Table of Contents

It's no secret that ARK Invest is bullish on Bitcoin. With a price target of $650,000 and its own spot Bitcoin ETF, it's clear that Cathie Wood has high expectations for the world's leading cryptocurrency.

In its Big Ideas 2024: Disrupting the Norm, Defining the Future report, ARK Invest detailed its bullish stance on Bitcoin and the risks that come with investing in crypto at an institutional level.

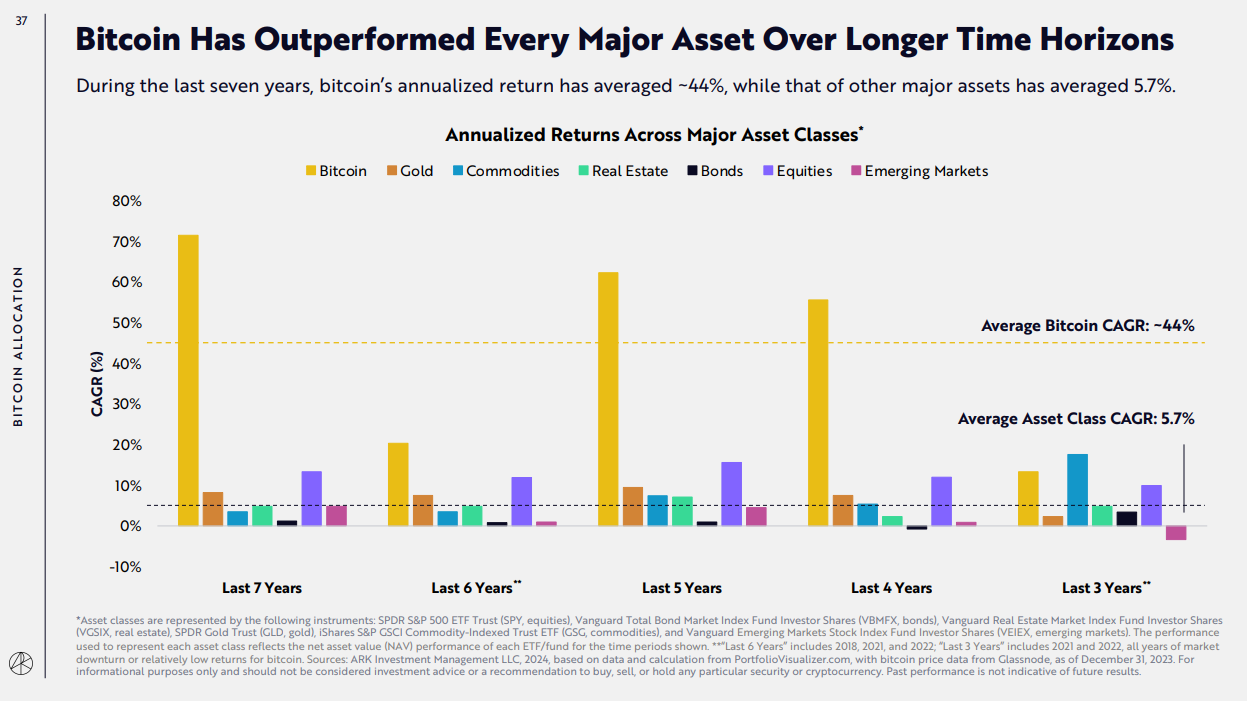

Unrivalled Performance

ARK Invest highlights how Bitcoin outperformed every major asset over three to seven years. Offering around a 44% return, Bitcoin has produced 7x the returns of major assets' 5.7%.

"Bitcoin’s volatility can obfuscate its long-term returns," ARK explains. "While significant appreciation or depreciation can occur over the short term, a long- term investment horizon has been key to investing in bitcoin... Historically, investors who bought and held bitcoin for at least 5 years have profited, no matter when they made their purchases."

ARK also suggests that Bitcoin has a relatively low correlation with other asset classes, averaging only 0.27 over the past five years.

