Table of Contents

After weeks of unstoppable rallying, Bitcoin has finally crashed. Or has it? After superseding its previous all-time high of $69K last night, Bitcoin immediately sank, touching a low of $59,700.

At the time of writing, Bitcoin has regained traction and is back to the $66K mark. But questions remain about which direction the world's biggest currency will head in.

BTCrash

Hindsight is often as beautiful as it is useless. In this case, Bitcoin's sudden crash after hitting its peak is actually simple to explain... In retrospect.

On-chain data from CryptoQuant shows that 1,000 BTC worth roughly $69 million were moved to Coinbase by addresses that are more than a decade old just ahead of Bitcoin reaching its apex.

These addresses are linked to miners, who essentially are selling their Bitcoins at nearly 100% profit, minus electricity fees.

"Considering that the exchange order book shows 5-10 bitcoins of liquidity for every $100 price change, a sell-off of 1,000 bitcoins is highly likely to trigger a significant price drop," Bradley Park, an analyst at CryptoQuant, told CoinDesk.

"Especially when traders are waiting to enter a short against bitcoin's all-time high like on Tuesday."

Park drew parallels to when Bitcoin plunged 40% on 12 March 2020 when COVID-19 began spiraling out of control, despite substantial inflows before that date.

Other traders were also lining up to take profits, with intense selling pressure seen on Binance's order books. Sell orders worth 300 Bitcoins amounting to $20 million at $69,000 and 500 Bitcoins at $70,000 resulted in an immediate drop sending BTC's price to under $60K in one strike.

Leveraged traders were hit the hardest, as $1.1 billion worth of derivatives trading positions were liquidated across all digital assets through the past 24 hours.

"The dip was bought up very quickly and aggressively, and 60k proved to be a good support level. The desk thinks this is a good opportunity to buy topside vol (ie calls); we saw significant interest to buy Sep-Dec calls in both BTC and ETH on this dip," crypto trading firm QCP said Wednesday morning in a note.

Some dude who held bitcoin for 14 years decided to sell today and nuke bitcoin pic.twitter.com/h9RQXw5mRc

— borovik.eth (@3orovik) March 5, 2024

BTCalm Down

Even while writing this, Bitcoin is making a palpable recovery after its unsettling dip last night. Bitcoin's bullish thesis has not changed, and arguably, there is even more reason to be optimistic as the days roll by.

While the market was anxiously watching Bitcoin price charts, Bitcoin ETFs were silently making their own history. On Tuesday, Bitcoin ETFs saw $10 billion in volume, obliterating its previous record of $7.6 billion.

BlackRock set its own record too, with its iShares Bitcoin Trust drawing in $3.7 billion in volume in one day; $400 million more than its previous record of $3.3 billion.

MILESTONE: the ten Bitcoin ETFs did $10b in volume today, smashing prev record set last Wed.. Volatility and volume go hand in hand with ETFs so not totally surprised. That said these are bananas numbers for ETfs under 2mo old. $IBIT, $FBTC, $BITB, $ARKB all w record days. pic.twitter.com/rIdbhoYifV

— Eric Balchunas (@EricBalchunas) March 5, 2024

“These are bananas numbers,” Bloomberg Intelligence analyst Eric Balchunas wrote on X.

The appetite for Bitcoin ETFs, and therefore Bitcoin, is not diminishing any time soon.

Others are also suspicious of Bitcoin's sudden crash. "Bitcoin is NOT naturally going down. It is being pushed down via whales placing spoofy sell orders on exchanges to make noobs and risk managers sell to 'buy back lower.' They are stealing your bags and will make you buy back at a higher price," concluded crypto analyst Hsaka.

Dear noobs,

— Hsaka (@HsakaTrades) March 5, 2024

Bitcoin is NOT naturally going down. It is being pushed down via whales placing spoofy sell orders on exchanges to make noobs and risk managers sell to "buy back lower". They are stealing your bags and will make you buy back at a higher price.

Altcoin Rotation

Bitcoin's ability to rise the tide across the crypto market is equally matched by its ability to pull down the market when it sinks.

