Table of Contents

Cryptocurrency markets have taken a hit this week, with major coins like Bitcoin experiencing price dips and memecoins suffering significant losses.

This downturn comes amidst concerns about potential tightening from the US Federal Reserve and news of outflows from Bitcoin ETFs, with uncertainty highlighted by the end of a 20-day streak of inflows into spot BTC ETFs and significant declines in memecoins (15%) and Solana (10%) over the past week.

Memecoin Mania Meets Reality

Memecoins, the once red-hot corner of the crypto market, are facing a harsh reality check. Dogecoin (DOGE) and Shiba Inu (SHIB), the two most recognizable memecoins, have both seen double-digit percentage drops in recent days. SHIB, in particular, has plummeted by 18.4% over the past week, while OG doggie DOGE is down 13%, WIF is -20.09%, BONK is -21.17%, and PEPE is -11.97% during the same period, placing them among the worst performing cryptocurrencies this week.

The change in memecoin fortunes has also resulted in a a 7% dip in Solana, a blockchain that has been the focus of a large segment of this space, over the past 24 hours. The token currently sits at $137.44.

This decline could signal a shift in investor sentiment away from memecoins and towards more established cryptocurrencies with perceived utility. However, it's important to note that memecoins are known for their unpredictable behavior, so a quick reversal is not entirely out of the question.

Bitcoin ETF Outflows Raise Questions

Adding to the market's jitters is the news of outflows from Bitcoin ETFs. These exchange-traded funds, which allow investors to gain exposure to Bitcoin without directly holding the cryptocurrency, have been hailed as a significant step towards mainstream adoption.

However, recent reports indicate a net outflow of over $620 million from Bitcoin ETFs last week, suggesting some investors might be pulling out due to the current market climate.

The pain continued this week - on Monday, the 11 bitcoin ETFs cumulatively posted net outflows of $145.83 million, led by Fidelity’s FBTC, which saw $92 million in outflows, The Block reported.

The outflow could be linked to the hawkish stance of the US Federal Reserve, which has signaled potential interest rate hikes to combat inflation. Rising interest rates can make riskier assets, like cryptocurrencies, less attractive to investors.

At publication time, Bitcoin stood at $65,701, or -0.74% in 24 hours and -2.69% in 7 days, according to CoinMarketCap data.

"Bitcoin’s price has been steadily decreasing since the recent hawkish comments from the Federal Reserve. This marks the fourth time BTC has failed to break the $71,500 mark and reclaim its all-time high. The abrupt reversal following the CPI-induced $4,000 price surge has instilled doubt in investors’ minds," said brn analyst Valentin Fournier.

"While we believe in a rebounding Bitcoin, a new catalyst will be necessary for it to break out of the $65,000-$71,000 range. Consistent evidence of diminishing inflation in the U.S. or global interest rate cuts could provide the required liquidity to drive the market higher," the analyst added.

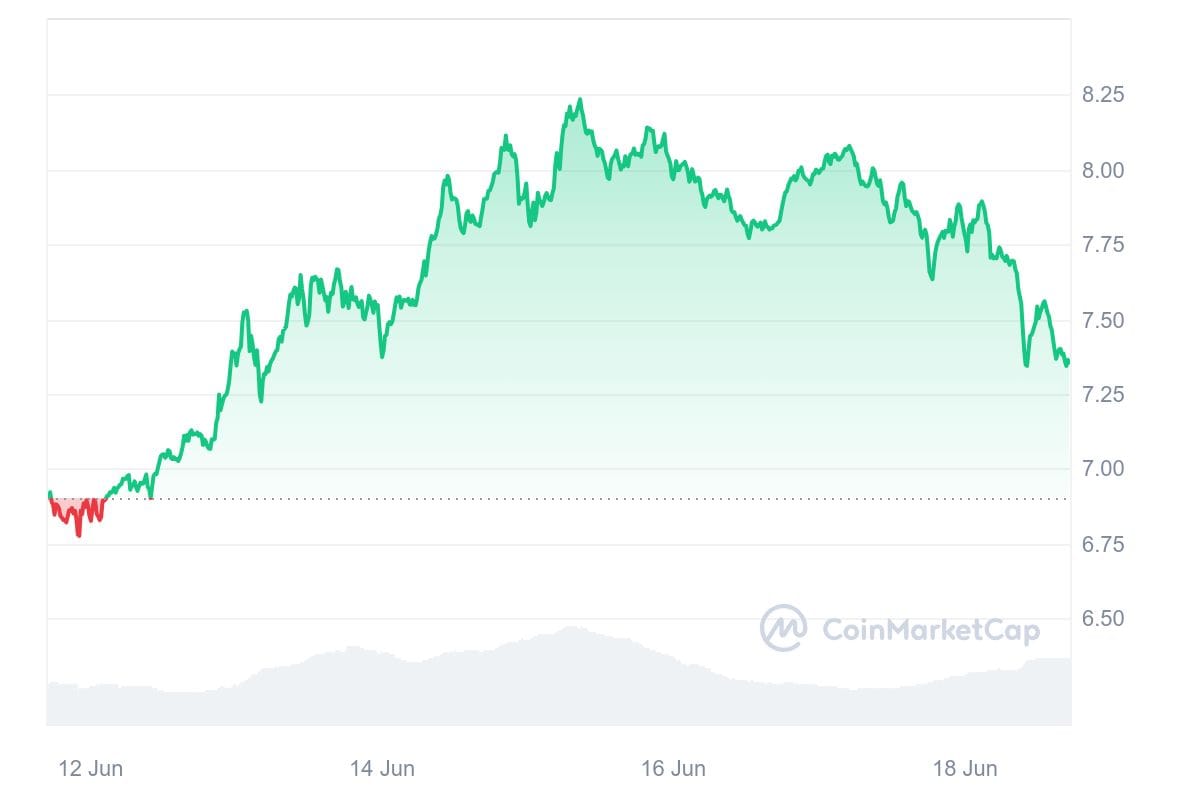

A Lone Bright Spark: TON Bucks the Trend with Explosive Growth

While the broader market experiences a downturn, the Telegram Open Network's native token, TON has defied the downtrend with a surge in price in recent days. This unexpected rally comes on the heels of significant developments within the TON ecosystem.

TON's impressive performance can be attributed to surging Total Value Locked (TVL) on the TON blockchain and its rapidly growing DeFi ecosystem. According to CoinTrust, TON's TVL has more than doubled in the past three weeks, surpassing $600 million. This substantial growth reflects investor confidence in the network's potential and the development of robust DeFi applications on TON.

Secondly, the integration with Telegram, a messaging platform with over 500 million monthly active users, is another key driver. This integration has the potential to introduce a massive user base to TON, fueling further adoption and demand for the token. Finally, the recent rise of memecoins within the TON ecosystem, like Resistance Dog, The Resistance Cat, and Ton Inu, has garnered additional attention.