Table of Contents

Even if they aren't jumping back in with both feet as they did during the previous bull market three years ago, small and regular investors are slowly returning to the cryptocurrency market.

According to a shareholder letter last week, the largest US crypto exchange, Coinbase Global, had a 60% increase in net consumer transaction revenue in the December quarter compared to the previous year and an 80% increase in the September quarter.

The retail-focused Robinhood Markets recorded a 242% year-over-year increase in crypto notional volumes in December.

Following the euphoria around the January debut of US exchange-traded funds (ETFs) investing directly in Bitcoin, there have been several indications that small traders, who suffered billion-dollar losses during the crypto-price fall or the crypto winter in 2022, could be coming back.

But the biggest question remains: amid all the excitement, Bitcoin's price more than doubled last year, and some investors are losing sight of the fact that cryptocurrency prices are extremely unpredictable due to the allure of even larger returns.

Key to the cryptocurrency market are retail traders. They are a major source of income for most cryptocurrency exchanges, including Coinbase, where they contributed significantly during the previous bull run.

Web searches for the word "Bitcoin" spiked in the first half of January, when the ETFs debuted, but then fell back to bear-market levels, according to Google Trends.

This suggests that retail investors are still on the fence about the market.

Also noticeably down from their bull-market heights are the downloads of the most popular crypto-exchange applications utilised by retail traders.

Market research company Sensor Tower reports that Binance, the largest cryptocurrency exchange in the world, had 8.1 million app downloads in the final three months of 2022 and 10 million in the December quarter last year, an increase from 9 million in the third quarter.

During the second quarter of 2021, it peaked at 25.8 million downloads.

The Bitcoin halving is a software update anticipated for April and would slash incentives to machines supporting the network in half. Many investors are hopeful that this will lead to another rise. The current price of Bitcoin is about $52,000, its highest level in over two years.

Market watchers predict that small-scale investors will be unable to resist the temptation of Bitcoin's 20% year-to-date price increase if it continues to surge in value, which is widely expected.

Crypto Market Value Over $2 Trillion & Counting

Following a widespread crypto surge that saw the second-biggest token, Ether, return to the level before the collapse of the TerraUSD stablecoin nearly two years ago, Bitcoin surged to around $52,000.

The market valuation of digital assets has surpassed $2 trillion for the first time since April 2022, largely thanks to Bitcoin's over 25% year-to-date rise.

Bitcoin has been bolstered by industry-specific elements, such as the US ETFs dedicated solely to the largest crypto.

Since January 11th, $3.9 billion has been raised via products launched by corporations such as BlackRock and Fidelity Investments.

Many view the upcoming Bitcoin halving in April as a historical precedent that might boost prices by reducing the supply of the largest digital currency.

Ether has been lagging behind Bitcoin in returning to levels seen before the TerraUSD collapse in early May 2022, which is a significant milestone considering the impact of that event.

Do Kwon, the founder of TerraUSD, is now in custody in Montenegro and is awaiting extradition to South Korea or the US, where he faces fraud accusations.

Bitcoin has tripled in value since the beginning of last year, recovering from the digital-asset downturn of 2022.

Options market wagers suggest traders are aiming for prices higher than the record of about $69,000 reached in November 2021.

Stocks Pause Near Record Highs for Triggers

Amid subdued trading, stocks and US futures remained stable as investors awaited new triggers following a week in which the S&P 500 surpassed new highs and European equities came close to matching new highs.

Nasdaq 100 contracts and S&P 500 futures made marginal gains as US cash markets were closed for the President's Day holiday.

Wednesday's earnings report from benchmark Nvidia may provide fresh impetus for the equity market as investors attempt to assess the global economy's health.

The Stoxx Europe 600 remained relatively unchanged following the 1.4% increase last week, which brought the gauge within four points of its all-time high in January 2021.

Defence industries, telecommunications and healthcare stocks gained.