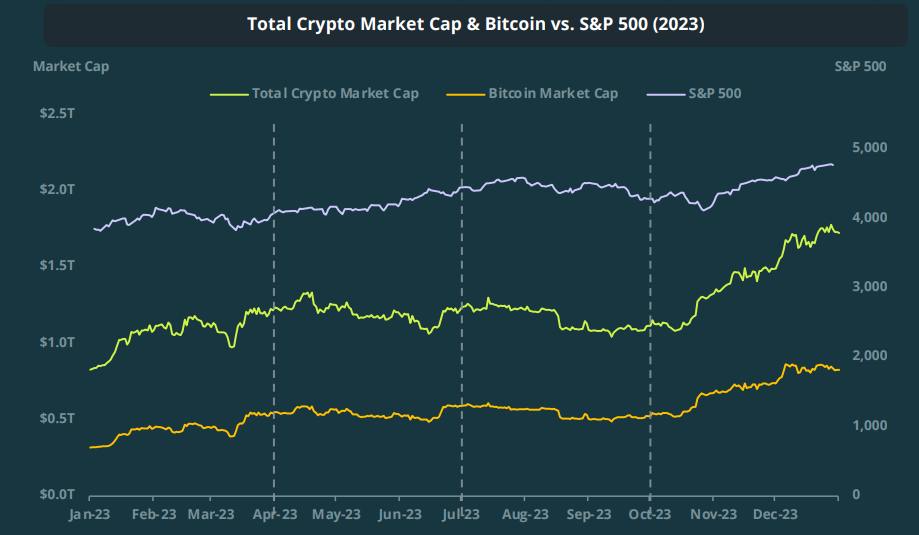

However, on the back of Bitcoin ETF approvals and the hype leading up to it, Bitcoin has become more correlated with traditional markets than crypto.

"Total crypto market cap climbed 108.1%, 4.6x more than the S&P500 which climbed 23.7%," CoinGecko explains in a new report. "Bitcoin was slightly more volatile than the overall crypto market, with an annualized volatility of 43.2%."

