Table of Contents

The cryptocurrency market's reversal of fortunes continued over the past 24 hours, with both Bitcoin (BTC) and Ethereum (ETH) experiencing significant price drops in the lead-up to the highly anticipated Federal Open Market Committee (FOMC) decision later today. This unexpected shift highlights the crypto market's sensitivity to broader economic factors.

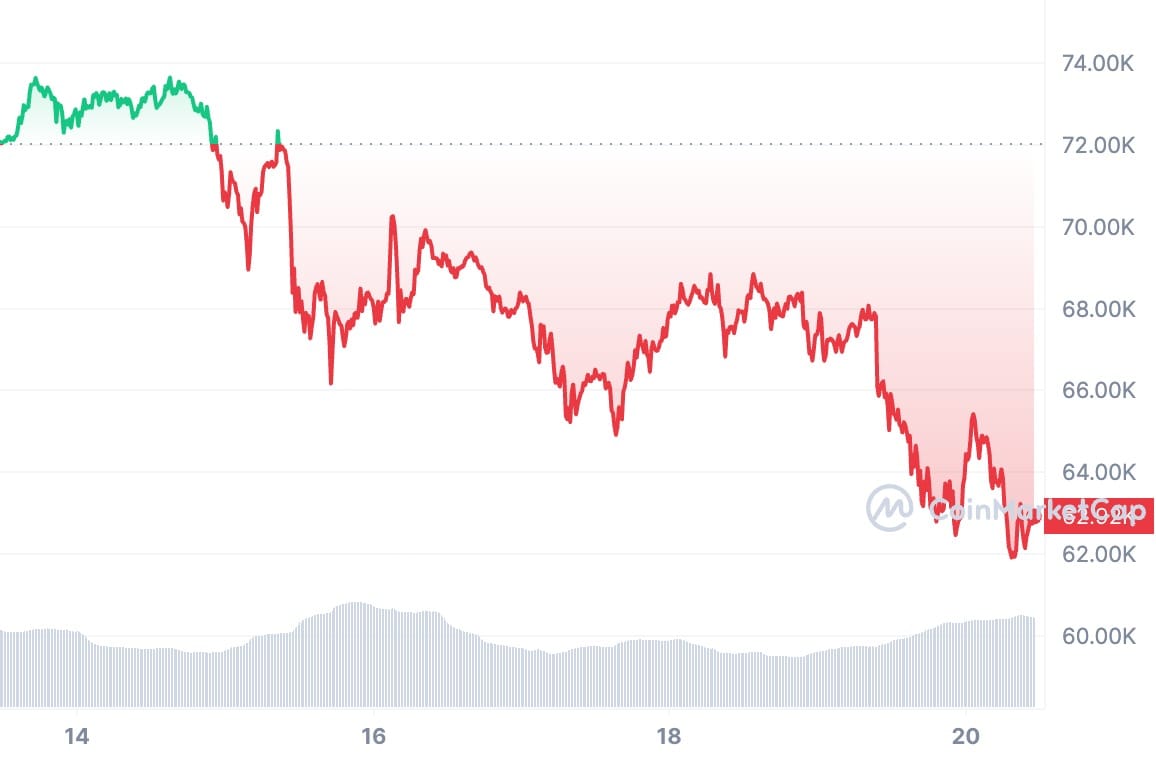

Bitcoin, which surged to over $73,000 last week, has taken a nosedive, plummeting over 6% to currently trade around $61,500 earlier this morning, following a 7% tumble the day before, as investors grapple with the potential impact of the Fed's upcoming interest rate decision.

The possibility of tighter monetary policy could dampen investor risk appetite, leading to a flight from riskier assets like Bitcoin.

