Table of Contents

- Donald Trump Positions Himself as the 'Crypto President' in 2024 Presidential Bid

- Germany's Bitcoin Approach More of an Upset Than Its Football

- Singapore's DBS Sees 3x Surge in Digital Exchange Trading Volume

- Singapore's SGX Not Listing Crypto Anytime Soon But City Still Warms to Digital Assets

- Judge Asks Coinbase to Reconsider Gary Gensler Subpoena

- US House Fails to Override Biden's Veto of Pro-Crypto Bill

- SEC Drops Probe Into Paxos' BUSD, Signaling Shift in Stablecoin Stance

- Goldman Sachs Prepares to Launch Three Tokenization Projects

- Uniswap Cites Supreme Court to Challenge SEC's DeFi "Exchange" Definition

- South Korea Tightens Crypto Rules, Targeting Fraud, Stability

- Bitcoin Miners Are Fed Up But It's Good News for BTC

- VanEck, 21Shares Amend ETH ETF Filings, Ball "Back in SEC's Court"

- Events

- It's All Happening on LinkedIn

The global relevance of crypto cannot be understated. Crypto, in its all mighty glory, is available to all equally, but governments have taken it upon themselves to restrict access to this revolutionary financial wave, in varying degrees of seriousness.

Germany, which is reaching the end of its Bitcoin sell-off, has caused an upset in the market by shredding $2 billion worth of the digital currency. Although, if you're a German football fan, you'll have other reasons fueling your upset this week. Yes, we're that up-to-date with current affairs across the board here at Blockhead.