Allocation

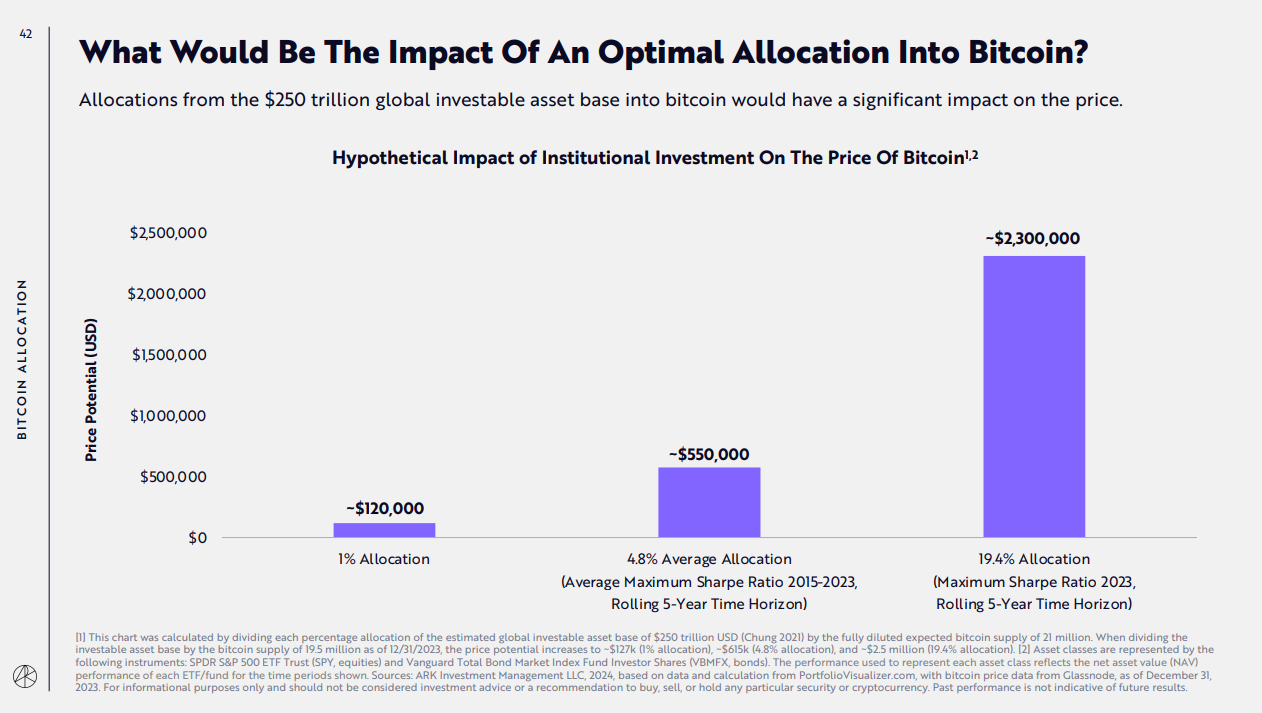

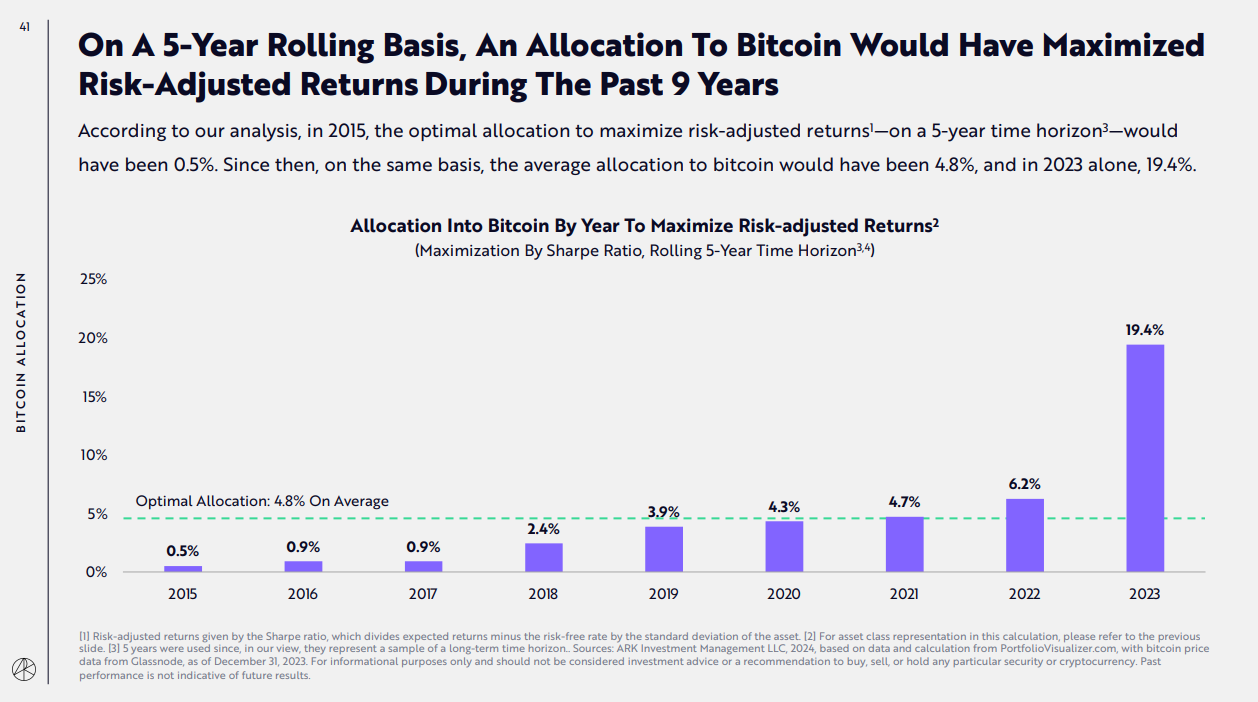

ARK encourages institutions to allocate a certain percentage of their portfolios to Bitcoin to maximize risk-adjusted returns. Providing simulated optimal portfolio allocation targets, ARK suggests that a portfolio seeking to maximize risk-adjusted returns would have allocated 19.4% to Bitcoin in 2023.

"This approach aims to tap into the exponential growth opportunities often overlooked in broad-based indices, while simultaneously providing a hedge against the risks posed by incumbents facing disruption," ARK states.

2023 Resilience

As much as we love to hear from our favourite investment Auntie, we don't necessarily need Cathie Wood to tell us that Bitcoin had a decent 2023.

