Table of Contents

Earnings season has been kind to Coinbase but the same can't be said for Microstrategy.

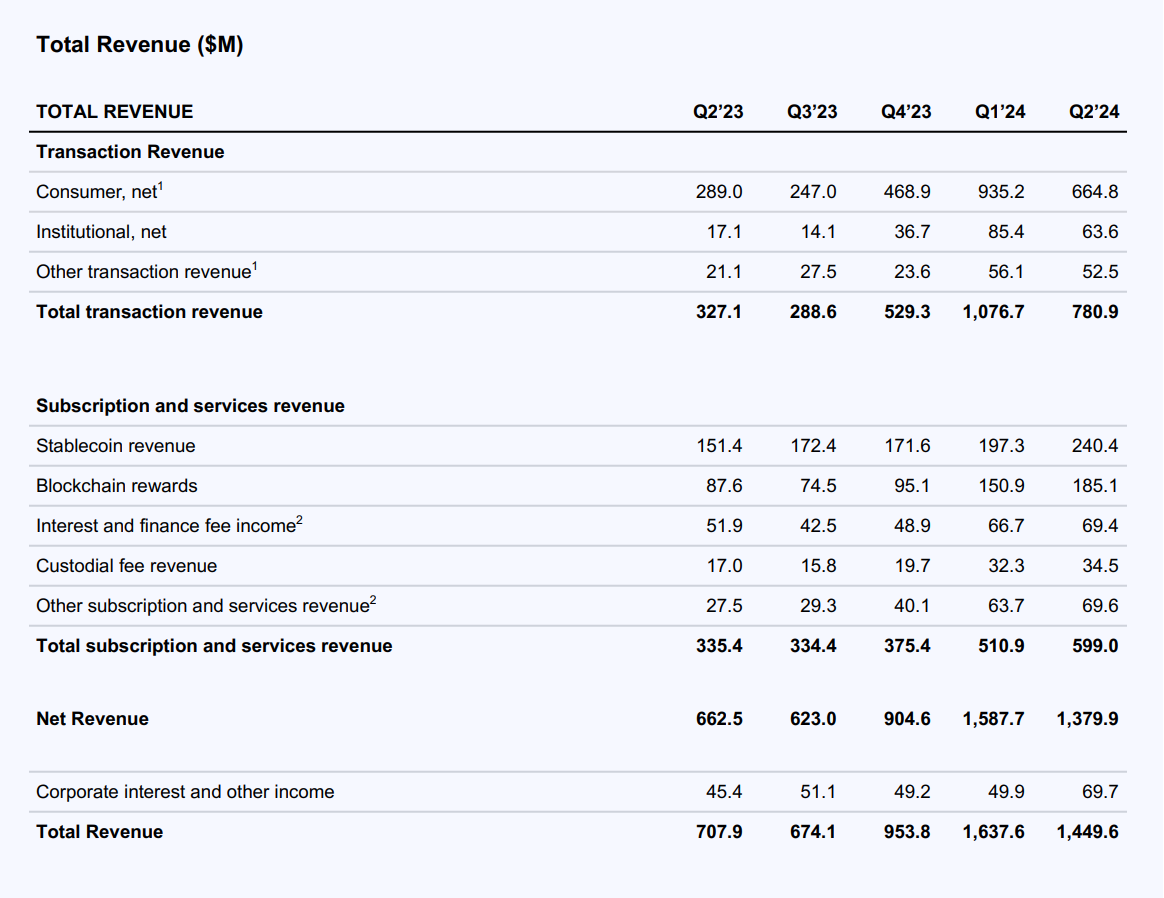

In its recent Q2 2024 earnings report, Coinbase reported a huge surge in second-quarter transactional revenue to $780.9 million from $327.1 million in the same quarter last year.

Coinbase's subscription and services revenue rose to $780.9 million, compared with $327.1 million in the same quarter last year.

Total revenue thereby came in at just shy of $1.5 billion, which is more than double last year's second quarter.

However, transaction revenue actually slipped from Q1, which saw the figure hit $1.076.7 billion, leading to total revenue of $1,637.6 billion.

In after-hours trading, Coinbase's stock price rose 3.2% following the release of its earnings report.

Last month, Coinbase's asset management arm announced that it would be creating a tokenized money market fund with the help of Bermuda-based Apex Group.

BlackRock's BUIDL was the first tokenized treasury product to hit $500 million in assets, despite only launching in March.

Franklin Templeton has also been a leader in tokenization, the process of converting real-world assets like funds and bonds into digital tokens. In 2021, the firm launched the first money market fund available on-chain using the Stellar network.

Meanwhile, Microstrategy reported a second-quarter net loss of $102.6 million, compared to income of $22.2 million.

In its Q2 earnings report, Microstrategy said the loss stemmed from an impairment charge on its Bitcoin holdings of $180.1 million, which was only $24.1 million in the same period last year.

As of 31 July, Microstrategy holds 226,500 BTC, which it purchased for $8.3 billion or an average of $36,821 per token. These assets total around $14.4 billion at Bitcoin's current price.

"On the adoption front, we are extremely optimistic with the improved understanding of Bitcoin and the increasing support for the ecosystem from bipartisan politicians and institutions on display at the Bitcoin 2024 Conference in Nashville," said Microstrategy CEO Phong Le.

Last month, Microstrategy announced a 10-for-1 stock split to make its shares " stock more accessible to investors and employees."

Despite reporting a loss, Microstrategy's stock price is up over 3% in after-hours trading.