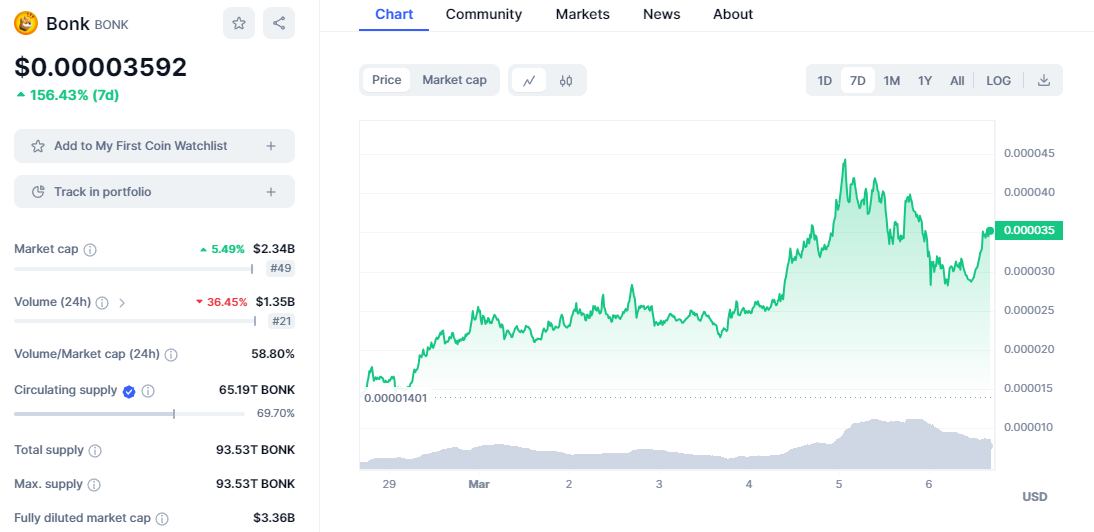

The likes of Dogecoin (DOGE), Shiba Inu (SHIB), Pepe (PEPE), and Bonk Inu (BONK) have skyrocketed over the past few weeks but also succumbed to Bitcoin's mini price crash.

Experiencing triple-figure percentage gains over the week but double-figure percentage losses over the past 24 hours is something only Memecoins are capable of.

Although Bitcoin euphoria may not be over yet, as the leading cryptocurrency regains traction, traders are already considering shifting their Memecoin gains to more stable investments.

Nevertheless, trader and online analyst @Cryptomanran had warned on X, “Memes are an amazing trade but remember to take profits kids and put them into protocols that will make a difference in 5 years!” warned CNBC crypto trader Ran Neuner.

There are literally people rich enough and dumb enough to convince themselves that holding a dog wif hat is an investment.

— Ran Neuner (@cryptomanran) March 3, 2024

Memes are an amazing trade but remember to take profits kids and put them into protocols that will make a difference in 5 years!

