Table of Contents

ETC Group, the Issuer of the largest Physical Bitcoin Exchange Traded Product (ETP) in Europe with over $ 1 billion in assets under management has been acquired by Bitwise Asset Management, the largest crypto index fund manager in America according to a blog post.

Founded in 2019, ETC Group offers a range of ETPs, including the most actively traded physical Bitcoin ETP (BTCE). Their portfolio also features ETPs for Ethereum with staking (ET32), Solana (ESOL), XRP (GXRP), and the MSCI Digital Assets Select 20 (DA20).

These products will be rebranded under the Bitwise name and no significant changes to the structure or goals of the current ETC investment strategies are planned at this time.

"For an asset management firm, culture and values are essential, and we couldn’t be more excited to continue our work in Europe as part of Bitwise,” said ETC Group co-founder Bradley Duke in the post.

The landmark deal will bring Bitwise's total assets under management to above $4.5 billion, representing a major milestone in the company's seven-year history.

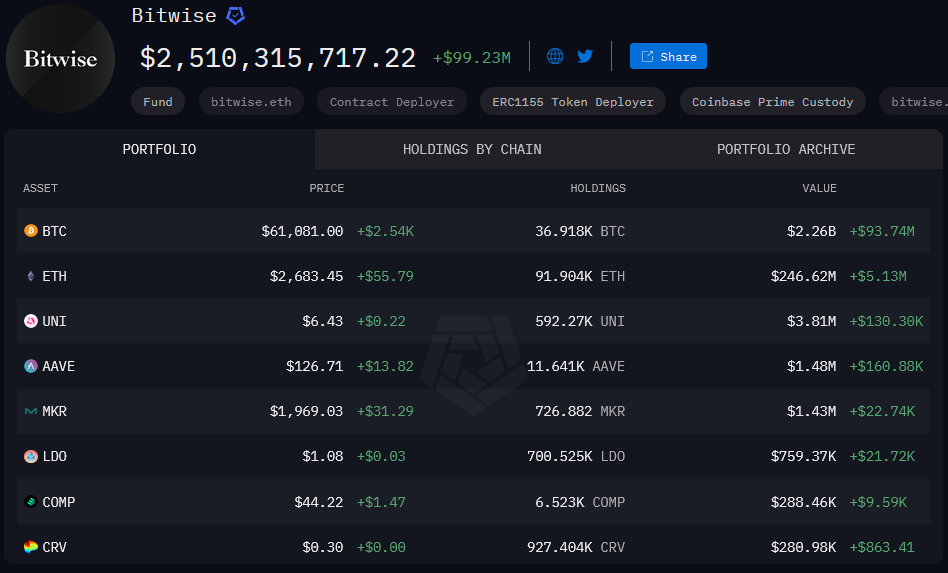

Earlier this year, the company introduced its first spot Bitcoin ETP which rapidly became one of the 25 fastest-growing ETPs in history, now exceeding $2.26 billion in assets at the time of writing.

In July, the company launched its first spot Ethereum ETP, the Bitwise Ethereum ETF (ETHW), which quickly amassed over $246 million in assets within its initial weeks.

"This acquisition allows us to serve European investors, to offer clients global insight, and to expand the product suite with innovative ETPs,” said Hunter Horsley, Bitwise’s CEO. Alongside the new ETPs introduced this year, Bitwise also intends to strategically expand the existing ETC Group platform across Europe.