Table of Contents

Hong Kong's highly anticipated Bitcoin and Ethereum ETFs are continuing to disappoint.

Debuting on 30 April, Hong Kong's crypto ETFs hit the market with a rather lacklustre start, reeling in just $12 million in trading volume, inflows paled in comparison to the US market's $4.6 billion first day of Bitcoin ETFs.

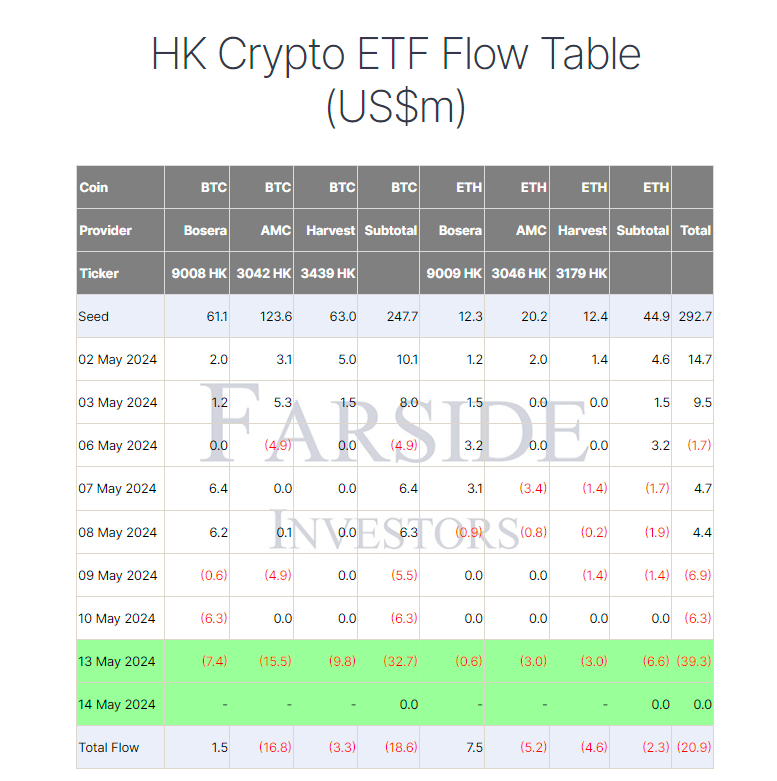

Off to a weak start, Hong Kong's crypto ETFs have yet to come to full fruition. On Monday, ChinaAMC, Harvest Global, and Bosera and Hashkey, saw combined outflows of $32.7 million.

The figure is more than five times that of the previous highest outflow number of $6.3 million. Monday was also the first time that all six ETFs saw outflows since their debut, as well as Harvest Globla's first-ever day in the red. ChinaAMC’s Bitcoin fund was the biggest loser with outflows reaching $15.5 million.

Total outflows since the launch of these products have amounted to $20.9 million, eradicating the $18.4 million in total inflows as of Friday 10 May.

Hong Kong's disappointing figures come as Bitcoin struggles to stay above $63,000 since the Bitcoin halving event last month.

However, the industry is still remaining optimistic for Hong Kong. Market maker Wintermute recently revealed it is providing liquidity to OSL and HashKey for Hong Kong's Bitcoin and Ethereum ETFs.

Additionally, LD Capital, Antalpha Ventures, and Highblock have announced the launch of a HK$1 billion (US$128 million) liquidity fund for Hong Kong ETFs.

Online trading platform Tiger Brokers has also launched digital asset trading services in Hong Kong as the city continues to embrace the crypto sector.

Professional investors can now trade 18 cryptocurrencies as well as stocks, futures, US Treasury bonds and Hong Kong's Bitcoin ETFs. Such investors must have an investment portfolio valued at more than 8 million HKD and corporate entities with assets exceeding 40 million HKD.