking discussions and networking opportunities with key players in the space. Event partners include AWS and Zodia Custody, while the event supporters include Liquid Collective, M2, MU Digital, Titanium Ventures, and Xangle.

For more info, click here.

Token2049 (Singapore, 18-19 September 2024)

Don't miss out on early bird ticket prices, until July 31! Use Blockhead's exclusive discount code BLOCKHEAD10 for a further 10% off.

All That Matters (Singapore, 16-18 September 2024)

The 19th All That Matters is the gateway to the APAC Music, Sports, Gaming, Marketing, Web3, Arts and Entertainment industries.

Conference by day and live music festival by night, ATM is Asia’s premiere ‘Business 2 Business 2 Fan’ event experience bringing together world class speakers with more than 2,000 senior executives.

Get your tickets now with Blockhead's 15% off code: ATM24BLOCKHEAD15

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3!

There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers. So be sure to sign up!