Table of Contents

The Hong Kong Securities and Futures Commission (SFC) officially approved several spot Bitcoin and Ethereum exchange-traded funds (ETFs) on Monday.

Leading asset managers including China Asset Management, Bosera Capital, and HashKey Capital Limited are among those that received the green light from the city's financial regulator.

China Asset Management's Hong Kong arm, in collaboration with OSL Digital Securities and BOCI International, has received approval to launch spot Bitcoin and Ethereum ETFs. This initiative aims to provide retail investors with direct access to crypto subscriptions through regulated channels.

Similarly, Bosera Asset Management and HashKey Capital's SFC-approved spot crypto ETFs, the Bosera HashKey Bitcoin ETF and the Bosera HashKey Ether ETF, will allow investors to directly use Bitcoin and Ethereum for ETF share subscriptions. Harvest Global Investments has also received an in-principle nod for its two digital asset spot ETFs, highlighting the SFC's commitment to fostering innovation and catering to diverse investor needs.

Hong Kong's Ambitions: A Crypto Hub Emerges

The introduction of virtual asset spot ETFs is seen as a significant step towards solidifying Hong Kong's position as a global financial center and a hub for virtual assets. This aligns with the city's strategic push to become a regional leader in financial innovation, particularly within the digital asset sector.

The approvals reflect Hong Kong's progressive regulatory framework, aiming for safe and secure integration of digital assets into its financial ecosystem. These ETFs are expected to provide a regulated and innovative investment avenue for both retail and institutional investors in the region. Analysts predict an impact similar to, though less hyped than US ETF approvals that happened at the start of 2024.

"There is a lot of anticipation for the BTC ETF in Hong Kong as investors have been eagerly awaiting since the approval and performance of the US spot BTC ETFs earlier this year," Nick Ruck, COO at ContentFi Labs, told Blockhead.

However, Ruck said he doesn't think that Hong Kong's ETFs will have much impact on other US ETFs gaining approval.

"The US regulators have a very diffident perspective and agenda, If the HK ETFs perform well in a regulatory perspective, then at most they may help as positive references if the US ETF approvals are denied and legally challenged like previously with the BTC ETFs."

Market Reaction: A Boost for Bitcoin and Ethereum

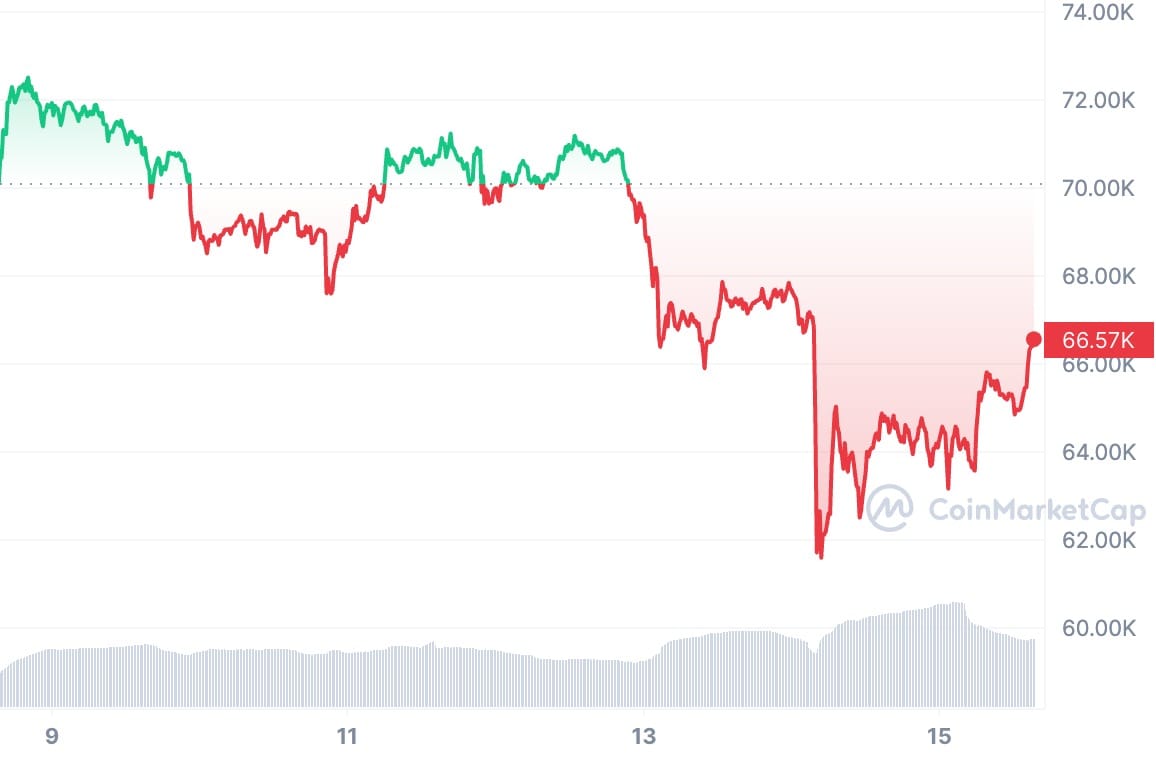

Following last week's rumors, today's confirmation has invigorated the market. Bitcoin prices have surged by 2.2%, surpassing the $66,000 mark, while Ethereum is over 5% up today to sit at around $3,200.

The approved ETFs are reportedly set to launch by the end of April.