Table of Contents

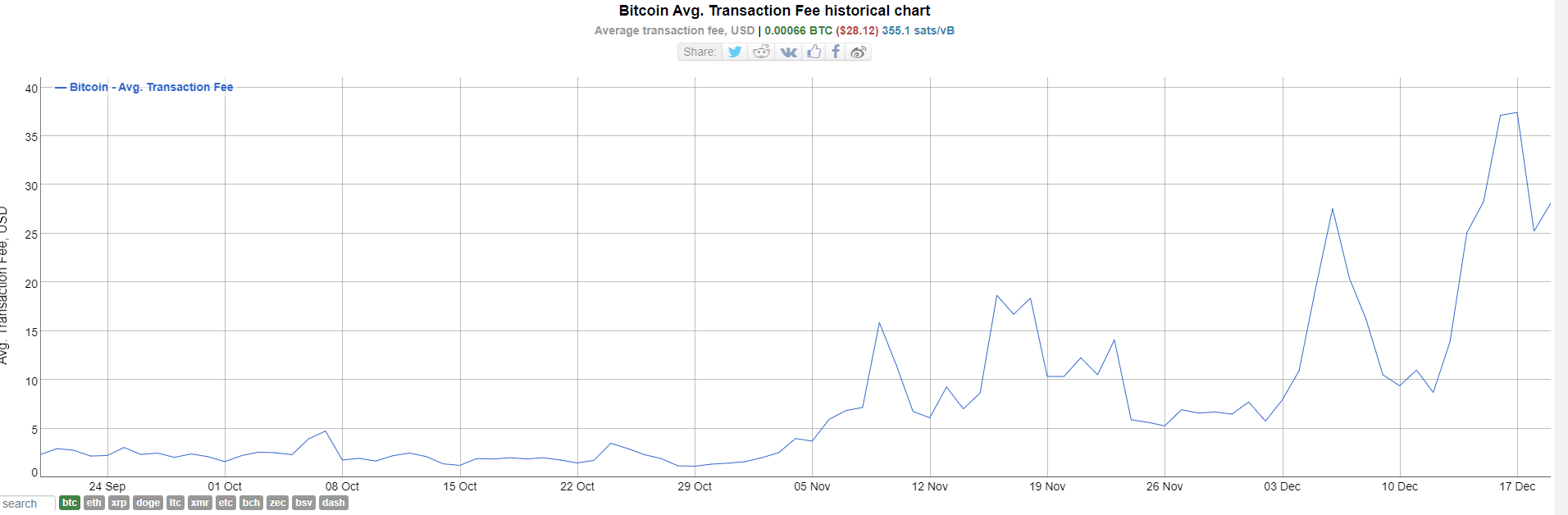

Bitcoin fees have reached a yearly high, at levels not seen since April 2021. The average price of Bitcoin transactions hit $37 over the weekend, as users created over 1.2 million new Ordinals inscriptions over the same period.

But what does this mean for Bitcoin's price trajectory?

Ordinary Fee

Bitcoin transaction fees are simply the fees users incur to prioritize their transactions. Also known as miner fees, these charges are determined by, you guessed it, miners who determine whether processing a transaction is worth their time. Lowballing miners can result in transactions being stuck for a long time.

According to Dune, 300,000 transactions were clogging the system over the weekend awaiting processing.

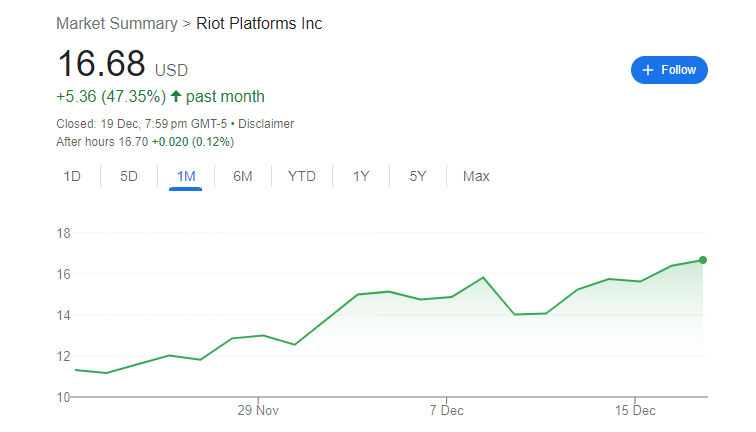

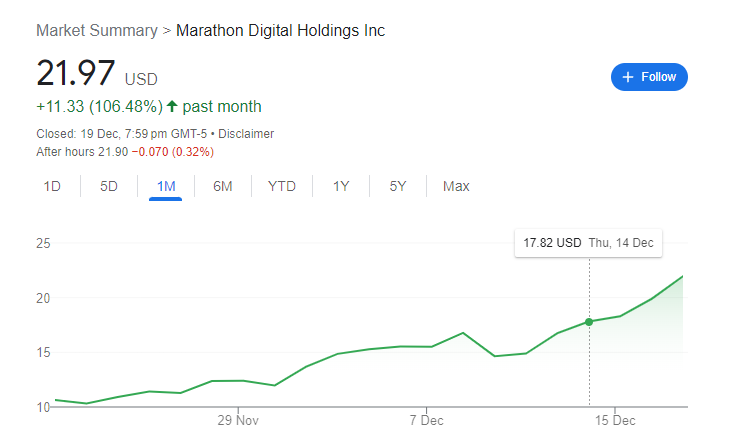

It goes without saying that higher transaction fees are good news for Bitcoin miners, who are essentially being paid more to do the same job. Riding the wave of Bitcoin's rising price, Bitcoin mining stocks have shown extraordinary performance too.