The reaction of the US and international equities to the selloff in Treasuries this month has yet to materialise, despite traders reducing their aggressive wagers on rate cuts in response to a series of economic data that exceeded expectations and hawkish remarks made by policymakers.

Additionally, investors are confronted with inconsistent earnings, and the shipping turmoil and conflict in the Red Sea present significant risks to the profitability outlook.

Swaps now price approximately 90 basis points of rate cuts by the Federal Reserve in 2024, down from over 150 basis points at the beginning of February.

Wagers in Europe have been reduced by approximately 100 basis points from 150.

Since the start of the year, US equities have been priced for perfection in the opinion of JP Morgan Asset Management, owing to "healthier" market momentum.

A measure of Asia-Pacific stocks went up a little and was expected to keep going up for a third session in a row.

The CSI 300 Index, which measures the health of the economy in mainland China, came back from its first day of losses on the first trade day after the Lunar New Year break.

At first, the stocks went down even though good travel and tourist figures showed that spending was picking up again, even though the economy as a whole was dealing with deflation and a real estate crisis.

Traders are now looking for more fiscal and monetary policy help from China over and above the cut in the reserve requirement ratio.

On Sunday, China's Premier Li Qiang called for "pragmatic and forceful" steps to boost trust in the economy.

As worries about future demand eased some of the pressures in the Middle East, oil fell from its best point in three weeks on the commodities market.

Gold kept rising after going up for two days. Iron ore prices went down after going up five days in a row because of worries about the Chinese economy.

THE WEEK AHEAD

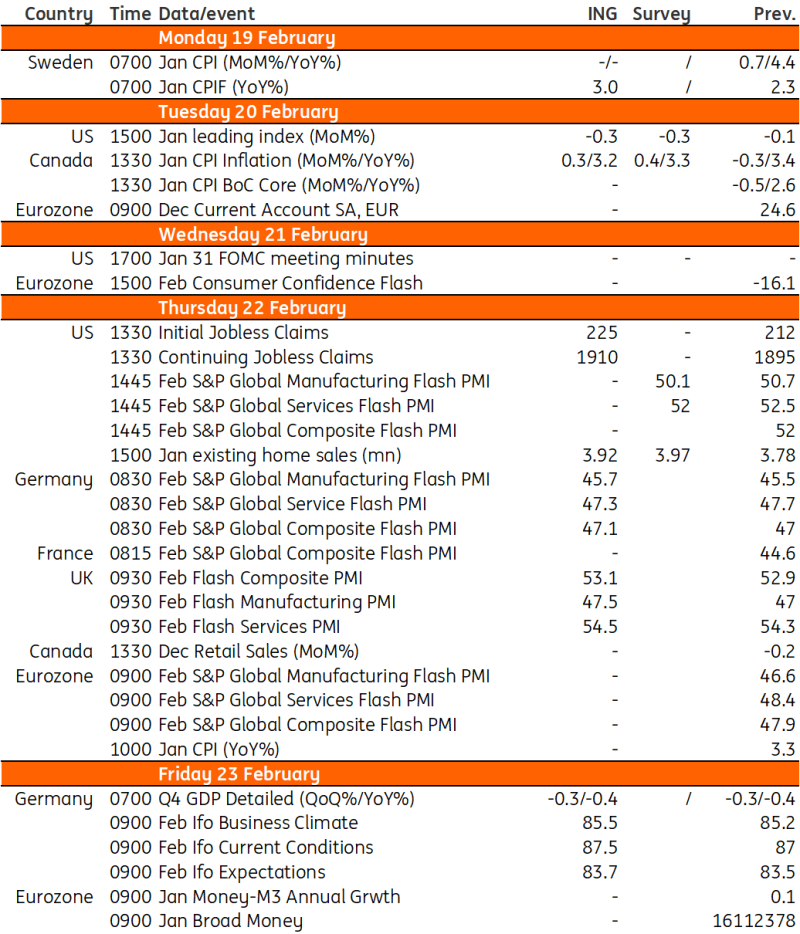

This week's calendar looks light in the US, with much of the data unlikely to have a significant impact, the highlights being existing home sales and the leading index.