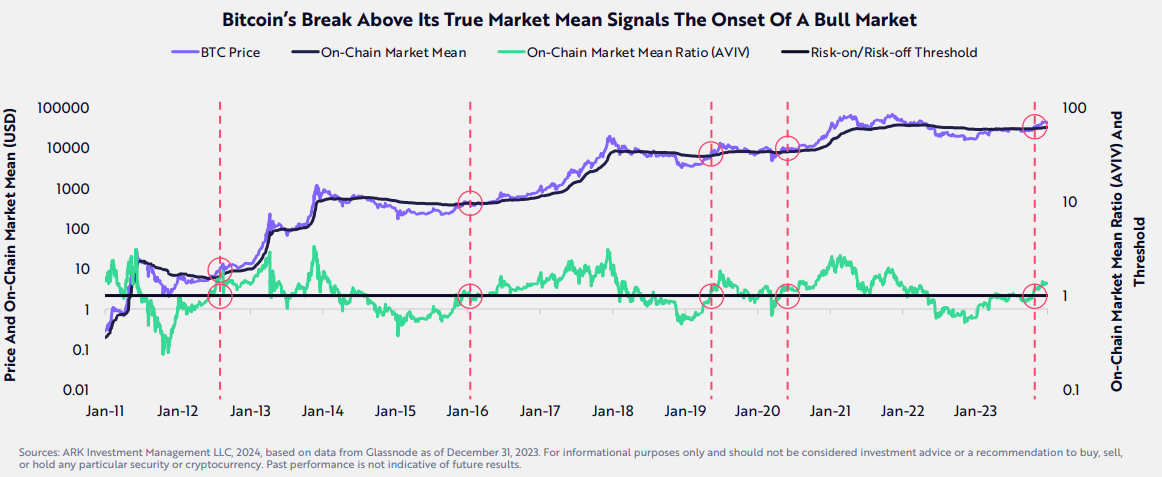

However, one metric that is unique to ARK is the ARK metric, which measures the on-chain market mean. On this metric, Bitcoin's price crossed above its on-chain market mean for the first time in around four years.

"Historically, when the price of bitcoin crosses above the market mean, it typically indicates the early stages of a bull market," Ark explains.

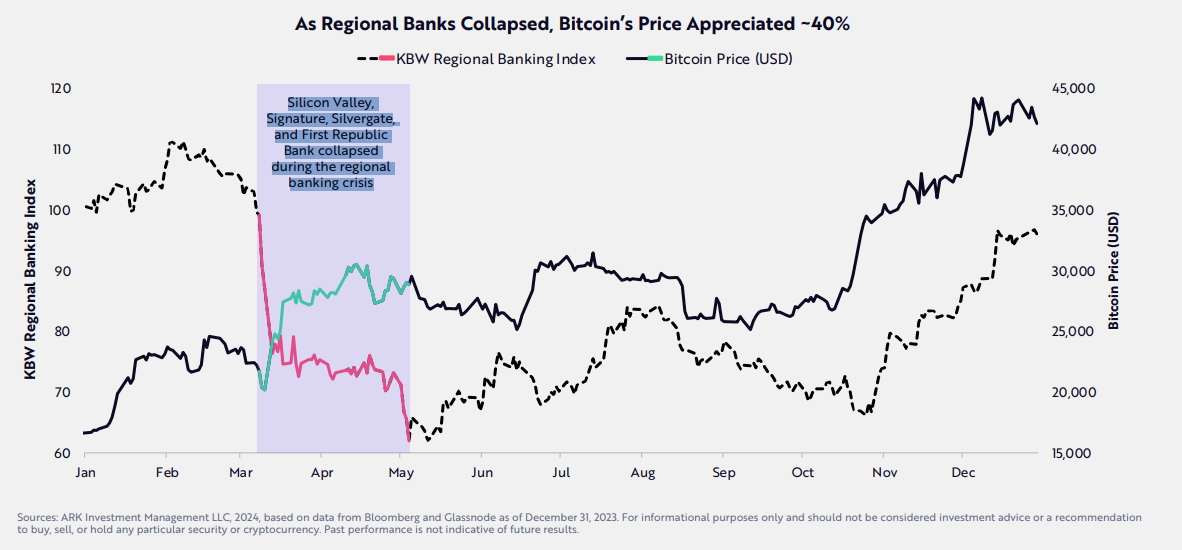

ARK also highlights how Bitcoin served as a safe haven during 2023's early banking crash. Whilst Silicon Valley, Signature, Silvergate, and First Republic Bank collapsed, Bitcoin appreciated over 40% and demonstrated its role as a hedge against counterparty risk.

Bitcoin Ordinals was another key event in 2023 mentioned by ARK but Blockhead has already covered the topic extensively. You're welcome.