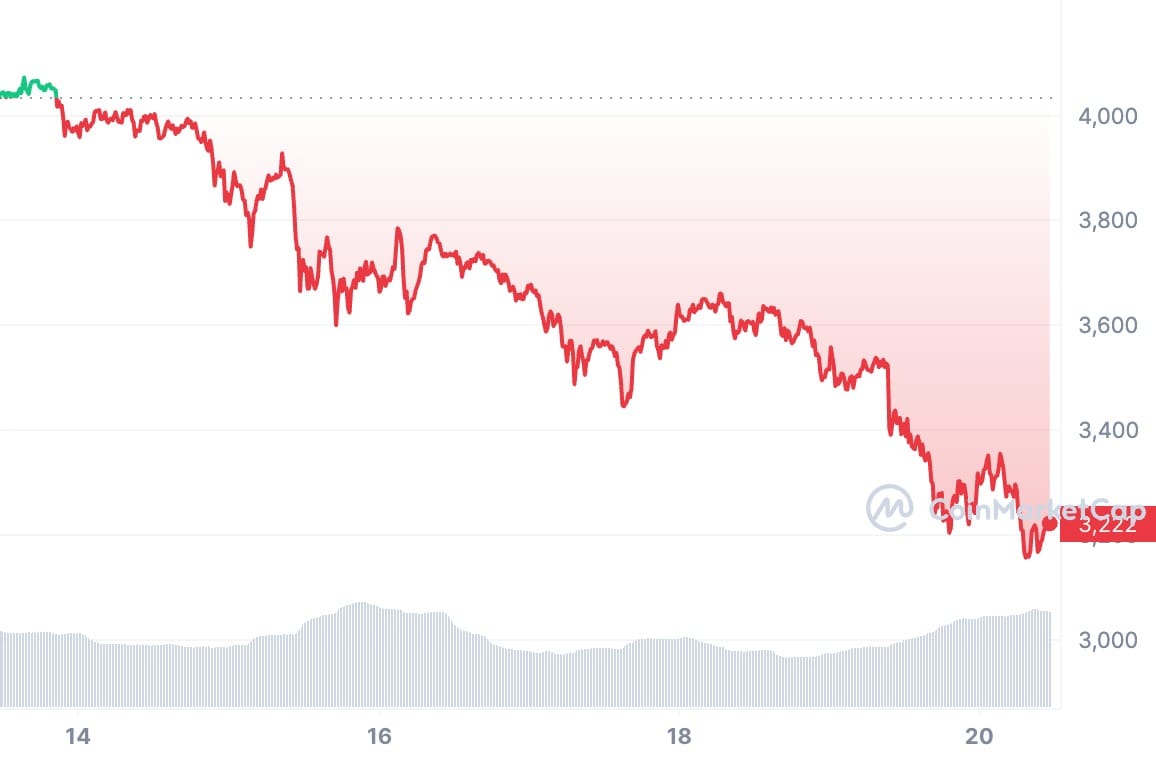

While Bitcoin bears the brunt of the immediate selloff, Ethereum's future also appears uncertain. An article on Ambcrypto noted the possibility of large investors strategically shorting Ethereum, potentially contributing to its price decline. However, the full picture remains unclear.

Regardless of the short-term tactics, Ethereum has undeniably been swept up in the market-wide sell-off. ETH prices have tumbled over 8%, currently hovering around $3,145 as of this morning.

Trading firm QCP's analysis suggests that downside panic has exacerbated losses in Ethereum, with front-end risk reversals "sinking even deeper to -20% and vols spiking to +10% over BTC." This technical indicator suggests a heightened fear of further price declines among investors.

Adding to the market jitters are continued outflows the GBTC Bitcoin ETF from Grayscale, the world's largest digital currency asset manager. Investors pulled out a record of over $643 million on Monday alone, Reuters reported. This is likely due to a combination of factors including high fees, profit-taking, and a shift to the recently launched ETFs with lower fees.

Despite the outflows, Grayscale maintains that they anticipated this behavior and the fund's assets still sit at a healthy $27.2 billion. The firm has also hinted at plans to reduce fees in the future, potentially stemming the tide of outflows.

Beyond Grayscale, the broader digital currency asset management industry also witnessed net outflows yesterday. Data from BitMEX suggests a total outflow of $154 million across various Bitcoin ETFs. While BlackRock continued to be a net investor, Fidelity's inflows dipped compared to previous days, recording only $5.9 million.

As the FOMC decision unfolds, the coming hours and days will be crucial in determining the trajectory of major cryptocurrencies like Bitcoin and Ethereum. Investors are advised to closely monitor the situation and exercise caution when making investment decisions.