Table of Contents

In case you haven't noticed, things aren't going particularly well for Bitcoin. Despite all the hype surrounding Bitcoin ETFs, the world's largest cryptocurrency has fallen around 9% over the past five days, experiencing its biggest single-day drop since August.

But should we be worried about this downturn? Apparently not.

Bitcoin to $32K: Sell The News

In December, CryptoQuant warned that Bitcoin could retreat to $32,000 following the approval of Bitcoin ETFs in what was anticipated as a "sell the news" event.

The firm argued that traders' unrealized profits were lingering at a level that historically precedes a correction.

"Short-term Bitcoin holders are experiencing high unrealized profit margins of 30%, which historically has preceded price corrections (red circles)," CryptoQuant explained.

"Moreover, short-term holders are still spending Bitcoin at a profit, while rallies usually come after short-term losses are realized."

Upon the approval of Bitcoin ETFs, the cryptocurrency remained fairly flat, despite a brief burst of upward momentum.

Over the past few days, Bitcoin has continued to slip, in line with CryptoQuant's prediction. Bitcoin is still $10,000 higher than CryptoQuant's price target but there's no refuting its downward pressure.

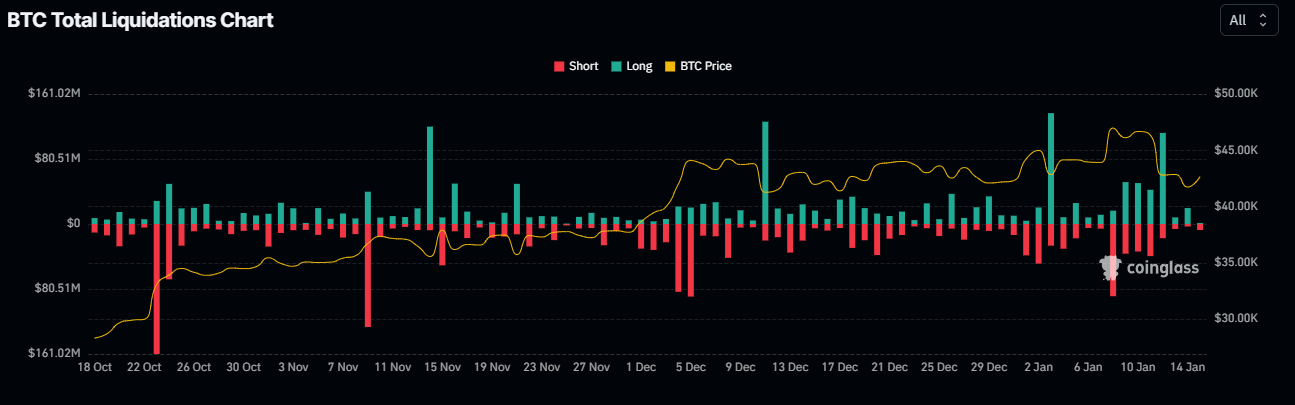

Bitcoin long liquidations have also been driving Bitcoin's price down, triggered by leveraged positions eating into traders' margins.

Rebounding

Despite Bitcoin's descent, analysts believe its price will still rise. Price analysts observing Bitcoin's behavior note that a reversal is expected after Bitcoin's drop.

Crypto analyst Ali Martinez suggested Bitcoin could fall as low as $34,000 - not as low as CryptoQuant's price target but still representing a further 20% drop.

However, Martinez says Bitcoin should rebound to as high as $57,000 if it hits its lower boundary of $34,000.

It appears this parallel channel is holding true! This suggests that #Bitcoin faced rejection from the channel's upper boundary at $48,000, and now $BTC will retrace to the lower boundary at $34,000, and then rebound back to the upper boundary at $57,000. https://t.co/2vDqYpwmpi pic.twitter.com/fBiNsmJ10C

— Ali (@ali_charts) January 13, 2024

Waiting Game

Other market analysts believe the drop in Bitcoin's price is a reflection of institutions waiting before deploying their capital.

According to data from LSEG, Bitcoin ETFs attracted $4.6 billion on its first day of trading.

"Trading volumes have been relatively strong for new ETF products," said Todd Rosenbluth, strategist at VettaFi. "But this is a longer race than just a single day's trading."

Yet, more money is yet to hit BTC according to analysts. "If I was an investor, new to Bitcoin, with large amounts of capital, I will wait a couple of days, and then will start to deploy my capital," analyst Luis Beldroega argues. The first day all systems and personnel are adjusting."