Despite the UK entering a technical recession in the final quarter of 2023, markets expect PMI data to point to a recovery in activity during the first quarter.

Additionally, inflation in Canada is expected to hover above 3%.

Macro Data Calendar

UK Recovery in Sight

The UK entered a technical recession in the final quarter of 2023, though in practice, the economy broadly stagnated last year.

However, things are looking up in 2024, and markets have seen an encouraging recovery in the service-sector purchasing managers index (PMI) over the past few months.

Interestingly, that contrasts with the eurozone equivalent index, which has been more subdued.

Economists expect the economy to return to modest growth in this and the coming quarters, with the consumer outlook improving and rate cuts on the horizon.

That said, the growth figures aren’t what will determine the timing of the first-rate cut from the Bank of England, which instead is focused on services inflation and wage growth as key guiding metrics.

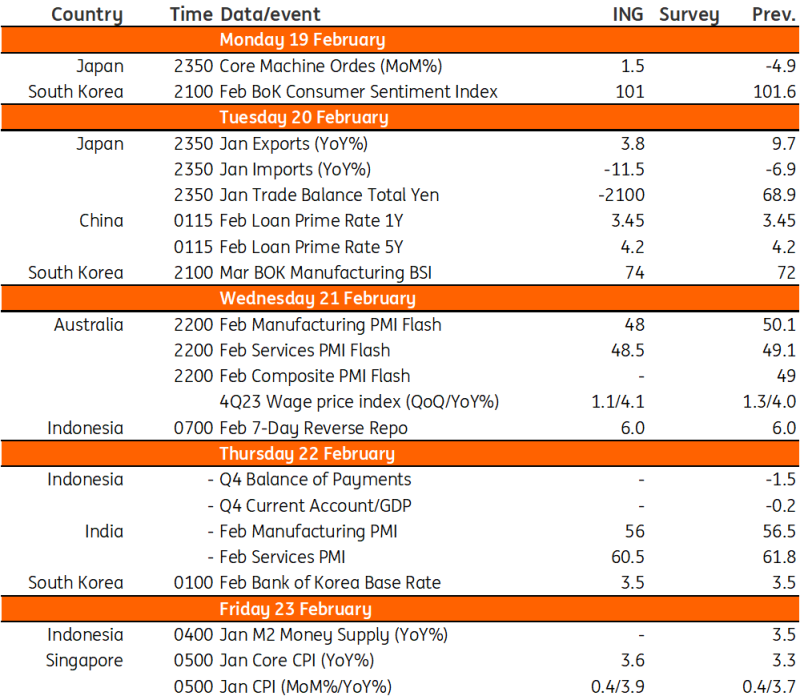

Asia Week Ahead

This week features decisions from central banks across the region plus the minutes from the latest RBA meeting.

Meanwhile, Japan reports activity data and India's PMI will be released.

Macro Data Calendar

Asian Funds Sold Record US Shares in 2023

Asian Funds Sell Record US Shares in 2023

Last year, Japanese and Chinese funds sold an all-time high of US equities to capitalise on the market's double-digit growth.

On Thursday, the US Department of the Treasury released data indicating that Chinese investors sold US shares worth $19.7 billion during the same period last year, while Japanese investors sold shares worth $30.8 billion. Starting from 1977, this constituted the most extensive data disposal.

Upon accounting for dividend reinvestment and inflation, Japanese-based investors in the S&P 500 Index in 2023 realised a return of 35.7%. A proportion of 30% was refunded in yuan.

Last year, however, Japanese investors purchased Treasuries in net for the first time since 2014.

Following the sale of $352 billion in US bonds during the eight years concluding in 2022, they acquired $19.5 billion in US bonds in 2023.

In 2023, Chinese funds maintained a pessimistic stance on US government debt, as evidenced by their $68.2 billion in sales.