Table of Contents

A new report by Seedly and Coinbase has revealed that more than 1 in 2 Singaporeans own cryptocurrency but regulators aren't caving on crypto ETF pressure anytime soon.

The Pulse of Crypto Singapore Report surveyed 2,006 Singapore-based adults, across all ages and household incomes but the majority of respondents surveyed were young adult males aged 25 to 34 years old.

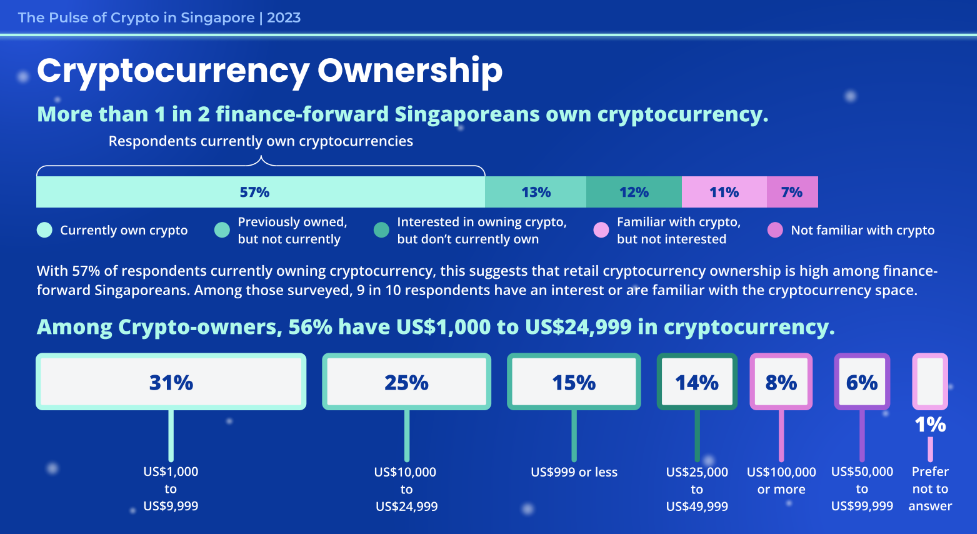

57% of those surveyed said they own cryptocurrency with 56% of crypto owners saying they have US$1,000 to $24,999 in cryptocurrency.

However, less than half (46%) are bullish about cryptocurrency in the next 12 months. Nonetheless, 56% still believe that crypto is the future of finance.

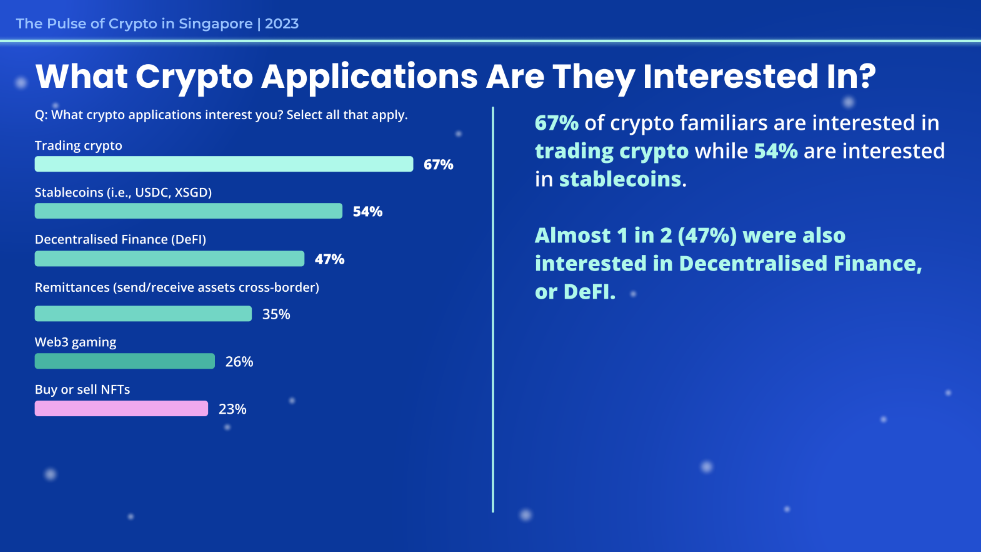

67% of Singaporean crypto enthusiasts are interested in trading the digital asset whilst 54% expressed an interest in stablecoins. And 47% are down the DeFi rabbit hole.