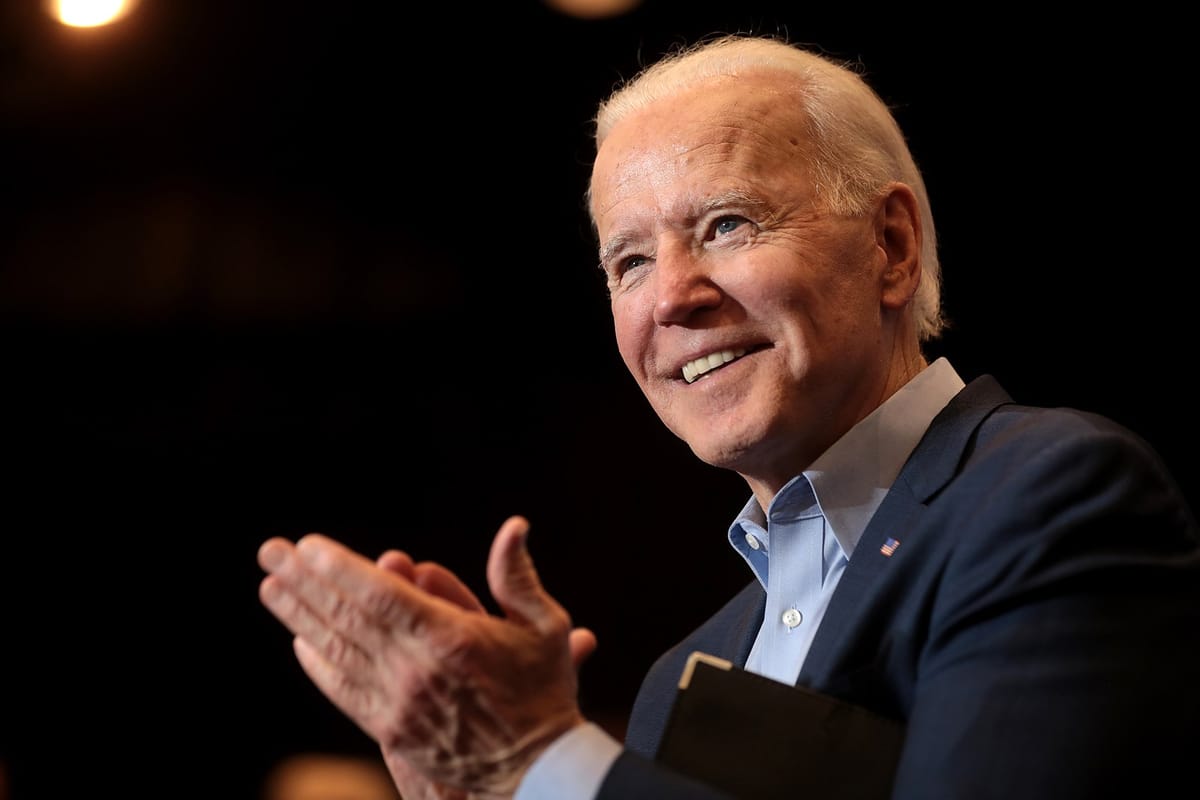

Meanwhile, as President Biden stumbles from one public gaffe to the next, Donald Trump has been busy declaring himself the "Crypto President" and even secured a keynote speaking slot at Bitcoin 2024 in Nashville later this month. Or was that "Vice President Trump"... or even "President Putin"?

HAHAHA holy sh*t Joe Biden just called Kamala Harris "Vice President Trump" pic.twitter.com/T2IzSEGsRn

— End Wokeness (@EndWokeness) July 11, 2024

🚨🇺🇸🇺🇦 Holy shit! Biden just introduced Zelensky as “PRESIDENT PUTIN.”

— Jackson Hinkle 🇺🇸 (@jacksonhinklle) July 11, 2024

“And now I want to hand it over to the President of Ukraine... ladies and gentlemen - President Putin.”

pic.twitter.com/0E2NPDbVAq

Singapore has also made headlines in the crypto world this week. The ever-cautious Little Red Dot has often refrained from embracing crypto and SGX's announcement that it won't be listing crypto anytime soon is a testament to this.

That said, Singapore's DBS has witnessed a 3x surge in trading volume on its digital exchange (DDEx). Singapore definitely has demand for these alternative assets but does it really have the stomach for it?

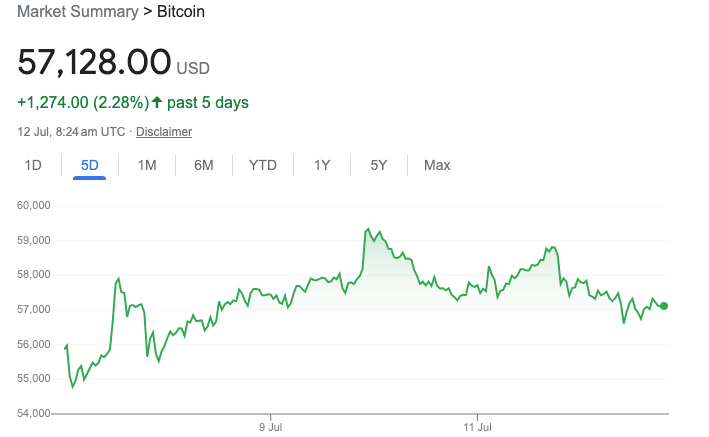

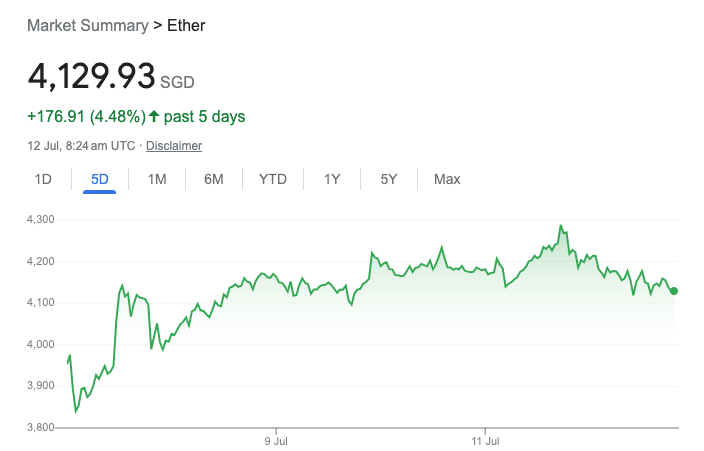

Speaking of stomachs, crypto investors needed a rather solid one to get them through this week. Although both Bitcoin and Ethereum have ended this week in the green, neither exactly instilled confidence in the market over the past few days.

Risk appetites on the Fear & Greed Index have intensified in the "Fear" zone, falling from 29, "Fear" to 25, "Extreme Fear."