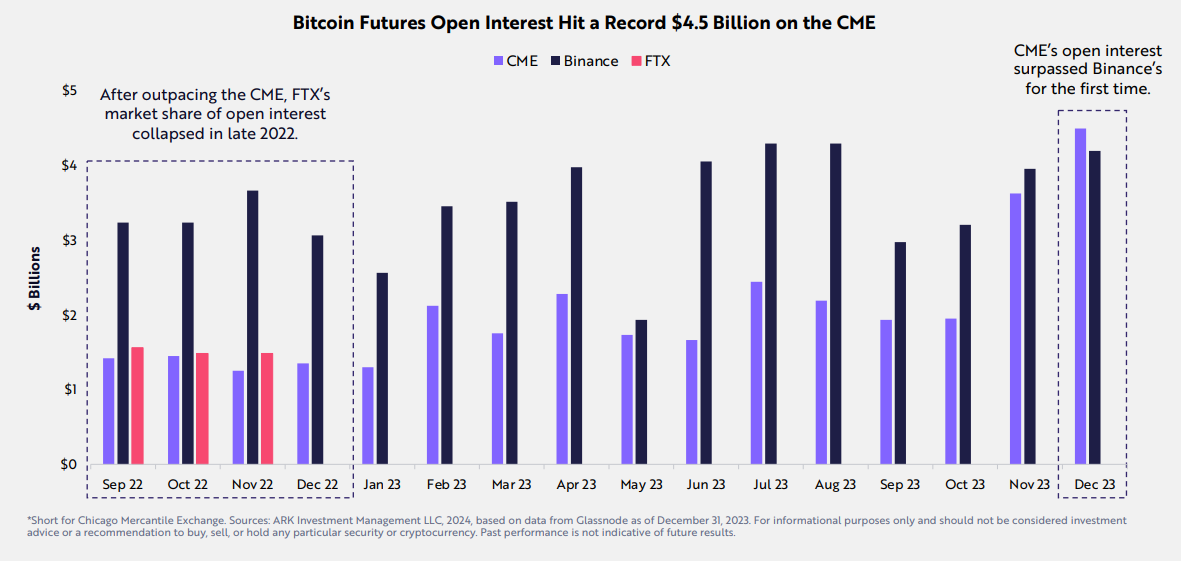

However, another interesting development that was rather overlooked occurred in December 2023 when Chicago Mercantile Exchange (CME) surpassed Binance as the world's largest Bitcoin futures exchange. Although Binance was undergoing its own reshuffling, the CME's strength reflects the broader interest from TradFi in crypto.

"As the demand for more regulated and secure infrastructure increased following the contagion in 2022, bitcoin’s market dynamics shifted more to the US," ARK explains.

2024 Excitement

Like the rest of us, ARK is looking for reasons to be excited this year. ARK highlights the Bitcoin ETF launch, Bitcoin halving, institutional acceptance, and regulatory developments as key drivers for the Bitcoin market in 2024. Of course, none of this is new for regular and loyal Blockhead readers.

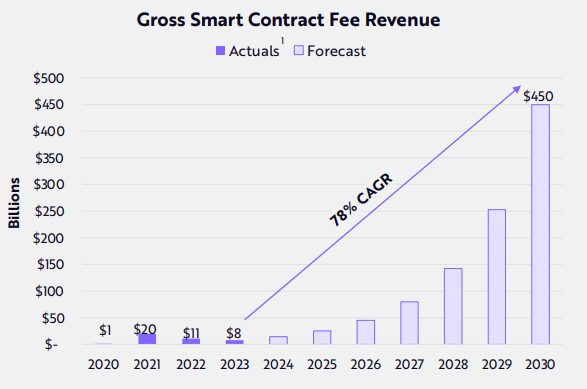

Nonetheless, another area of blockchain worth monitoring is smart contracts, according to ARK. Describing them as the "foundation of the internet financial system," ARK says smart contracts are crucial as decentralized applications could scale 32% at an annual rate, from $775 billion in 2023 to $5.2 trillion in 2030.

Hyperinflation in emerging markets is resulting in a boom in the demand for stablecoins, with daily stablecoin addresses increasing at an annual rate of 93% over the past three years. Stablecoins highlight the value proposition of smart contracts, ARK argues.

Tokenization, developing protocols, and layer 2 networks are also ever-evolving sectors that require smart contracts.

Furthermore, ARK believes smart contracts could "collapse the cost of financial services." Between 2000 and 2020, the global value of financial assets surged from $140 trillion to $510 trillion. However, this growth was mirrored by an increase in the operating costs of the global financial system. With a total annual revenue of $20 trillion, the financial services industry's take rate stood at 3.3% relative to the total value of all financial assets. Smart contracts could lower this.

What's more, if financial assets transition to blockchain infrastructure, and decentralized financial services charge one-third of the fees of traditional services, smart contracts could generate over $450 billion in annual fees. This could create more than $5 trillion in market value. ARK believes these figures are projected to grow at compound annual rates of 78% for fees and 32% for market value through 2030.

Elsewhere