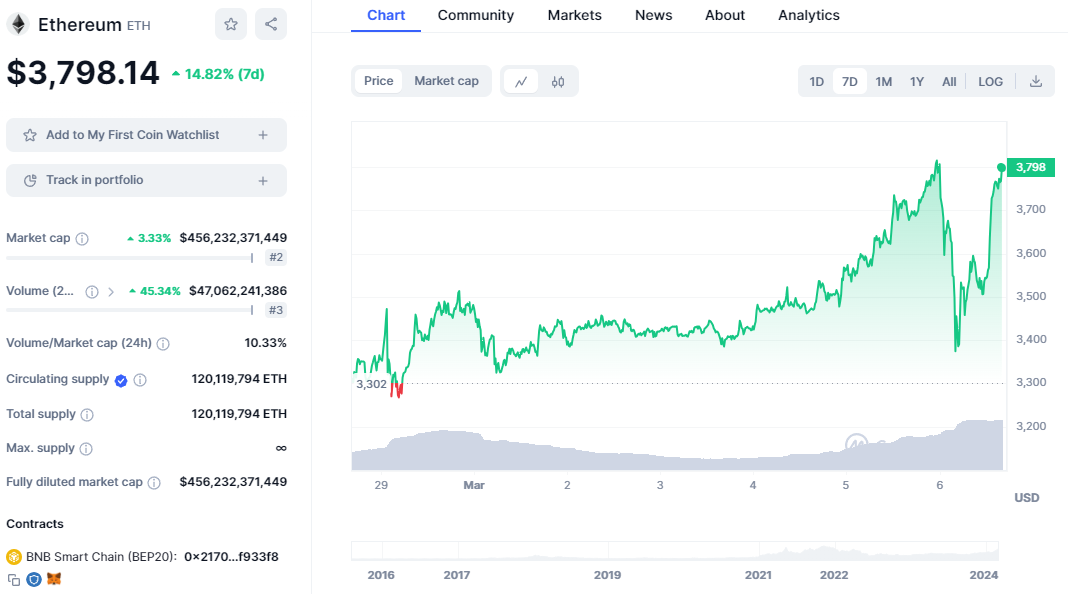

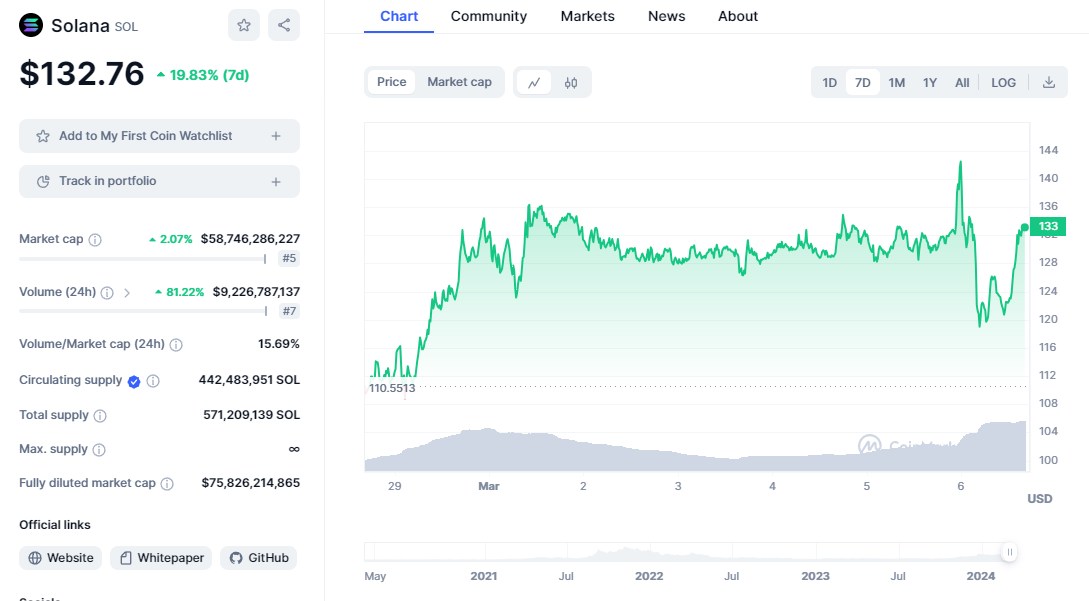

Liquidity has steadily been rotating into altcoins such as Ethereum and Solana, which are showing encouraging gains. Both also succumbed to Bitcoin's crash but are showing strong signs of recovery.

What's more, their ecosystems were showing promise independent of the Bitcoin euphoria. Developers are being spoilt by both blockchains, with upgrades offering a wide array of opportunities and tools to build and innovate.

zkLink, a company building infrastructure for the blockchain network Ethereum, recently announced the launch of the first aggregated Layer 3 zkEVM rollup network, based on zkSync's ZK Stack and zkLink Nexus.

Layer 2s have "failed to scale the Ethereum blockchain as originally intended," zkLink said in an announcement. Nova addresses liquidity fragmentation, multi-chain dApp development complexities, and poor user experience.

Aside from its Memecoin qualities, BONK even demonstrated the strength of the Solana ecosystem, feeding into airdrop season.

Altcoin profit rotation is nothing new and has proven to be a successful and smart strategy to shift focus on more tangible projects whilst diversifying away from Bitcoin. A mix of the project's technology, team, community, and market potential are some of the factors used to highlight these tokens.

Last month, we highlighted Chainlink (LINK) Avalanche (AVAX) Solana (SOL) Cosmos (ATOM), and Polkadot (DOT) as altcoins worth watching. These tokens provide investors with a low price point for entry and the potential for massive price increases.

Elsewhere