Table of Contents

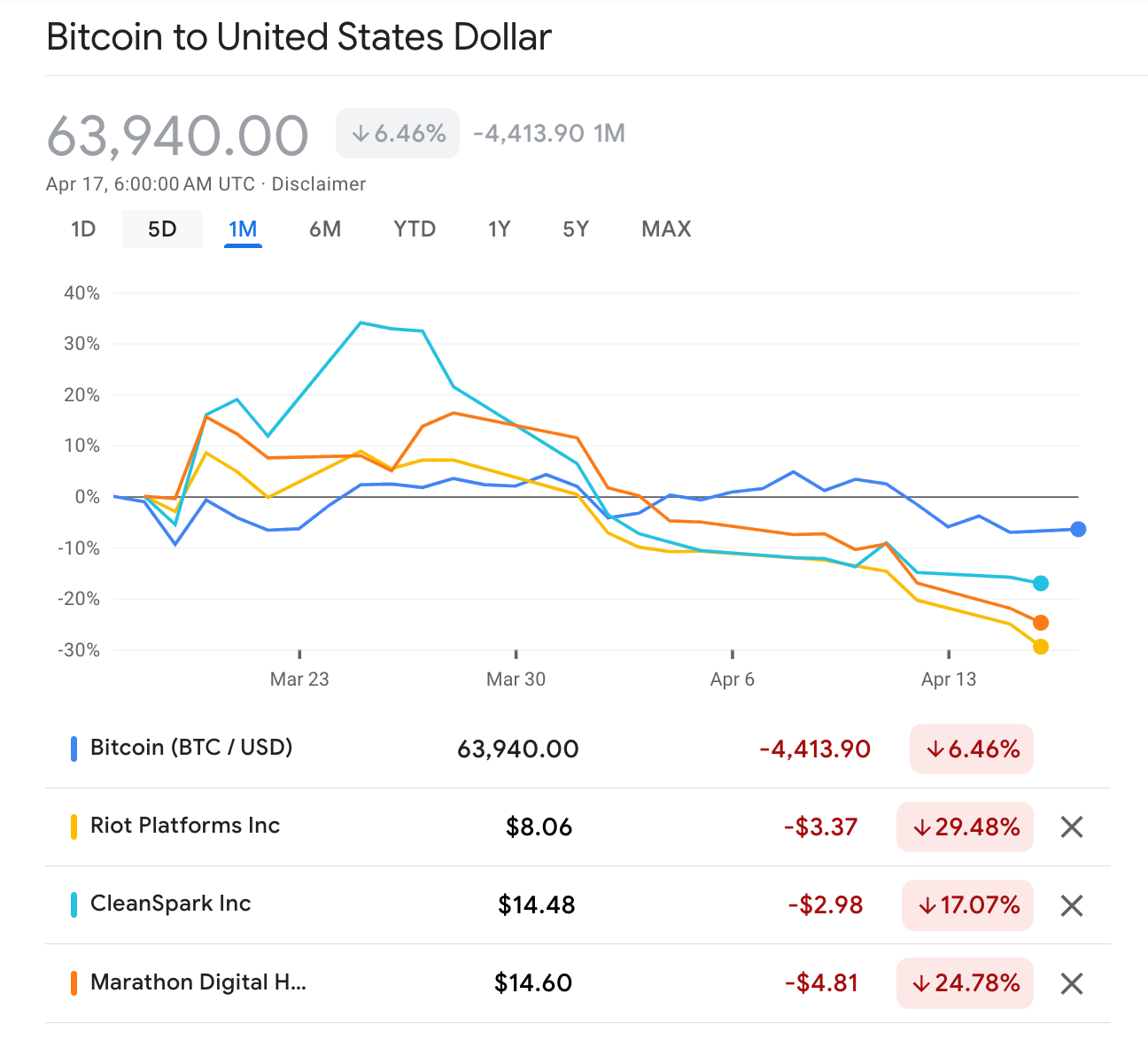

The Bitcoin halving, a pre-programmed event that cuts Bitcoin mining rewards in half, is fast approaching. Scheduled for sometime later this week, this halving has investors dumping Bitcoin mining stocks. But are they really an overhyped risk or a bargain to be scooped up?

