Table of Contents

In the past 24 hours, the crypto market saw more than $1 billion in liquidations, with $800 million in longs liquidated as Bitcoin (BTC) dropped below $50,000 briefly. The previous time liquidation hit $1 billion was during March 2024 after which prices traded in a range bound until the most recent decline.

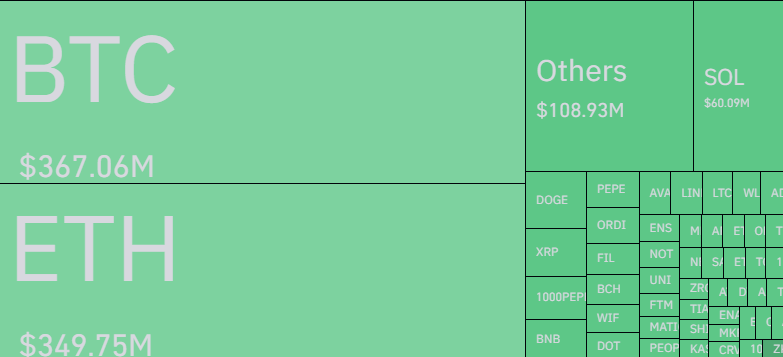

Bitcoin (BTC) accounted for the majority of the liquidation, followed by Ethereum (ETH) and Solana (SOL) at a lesser magnitude.

Liquidation happens when a trader trades with leverage and is forced to close their position due to a lack of margin to keep the trade open as prices move. In such cases, the exchange will automatically close the position and the trader will incur a loss depending on the initial margin amount and change in asset price.

Post-liquidation, Bitcoin quickly rebound below $50,000 to approximately $55,800 at the time of writing. Bitcoin also saw a surge in Bitcoin ETF trading with volume reaching $5 billion in daily trading volume, the highest level since April.

Eric Balchunas, senior ETF analyst at Bloomberg, explained that high trading volume in a market downturn is a "pretty reliable measure of fear."

"If you bitcoin bull you actually DONT want to see crazy volume today as ETF volume on bad days is a pretty reliable measure of fear [sic]," he said.

"Deep liquidity on bad days is part of what traders and institutions love about ETFs, so you also want to see volume too, good for the long term."

Bitcoin ETFs have traded about $2.5b so far, a lot for 10:45am, but not too crazy (full history below). If you bitcoin bull you actually DONT want to see crazy volume today as ETF volume on bad days is a pretty reliable measure of fear. On flip, deep liquidity on bad days is part… pic.twitter.com/TOQRjyriqp

— Eric Balchunas (@EricBalchunas) August 5, 2024

According to DefiLlama, the majority of the volume can be attributed to BlackRock’s IBIT with nearly $3 billion in trading volume. Fidelity’s FBTC and Grayscale's GBTC also saw lesser volumes of 858 million and 693 million respectively. Despite the surge in volume, there was a net outflow of around 168 million in Bitcoin's ETF.

Ethereum on the other hand saw a slight inflow of 1.7million after being launched recently. In an interview with Bloomberg, BlackRock's ETF investment chief Samara Cohen revealed that "Investors want to get their ETH exposure, Bitcoin and Ether are two very different asset classes useful as “portfolio diversifiers.”

Lastly, Samara also mentioned, “What will happen toward the end of this year and into next year is we will see allocations into model portfolios which will give us much more of a steer into how investors are using them.”

With the introduction of spot ETFs and potential inflows incoming, it remains to be seen if such inflows will eventually reduce the magnitude of future sell-offs that market participants may experience.