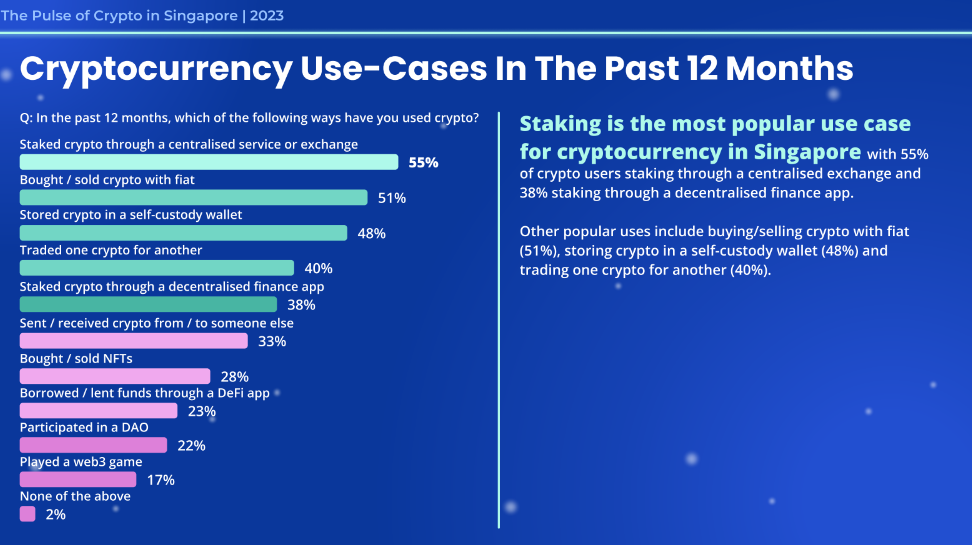

Staking is proving to be the most popular use for cryptocurrency in Singapore. About 55% staked crypto through a centralised exchange whilst 38% chose a decentralised finance app.

Word of mouth is the main source of information regarding crypto, accounting for 57% of respondents. Another 53% said they also get their information from crypto publications (you're welcome).

In terms of ongoing concerns, market volatility remains the biggest deterrent (57%) for non-crypto users from participating. Risk and the lack of regulation accounted for 53% and 45% of respondents respectively.

Hassan Ahmed, Singapore country director at Coinbase, said the survey shows Singapore's digital asset ecosystem has "remained resilient over the last year."

"Singapore users are fortunate they have access to onshore, regulated service providers underpinned by sound regulations that increases trust in the system,” Ahmed said.

No Crypto ETF Greenlight

Singaporeans might be developing an appetite for crypto but the Monetary Authority of Singapore (MAS) is yet to fully embrace digital assets for the wider masses.

"Cryptocurrencies have failed the test of digital money," ex-MAS managing director Ravi Menon boldly stated on stage at the Singapore Fintech Festival a few months ago. "They have performed poorly as a medium of exchange or store of value, their prices are subject to sharp speculative swings, and many investors in cryptocurrencies have suffered significant losses."

MAS's tune hasn't changed either. Despite all the Bitcoin ETF hype in the US, MAS reiterated that digital assets remain an institutional game in Singapore and has not indicated that the products will be greenlit any time soon.

ETFs are part of the collective investment schemes (CIS) accessible to retail investors in Singapore, and are regulated under the Securities and Futures Act, MAS said.

"Given this, spot Bitcoin ETFs are not approved by MAS for offer to retail investors," the regulator clarified.