Table of Contents

Bitcoin mining firm Riot Platforms reported a company record for net income in Q1 2024 but failed to meet analysts' expectations for revenue.

In its most recent earnings announcement, Riot's net income came in at a record $211.8 million, marking a 1,000% increase from the same time last year.

Mining revenue also jumped 55.4% year on year due to Bitcoin's 131% increase in price. However, Riot's total revenue of $79.3 million fell 14% short of estimates.

Riot cited lower Bitcoin production and higher mining costs due to a rise in the cryptocurrency's network difficulty and hash rates as a reason for its slow revenue growth.

The firm mined 1,364 BTC during Q1, marking a 36% drop year on year, whilst its average cost to mine 1 BTC was 144% higher at $23,000.

Last month, Riot announced their new Corsicana Facility. Jason Les, CEO of Riot, said the new facility will add "an anticipated 3.7 EH/s to [their] self-mining hash rate once miners have been fully deployed shortly thereafter."

In the most recent quarter, Les said, “Miners deployed at our Corsicana Facility are already hashing, and we remain on track to increase our self-mining hash rate capacity to 31 EH/s by the end of the year, which will nearly triple our existing hash rate capacity."

Riot stated that upon full deployment in 2025, it anticipates a total self-mining hash rate capacity of 41 EH/s.

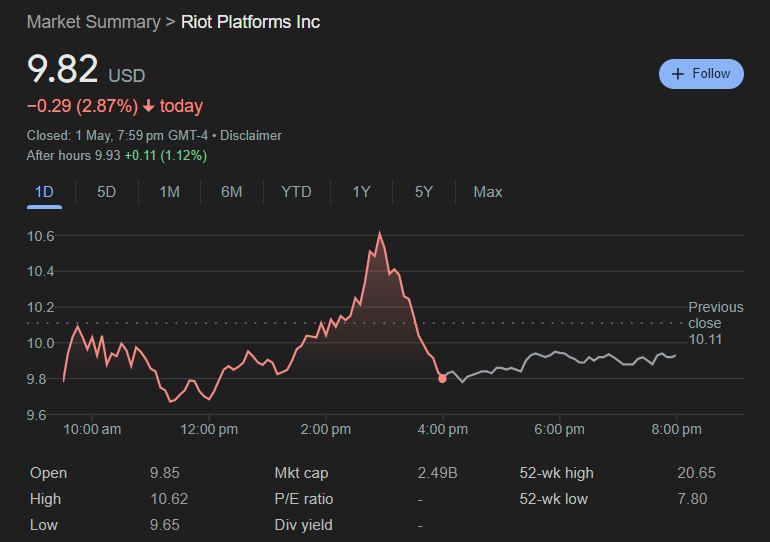

Riot's stock price fell 2.87% but has risen slightly in after-hours trading.