Table of Contents

BlackRock's iShares Bitcoin Trust (IBIT), a spot Bitcoin exchange-traded fund (ETF), has taken the traditional finance world by storm. Launched in January 2024, IBIT has surpassed Grayscale's Bitcoin Trust (GBTC) to become the world's largest Bitcoin ETF, touching the $20 billion mark in a mere 137 days.

As of May 28, IBIT holds over $20 billion in assets with 288,670 Bitcoin in its trust. This surpasses GBTC's $19.7 billion in assets and 287,450 bitcoin holdings, according to HODL15Capital, posting on X/Twitter.

This meteoric rise highlights the growing institutional appetite for exposure to Bitcoin through regulated investment vehicles.

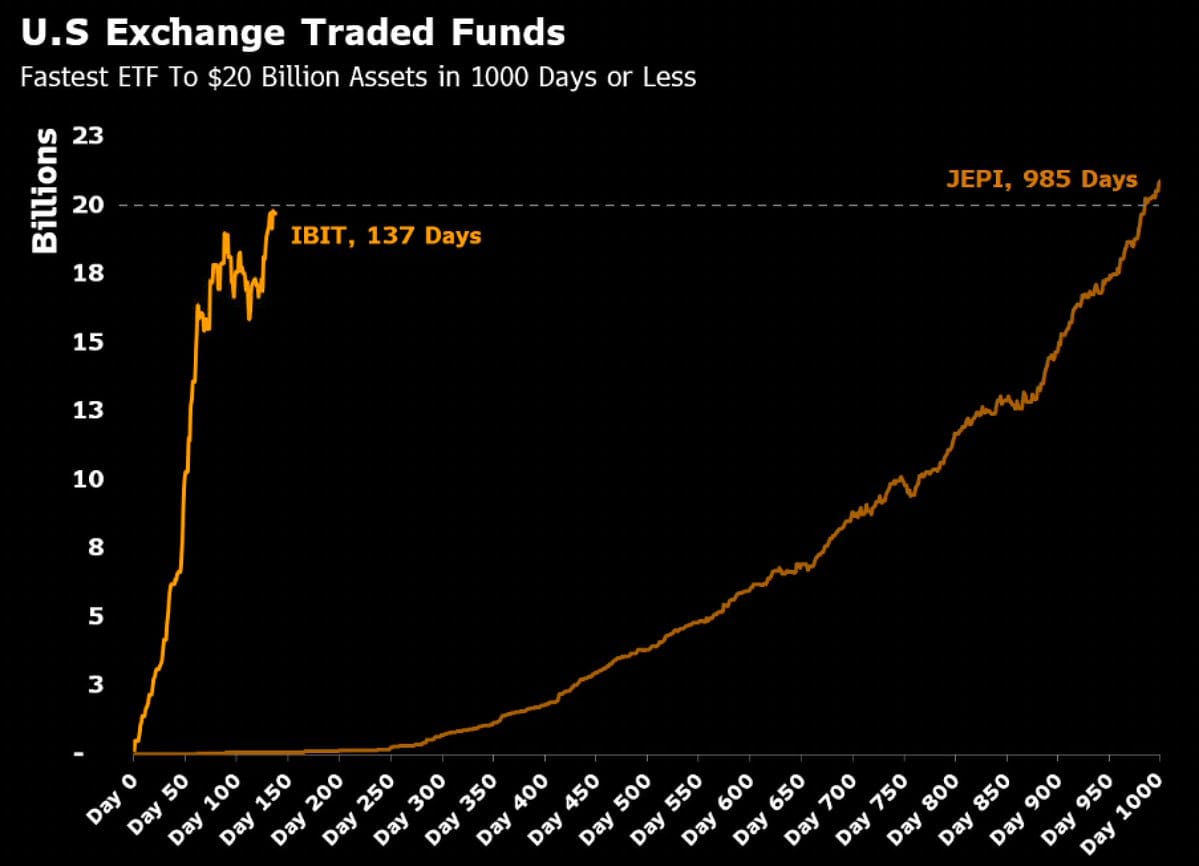

The speed of IBIT's adoption is particularly striking. Historically, no ETF has reached $20 billion in assets under management within 1,000 days. The previous record holder, the JPMorgan Equity Premium Income ETF ($JEPI), achieved this feat in 985 days. IBIT has shattered this benchmark, demonstrating the unprecedented demand for a secure and transparent way to access Bitcoin.

According to recent 13F filings, Bracebridge Capital is the largest holder of IBIT, with an investment of $81 million. In Q1, the Wisconsin Investment Board bought 2.5 million shares of IBIT for a total value of $99.2 million. Elliot Capital also disclosed a $12 million stake in IBIT.

