Table of Contents

Bitcoin just delivered a knockout punch, rocketing past $70,000 and sending tremors through the cryptocurrency landscape overnight. But the aftershocks are strongest in the realm of Bitcoin mining stocks, where companies are experiencing a surge even more dramatic than the underlying asset.

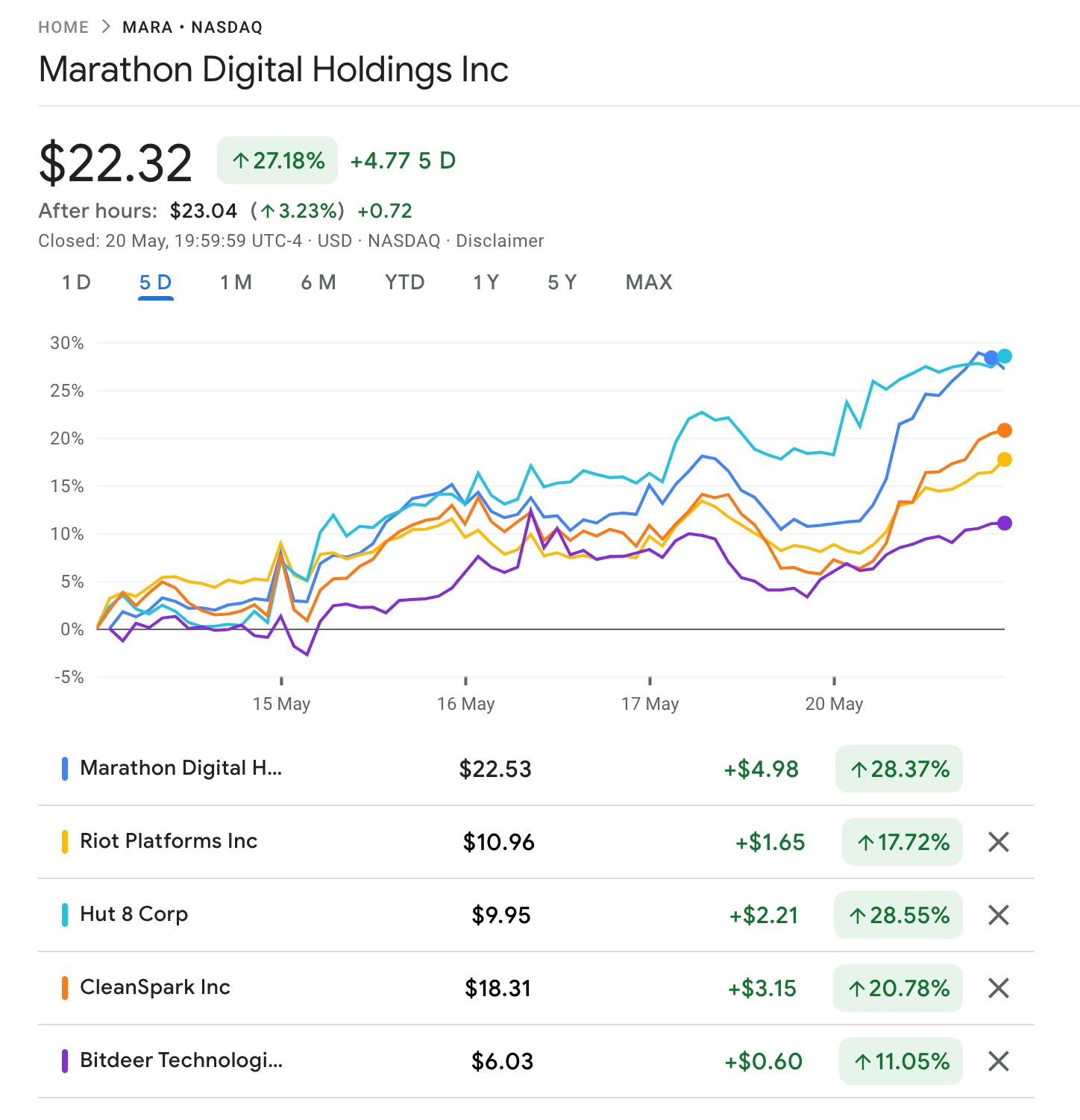

Leading Bitcoin mining stocks are celebrating alongside the king of crypto. Riot Blockchain (RIOT) is up a staggering 32.72% to $10.96, Hut 8 (HUT) is not far behind with a 28.22% jump to $9.95, and Marathon Digital (MARA) is leading the pack with a 32.7% surge to $22.32.

The positive sentiment isn't exclusive to mining stocks. Other companies heavily invested in Bitcoin, like MicroStrategy (MSTR), are experiencing significant gains as well. MicroStrategy's stock price climbed 12.4% this week to $1,764 in after-hours trading, reflecting the appreciation of its massive Bitcoin holdings. Coinbase (COIN), the leading US-based cryptocurrency exchange, is also enjoying the rally, with its stock price rising 8.7% over the past week to sit at $230 in after-hours trading

This trend highlights the leveraged nature of mining and crypto-adjacent stocks - their performance is often amplified compared to Bitcoin's price movements. When Bitcoin goes up, mining becomes more lucrative, attracting investment and driving the share prices of mining companies upwards.

Bullish Outlook, Despite Hashprice Challenges

However, this relationship isn't without its complexities, and factors like hashrate and energy costs can play a significant role in determining the long-term health of the mining sector.

While the current hashprice of $55/PH/day isn't exactly setting records (it's near the all-time low from the last halving), there's a silver lining. Tight mining economics are keeping hashrate growth in check. Even with Bitcoin's price rally, the hashrate increase has been slow, meaning the next difficulty adjustment is likely to be minor.

The hashrate, which had been dipping, appears to have stabilized around 600 EH/s on the 7-day average, according to Hashrate Index. However, its future trajectory depends heavily on where Bitcoin's price heads. The upcoming North American summer, with its high energy costs, may force miners in the US to curtail operations, potentially keeping the hashrate range-bound between 600-700 EH/s for the next few quarters.

Looking Ahead

While the outlook for Bitcoin mining stocks appears bullish in the short term, there are some factors to consider:

- Summer curtailment: US-based miners may be forced to reduce operations due to high energy costs, potentially impacting hashrate growth.

- Global hashrate expansion: How miners in other regions respond to Bitcoin's price increase will be a key indicator of future hashrate growth.

Bitcoin's price surge is a boon for mining stocks, but keeping an eye on hashrate developments and the upcoming summer months will be crucial for understanding the sector's long-term prospects.