"Large accounts, are not the important ones, they are experts, have time, and enough capital to wait and buy at lower prices when the opportune moment arrives, and do it over and over again"

Adjusting positions, on a 1st day, after a terribly managed oficial approval, it is not a failure

— Luis Beldroega (@luisbeldroega) January 12, 2024

If i was an investor, new to bitcoin, with large amounts of capital, I will wait a couple of days, and then will start to deploy my capital. 1st day all systems and personal are…

New Targets

Prior to the SEC approving Bitcoin ETFs, we compiled the industry's most outlandish predictions for Bitcoin prices this year, ranging from $25,000 to $1,000,000.

Following the SEC's approval, new targets have emerged. CEO & Founder of MN Trading Consultancy, Michaël van de Poppe, said Bitcoin's price drop is a result of "parties rotating from spot Bitcoin towards an ETF."

He added that in the long run, Bitcoin will soar beyond $200,000 and encouraged his followers to buy this dip.

The #Bitcoin ETF is causing Bitcoin's price to drop from $48,000.

— Michaël van de Poppe (@CryptoMichNL) January 12, 2024

Is that bad? No.

It's short-term sell pressure from parties rotating from spot Bitcoin towards an ETF.

Long-term, this is absolutely massive and will push Bitcoin to $200k+.

Buy the dip.

Tom Lee, managing partner at Fundstrat Global Advisors, told CNBC on Wednesday that Bitcoin could hit $150,000 in the next twelve months, and could continue to rise to $500,000 in five years.

Meltem Demirors, chief strategy officer of CoinShares, also told the media outlet that "we are going over six figures by the end of the year,” pointing towards the Bitcoin ETF approval and the halving event. James Butterfill, head of research at CoinShares had previously had a target of $80,000.

Within 24 hours of the SEC approving Bitcoin ETFs, founder and CEO of SkyBridge Captial, Anthony Scaramucci said Bitcoin will break its all-time high by January 2025.

“I think it is a much broader story for digital property in general, and I think Bitcoin will probably see its all-time high before the end of the year and will likely go through its all-time high by this time next year,” Scaramucci said to CNBC.

Bitcoin's previous all-time-high was $69,000 in November 2021.

“The SEC is obviously not endorsing bitcoin but in a weird way they are endorsing bitcoin because they’ve now allowed it from a regulatory point of view to be offered to retail investors with a prospectus,” Scaramucci said.

“And so, this wrapper if you will, will allow people to put it in their brokerage accounts. That is incredibly meaningful,” Scaramucci declared, adding that he will be a "ceremonial buyer" of Bitcoin ETFs.

Meanwhile, Samson Mow, who previously had a price target of $1,000,000 for 2024, reshared his projection on X.

Samson Mow believes #Bitcoin will surge to $1 million 'within days or weeks' once supply crunch hits@Excellion's forecast hinges on a perceived supply shock driven by demand from the recently approved Bitcoin ETFs and the upcoming halving event.

— CryptoSlate (@CryptoSlate) January 14, 2024

via @Saajthebard…

Buying Bitcoin

BlackRock, the OG Bitcoin ETF applicant, has reportedly bought 11,500 BTC during its current dip.

Only 900 Bitcoin are issued daily, meaning that BlackRock's purchase represents 13 days' worth of Bitcoin production.

#Blackrock took 11,500 $BTC from Supply in 2 days

— InvestAnswers (@invest_answers) January 13, 2024

900 Bitcoin are issued daily, and you can see Blackrock's move into their cash supply from last night into Bitcoin, buying the dip. Now, they mostly hold Bitcoin.

The key point is 11,500 BTC were sucked from the system in 2 days… pic.twitter.com/GzoEk2uMSl

iShares Bitcoin Trust (IBIT) Spot ETF managed only around 25% of the trading volume over the same two-day period, meaning 46,000 BTC were removed from the system over this period.

Update on @Blackrock $IBIT holdings: Yesterday I reported that @BlackRock moved 50% of their ETF into cash. Well today they updated and they did indeed as I thought buy the dip. They are now back in 100% in Bitcoin. 👀

— MartyParty (@martypartymusic) January 13, 2024

How did they know ? We have a new set of whale traders in… pic.twitter.com/FtOQnKxJUE

CryptoSlate argues that this could potentially lead to a severe supply crunch. "With an estimated 46,000 BTC being absorbed in two days, which equates to 23,000 BTC per day, this rate is about 25.5x the daily production of Bitcoin," CryptoSlate explains.

As always, we're not in the business of telling you what to do with your money!

Elsewhere