Table of Contents

Franklin Templeton and SBI Holdings are teaming up to bring Bitcoin ETFs to Japan by establishing a digital asset management company there.

SBI will hold a 51% stake in the new company and Franklin Templeton will hold the remaining 49%.

The new joint venture will also offer digital asset securities including tokenization - an area that is expected to grow to $16.1 trillion in 2030.

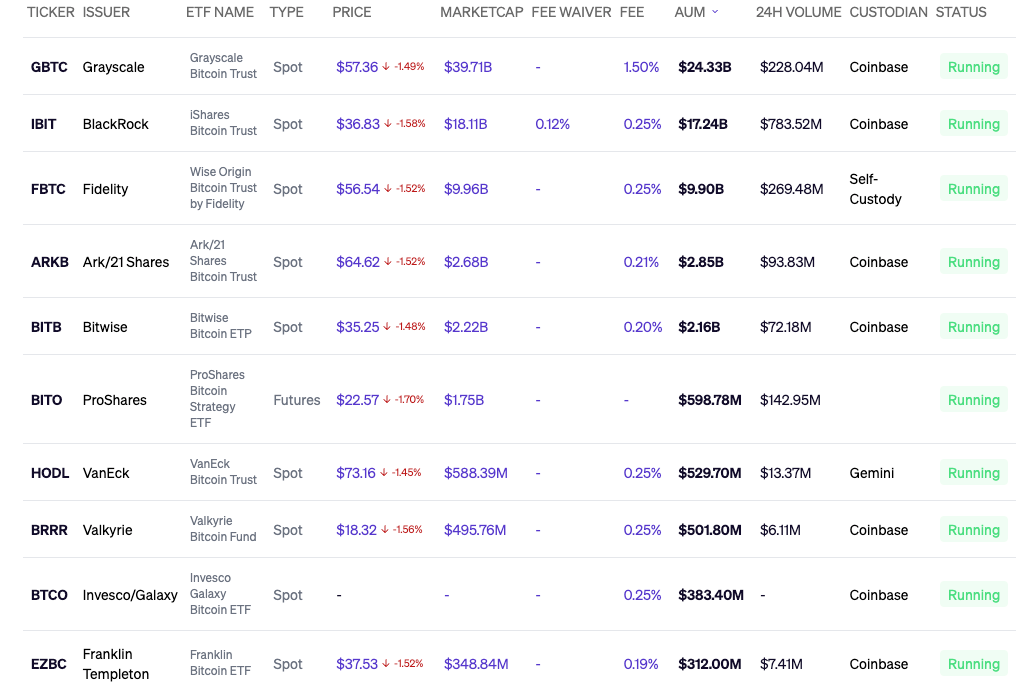

Franklin Templeton's US Bitcoin ETF is the tenth largest with $312 million in AUM.

“We have been active participants and builders in the digital asset ecosystem since 2018 and have seen the transformative power of blockchain technology firsthand,” said Roger Bayston, Head of Digital Assets at Franklin Templeton.

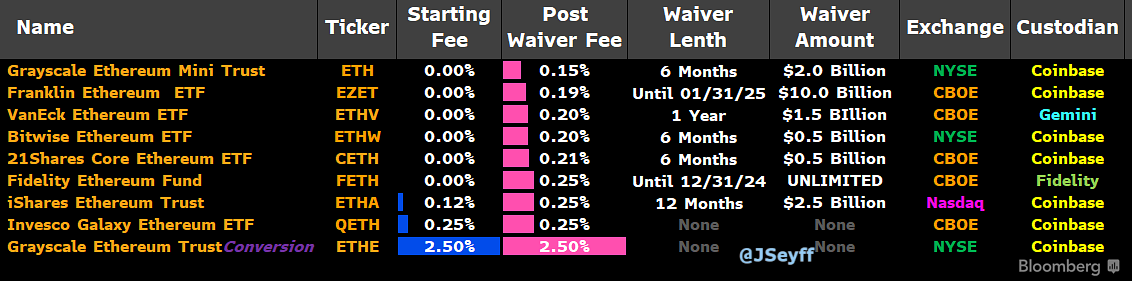

On Tuesday, Franklin Templeton launched the Franklin Ethereum ETF (EZET) on the Cboe BZE Exchange. The firm is charging a 0.19% fee, waived until the first $10 billion in assets on 31 January 2025.

“After the success of our spot bitcoin ETF (EZBC) launch in January, we are proud to add EZET to our growing lineup of digital asset ETFs,” said Patrick O’Connor, Head of Global ETFs for Franklin Templeton.

“With EZET, we are thrilled to offer our clients additional access to the digital asset ecosystem within a regulated fund structure that integrates seamlessly into traditional portfolios.”

Bayston further explained the firm's interest in Ethereum, stating. “Ethereum has been at the forefront of Web3 innovation with things like smart contracts and the Ethereum Virtual Machine and we're excited to bring that technology revolution to our clients.”

Meanwhile, SBI Holdings has been partnering with companies overseas to expand its alternative asset investment offerings.

In November 2023, stablecoin issuer Circle and SBI Holdings announced a strategic partnership that was thought to revolutionize the use of digital assets and usher in the era of Web3 services in Japan.

At the heart of this collaboration is the wide-scale adoption of the US Dollar Coin (USDC). The integration of the stablecoin, issued by Circle and pegged to the US dollar, into the Japanese financial ecosystem aims to unlock numerous opportunities.

These include simplifying cross-border transactions, enhancing liquidity in the digital asset market, and introducing innovative financial products and services, Circle said in an announcement.