The Fear & Greed Index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

But (extreme) fear not, Bitcoin is headed back to $60K soon, according to BRN analyst, Valentin Fournier.

"Bitcoin has weathered the actual sell-off significantly better than the looming pressure of Mt. Gox and the German government, suggesting that fear was responsible for most of the decline in June," he reassured. "We believe Bitcoin will continue pushing toward $60,000 this week. Favorable macroeconomic news and reduced selling pressure will likely support its breakout from the downward trend."

Donald Trump Positions Himself as the 'Crypto President' in 2024 Presidential Bid

In a recent San Francisco fundraiser, former US President Donald Trump declared his strong support for the cryptocurrency industry, positioning himself as the "crypto president" in his 2024 presidential campaign.

The fundraiser, held at tech venture capitalist David Sacks' home, saw Trump raise $12 million, with prominent figures such as Chamath Palihapitiya and former Trump ambassador Trevor Traina in attendance.

Germany's Bitcoin Approach More of an Upset Than Its Football

Germany has become the first ever Euros host to exit the competition at the quarter-final stage after a painful defeat by Spain. Unable to shine on their home turf, Germany exited the tournament earlier than expected, leaving fans disappointed, humiliated, angered, and frustrated.

But yet, the upset isn't causing as much of a stir as its government has been causing for the crypto industry. Tenuous link, we know, but what's more important than football and crypto?

Singapore's DBS Sees 3x Surge in Digital Exchange Trading Volume

Singapore's biggest bank, DBS, has seen trading volume on its digital exchange boom this year.

Digital payment tokens on the DBS Digital Exchange (DDEx) in the first five months of 2024 tripled over the same period last year. Active trading clients on the exchange grew by 36% while digital assets (assets under custody) on the platform increased by 80%.

Singapore's SGX Not Listing Crypto Anytime Soon But City Still Warms to Digital Assets

Singapore's stock exchange, SGX, has declared that it has "no immediate plans" for crypto listings. But as the Little Red Dot vies to be a regional hub for the crypto industry, is SGX's stance souring Singapore's relationship with the industry?