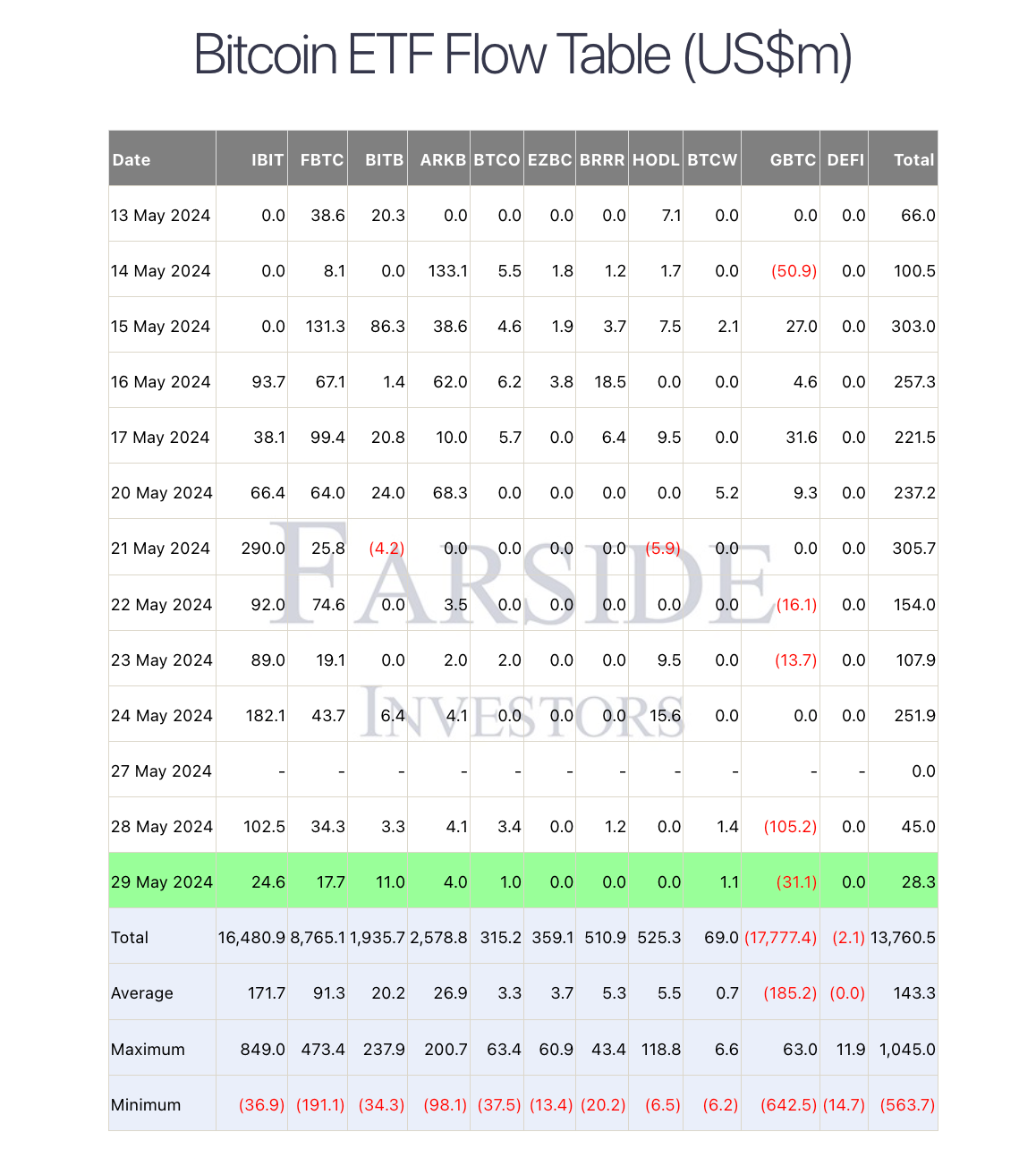

This rapid adoption coincides with a period of sustained positive inflows into spot Bitcoin ETFs. Since the news broke on May 16 that Wisconsin invested over $160 million in Bitcoin ETFs earlier this year, there has been strong daily net inflows into IBIT. This suggests a broader trend of traditional institutions allocating a portion of their portfolios to Bitcoin, potentially seeking diversification and potential for high returns.

The surge in IBIT's popularity can also be seen within the context of a larger movement towards digital assets.

"IBIT's record-breaking growth presents a compelling case for traditional finance professionals interested in exploring digital assets. It demonstrates a growing comfort level with Bitcoin among institutional investors and paves the way for further integration of this asset class into mainstream portfolios" Valentin Fournier, analyst at Blockhead's research arm, brn, said.

IBIT's record-breaking trajectory serves as a powerful indicator of the deepening relationship between Bitcoin and traditional finance. With its low fees (0.25%), superior liquidity, and the backing of a trusted brand like iShares, IBIT will likely remain a dominant force in the Bitcoin ETF landscape.