Table of Contents

The price of Bitcoin is now at it's lowest in almost two months, with the price of BTC dipping under $40,000 in the past 24 hours, currently sitting just a touch above this level, even as conventional equities continue hitting new all time highs.

In the past 24 hours, 77,322 traders were liquidated, with the total liquidations at $210.98 million. The largest single liquidation order of $5 million happened on Bybit, according to Coinglass data.

The price of Ethereum also saw a decline of 3.26% to reach $2,328.3. The global crypto market cap is $1.58 trillion, a 2.52% decrease since yesterday, according to CoinMarketCap.

Stocks, on the other hand, are experiencing a historic bull run. A heated discussion on the direction of monetary policy is being ignored by traders who have driven the S&P 500 to all-time highs. The index achieved a second weekly increase, lifting it to a new high, following a shaky start to the year. The Nasdaq 100 set a record and gained about 3% for the week, powered by tech firms.

For the first time in the previous two years, the S&P 500 gauge reached a record thanks to another surge in technology, the index's most significant sector.

Prices correcting

The spot Bitcoin ETF narrative, which was riding on an expected influx of institutional investment, has helped push the price of bitcoin from $16,000 in mid-2023, to over $49,000 after they were approved by the US Securities and Exchange Commission earlier this month. Since then, it's price has dropped by almost 20%.

"Overall VRP (volatility risk premium) has risen, and the Skew curve is skewed towards put options," Singapore-based options trading platform Greekslive said in a weekly trading update, noting that this "reflects the existence of a certain number of short-term panic orders in the market, the market bearish force has increased, but on the whole the long and short are relatively balanced, and it is still a fierce game."

According to Bloomberg, citing Coinshares data, crypto investment products saw $21 million in outflows, while Grayscale's spot exchange-traded fund GBTC saw $2.2 billion in withdrawals over the past week. A large portion of the outflows came from the FTX estate selling 22 million GBTC shares worth nearly $1 billion, which brought FTX estate’s GBTC holdings down to 0, Coindesk reported, citing industry sources.

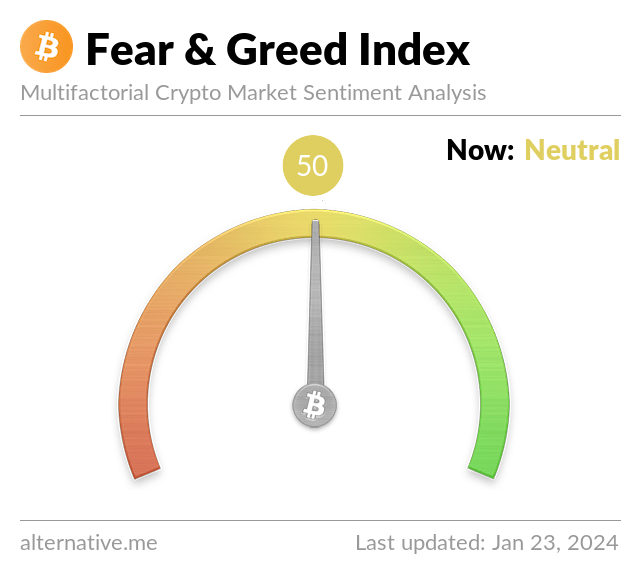

The Fear & Greed Index for the world's largest cryptocurrency is current "neutral" at 50, indicating cautious optimism and stable market sentiment. This is 5 points lower than yesterday, and its lowest level reached since mid-October 2023.

Downward pressure on Bitcoin is somewhat limited by several factors: the Bitcoin halving in April-May, which cuts the reward for mining new Bitcoin blocks in half, controling the supply of Bitcoin and ensure its scarcity over time; and institutional investment via spot Bitcoin ETFs. But there could be more pain on the cards before things turn around.