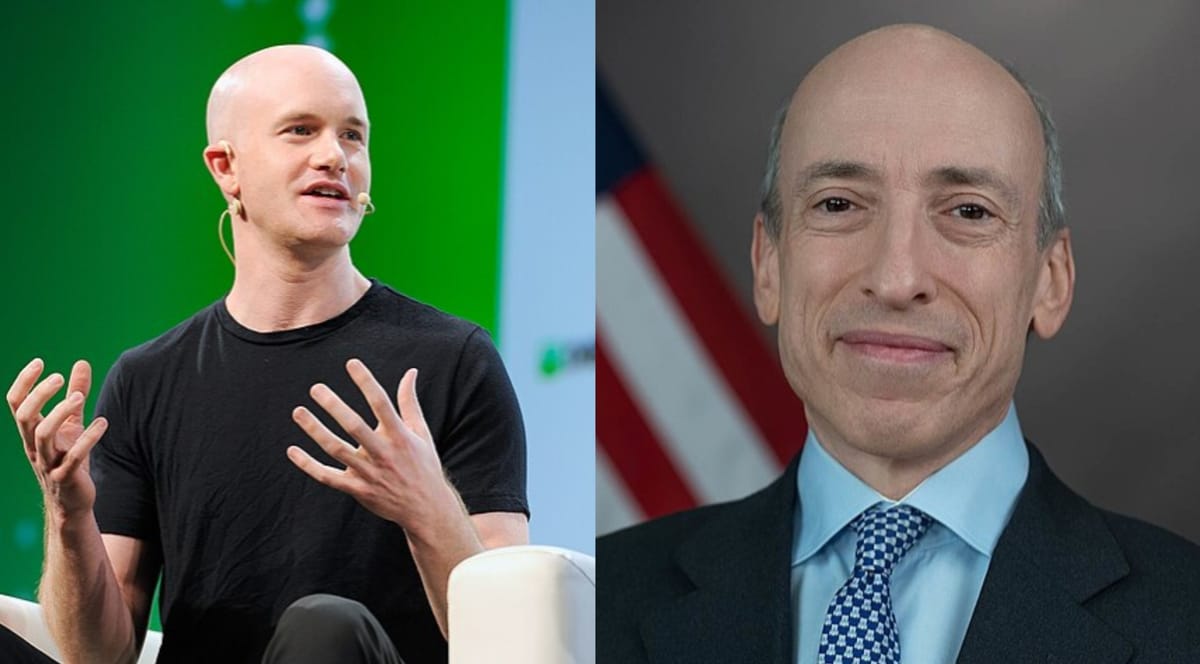

Judge Asks Coinbase to Reconsider Gary Gensler Subpoena

A federal judge has urged Coinbase to reconsider its attempt to subpoena SEC Chairman Gary Gensler’s personal communications.

Judge Katherine Polk Failla, of the District Court for the Southern District of New York, said she was "sort of surprised and not in a good way" about Coinbase's subpoena request.

US House Fails to Override Biden's Veto of Pro-Crypto Bill

The Houses of Congress have failed to overthrow President Joe Biden's veto of a pro-crypto accounting bill.

Failing to achieve a two-thirds majority from both houses of Congress in a 228-184, US lawmakers were unsuccessful in countering Biden's veto. 21 Democrats and 207 Republicans voted yes but 183 Democrats and one Republican voted no.

SEC Drops Probe Into Paxos' BUSD, Signaling Shift in Stablecoin Stance

In a surprising turn of events, the United States Securities and Exchange Commission (SEC) has formally ended its investigation into Paxos Trust Company, the issuer of the Binance USD (BUSD) stablecoin.

The decision, announced Thursday by Paxos, marks a significant victory for the stablecoin industry and raises questions about the SEC's broader approach to digital assets.

Goldman Sachs Prepares to Launch Three Tokenization Projects

Investment bank Goldman Sachs is expanding its crypto offerings to include three tokenization projects by the end of the year.

In an interview with Fortune, Goldman Sachs' digital assets global head, Mathew McDermott, revealed that the 150-year-old banking giant is rolling out the products due to demand from investors.

Uniswap Cites Supreme Court to Challenge SEC's DeFi "Exchange" Definition

Uniswap has strongly urged the US Securities and Exchange Commission (SEC) to abandon its attempt to include decentralized finance (DeFi) markets in its definition of an "exchange."

In a letter on 9 July, Uniswap cited a recent Supreme Court ruling on the Chevron doctrine, stating that the regulator could no longer use the “Chevron deference” to exert its power over the crypto industry.

South Korea Tightens Crypto Rules, Targeting Fraud, Stability

South Korea is taking a stricter approach to regulate the digital asset market. To enhance investor safety, authorities are intensifying their efforts to compel local cryptocurrency exchanges to eliminate fraudulent practices.

This push for tighter controls comes ahead of a new digital-asset legislation set to be implemented later this month, on July 19th. The Financial Supervisory Service (FSS) is taking a proactive stance, announcing that it will be closely monitoring atypical Bitcoin transactions to identify potential red flags.

Bitcoin Miners Are Fed Up But It's Good News for BTC

Bitcoin miners are putting down their computer picks and cashing in on their efforts but it could strengthen the price of BTC.

Since the end of last month, Bitcoin's total hash rate has declined from 658 exahashes per second (EH/s) to 556 EH/s. This weekend, Bitcoin's block mining difficulty has declined 7.8% from 83.68 terahashes per second (TH/s) to 79.5 TH/s.

VanEck, 21Shares Amend ETH ETF Filings, Ball "Back in SEC's Court"

Asset management firms VanEck and 21Shares have submitted amendments to their Ethereum ETF S-1 registrations with the United States Securities and Exchange Commission (SEC).

Filed on 8 July, 21Shares amended its s-1 registration form for its Core Ethereum ETF form while VanEck did the same for its Ethereum ETF on the same day.

Events

Coinfest Asia (Bali, 22-23 August)

Get ready to connect with 6,000+ people from 2,000+ companies at the largest Web3 festival in Asia. Get your tickets now with Blockhead's 10% discount code: CA24BLOCKHEAD

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3!

There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers. So be sure to sign up!