Riot Platforms (NASDAQ: RIOT) is up 47% over the month whilst Marathon Digital Holdings (NASDAQ: MARA) has jumped more than 106% in the same period.

Most recently, Marathon Digital Holdings announced plans to expand its mining operations through a substantial investment of $179 million.

The firm will acquire two currently operational Bitcoin mining sites, totaling 390 megawatts of capacity, from subsidiaries of Generate Capital. This brings its Bitcoin mining portfolio to approximately 910 megawatts of capacity, 45% of which will reside on sites directly owned by the Company, and 55% of which will be hosted by third parties.

Unordinary Ordinal Craze

As mentioned, Bitcoin Ordinals have seen a recent surge in attention, with inscriptions accounting for over 20% of Bitcoin fees.

Inscriptions share of #bitcoin fees:

— Dylan LeClair 🟠 (@DylanLeClair_) December 7, 2023

- 24 hours: 23.4%

- 7 days: 20.49%

- 30 days: 24.77%

- Year to Date: 21%

1/2 pic.twitter.com/JRMjy6WnLW

Since its inception, Bitcoin Ordinals have divided the Bitcoin community. Launched on 21 January 2023 by Bitcoin Core contributor and software engineer Casey Rodarmor, the new Ordinals protocol built on the Bitcoin mainnet allows digital media to be inscribed on the Bitcoin blockchain, effectively allowing for NFTs on Bitcoin.

Unlike Ethereum based NFTs, Ordinals allows users to store all the data to a Bitcoin NFT such as full songs, videos and apps up to the full size of a Bitcoin block.

Traditionalists argue that Ordinals contradict Bitcoin's original purpose. The Hash co-host Jennifer Sanasie explains that the anti-Ordinals believe that the development is "not part of Satoshi's vision."

And of course, Ordinal inscriptions drive up fees. “Ordinal NFTs are contributing to the rise in transaction fees we’ve seen this week.” said Colin Harper, head of content and research at crypto-mining services firm Luxor Technologies. “Transaction fees wouldn’t be as high as they are currently if it weren’t for the sudden influx of Ordinal NFT transactions”.

The surge in Ordinals has also been attributed to Binance's recent BRC-20 SATS listing, allowing people to trade Ordinals through pairings 1000SATS/USDT, 1000SATS/FDUSD, and 1000SATS/TRY.

SATS is a BRC-20 token and is the smallest unit of Bitcoin, paying tribute to Satoshi Nakamoto. One SAT equals 0.00000001 BTC. Within hours of Binance's announcement, SATS surged 140%.

The $SATS price is up ~120% since #Binance announced the listing of BRC-20 Sats,

— Lookonchain (@lookonchain) December 12, 2023

On-chain data shows that the top 20 holders of $SATS hold 333.3T $SATS($150.8M, 15.90%% of the total supply).

6 of the top 20 holders obtained $SATS through minting, with ~78.57M $SATS($35.5M). pic.twitter.com/ELRYrld6nM

Binance also disclosed plans to add 1000SATS as a new borrowable asset with the new margin pair on Isolated Margin.

BTC to $50K

Bitcoin has comfortably cleared the $40K mark but will the world's largest cryptocurrency hit $50K in 2024? Bitcoin ETFs being the biggest driver are certainly pushing it in the right direction but how with Ordinals driving up fees, will the new phenomenon stunt Bitcoin's growth?

Austin Alexander, co-founder of LayerTwo Labs, argues that Bitcoin fees are good for the network's long-term security. “Bitcoin is not inevitable and needs to be paid for. And people are only going to pay if they see the utility of [Bitcoin],” Alexander said.

Blockchain developer Andrew Poelstra believes blocking Ordinals could be counterproductive. Blocking Ordinals would lead to "spam" hidden within "useful" transaction data like signatures, which could complicate the network, Polestra says.

On why banning arbitrary data is a rabbit hole you don't want to go down. Excellent objective analysis by Andrew Poelstra. pic.twitter.com/8Fn3bn3Bbo

— Jameson Lopp (@lopp) January 31, 2023

Bitcoin upgrades such as Taproot and SegWit make transactions more efficient on the blockchain, thus making the creation of Ordinals more cost-effective.

Earlier this month, a piece of Bitcoin Ordinals art sold for a record of $450,000. . Ordinals inscription number eight from the Honey Badger collection sold for 10.4 BTC.

However, 75% to 90% of inscriptions are creating BRC-20 tokens, not digital art. The process standardizes tokens within the Bitcoin network.

In terms of Bitcoin's price, fees are unlikely to go down as long as its price continues to rise. Ordinals might exacerbate this but mining fees ultimately improve the security of the blockchain.

Additionally, another Bitcoin halving is scheduled for next year. Although miners will see their rewards slashed, the price of Bitcoin has historically benefited from halving as a result. Miners will be forced to seek more cost-cutting measures, thus improving mining efficiency. This will in turn reduce the significance of Ordinals driving up fees.

Elsewhere