Table of Contents

VanEck is temporarily removing its management fee for its Bitcoin ETF, HODL.

In a post on X, the investment manager said it will offer a 0% management fee from 12 March 2024 until 31 March 2025. However, VanEck stated the fee cut will only apply for the first $1.5 billion of the trust's assets. Fees on assets over $1.5 billion will be 0.2%.

IMPORTANT UPDATE!

— VanEck (@vaneck_us) March 11, 2024

Because we believe in #bitcoin so much, starting tomorrow, you can invest in VanEck Bitcoin Trust (HODL) with no fees until March 31st, 2025.*

*During the period commencing on March 12, 2024, and ending on March 31, 2025, the Sponsor will waive the entire…

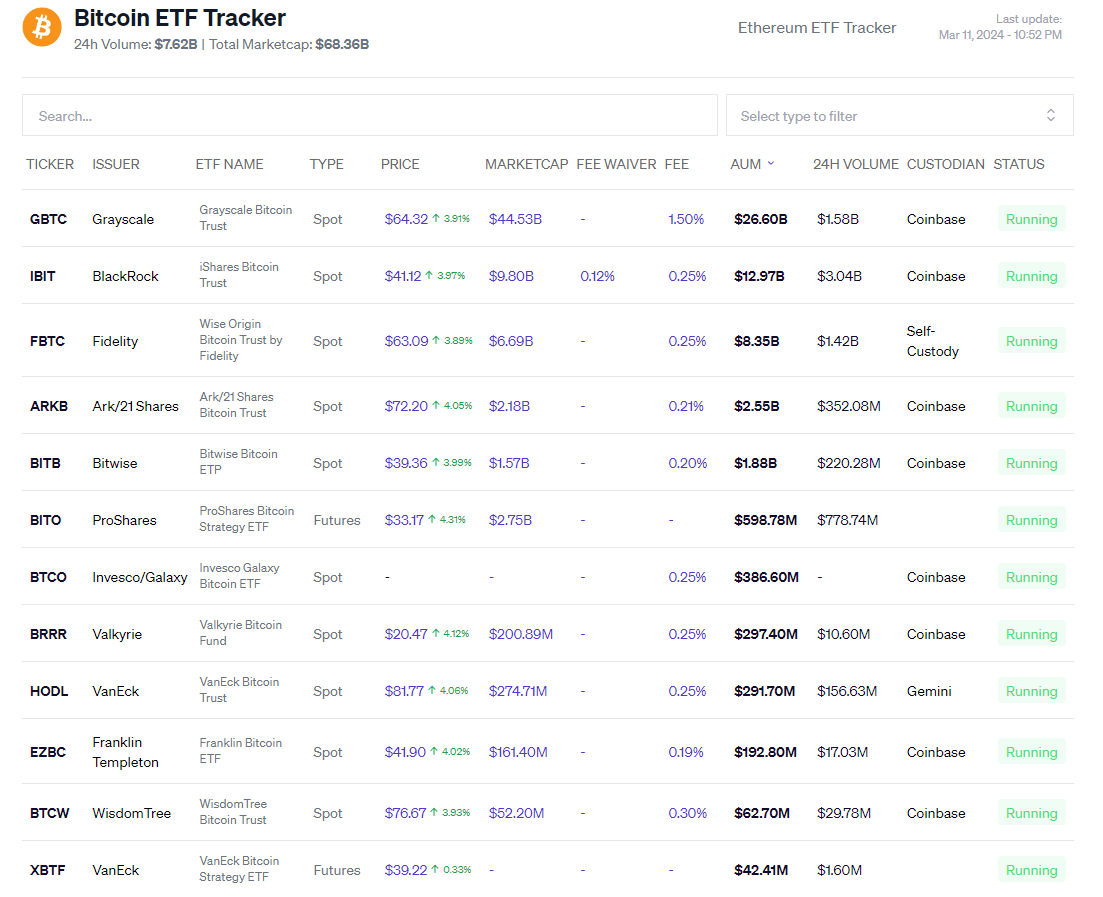

HODL, listed on BATS Global Markets, had previously imposed a 0.2% fee, which was one of the lowest among its competitors – BlackRock, Fidelity, Invesco, WisdomTree, and Valkyrie charge 0.25%.

VanEck stated the fee cut is due to it "believing in Bitcoin so much" but skeptics are pointing towards the fund's "underperformance."

Currently, HODL has $292 million in AUM, which is a small fraction of the likes of Grayscale, BlackRock, Fidelity, Ark, and even Bitwise, which imposed the same 0.2% fee despite managing $1.88 billion.

HODL's fee cut will certainly make it more competitive but whether the bet will pay off is yet to be seen. As mentioned, its competitors that have larger AUM charge higher fees, so lower fees do not guarantee a more sizeable asset base.

Earlier this week, BlackRock's Bitcoin ETF broke records by reaching $10 billion faster than any US ETF in history. The fund reached the milestone in under two months from 11 January when the SEC greenlit Bitcoin ETFs. Invesco QQQ previously held the record of just over a year.

Recently, BlackRock announced its intention to incorporate spot Bitcoin Exchange-Traded Products (ETPs) into its Global Allocation Fund (MALOX), signaling a significant shift towards mainstream cryptocurrency adoption.

In total, Bitcoin ETFs have built up $55 billion in assets with double that in volume at $110 billion. "If these were the numbers at the end of the year I'd call them a success. To do it in eight weeks is simply absurd," said Bloomberg Senior ETF Analyst Eric Balchunas.

First two months officially in the books (it's felt like six) and the ten bitcoin ETFs now have over $55b in assets with exactly double that in volume at $110b. If these were the numbers at the end of year I'd call them a success. To do it in eight weeks is simply absurd. pic.twitter.com/8YvzQZdYyJ

— Eric Balchunas (@EricBalchunas) March 11, 2024