The upcoming halving event will slash mining rewards in half, while operational expenses hold steady, significantly diminishing mining companies' profitability. This raises a critical question for investors: how will mining companies maintain profitability in a post-halving environment?

Navigating the halving

Several strategies are being explored among mining firms, including selling off Bitcoin stock to replace old machines, and making their operations more efficient.

Companies like Riot Platforms (NASDAQ: RIOT) – down 54% from its year-to-date high in February – are focusing on cost reduction and expanding their self-mining operations. Their recent purchase of miners from MicroBT underscores this commitment.

Riot's CEO remains optimistic, believing the current slump is temporary: "Replacing these under-performing miners with the new M60S model will have a positive effect on both our operating uptime and energy efficiency, as these are the most efficient miners ever produced by MicroBT. The investment made in this purchase order strengthens our commitment to be a leading low-cost miner and further enhances our industry leading fleet into the future,” Jason Les, CEO of Riot, said.

For CleanSpark, (NASDAQ: CLSK) the company recently surpassed 17 EH/s in hashrate, a metric that reflects their mining power. Their focus on low carbon energy sources and strategic acquisitions positions them well for a future increasingly concerned with environmental impact. It's stock is down almost 40% from its YTD high in March, but is still up more than fivefold since the start of 2024.

"After halving, many old and inefficient machines will go offline, increasing CleanSpark's organic market share while lowering the network's energy consumption. We are well-suited to take advantage of the opportunities that the halving affords and look forward to continuing our unmatched growth," Zach Bradford, CEO, said last week.

Marathon Digital (NASDAQ: MARA) recently appointed a new managing director for European expansion, signaling its commitment to global growth. The company has also been acquiring new sites to reduce Bitcoin production costs and expand operational capacity.

Their ongoing efforts to optimize Bitcoin production and mining operations further demonstrate their preparedness for the halving, though its stock is down almost 25% over the past month, following an almost fourfold rise between November 2023 and the start of 2024.

Investing in Bitcoin Mining Stocks: A Calculated Risk

Mining companies are taking steps to ensure profitability post-halving, and a rise in the price of Bitcoin could significantly improve their financial standing.

Several factors paint a bullish picture for the future of Bitcoin. The recent approvals of Bitcoin ETFs in Hong Kong, following similar moves in the US earlier this year, represent a significant step toward mainstream adoption. These ETFs offer a regulated way for institutional investors to gain exposure to Bitcoin, potentially leading to a significant influx of capital into the cryptocurrency market.

A surge in Bitcoin's price would directly benefit mining companies. Even with the halving reducing rewards, the increased value of each mined Bitcoin could more than compensate. Additionally, with greater institutional involvement, the cryptocurrency market is likely to experience increased stability and regulation, potentially mitigating some of the volatility that has plagued mining stocks in the past.

So, can Bitcoin mining stocks offer a potential bargain for investors with a high-risk tolerance, especially given the recent dip across the board?

"The growth prospects of mining companies appear less robust compared to Bitcoin, given similar volatility and high correlation," an analyst at Blockhead's in-house research arm, brn, said.

"Bitcoin mining firms experienced a surge in share prices over the past year, driven by anticipation of the halving. Despite a recent price correction, the potential for returns lags behind that of Bitcoin itself."

While mining operations are expected to become increasingly efficient, these gains are already factored into stock prices, exacerbating volatility concerns shared with Bitcoin, the analyst explained.

In fact, looking at Bitcoin's performance – down only 6% in the past month and up 40% year-to-date, it might be wiser to hold the token instead.

"We advise investors seeking exposure to Bitcoin to consider direct investment in the token rather than in mining stocks," the analyst said.

To read more insights from brn, subscribe for early access. Ahead of the platform's launch, newsletters featuring detailed insights will be free.

Elsewhere