Table of Contents

As both the crypto and TradFi industries eagerly await the approval of Bitcoin ETFs and relish in BTC's unstoppable performance, one particular financial head is killing the mood.

In a Senate hearing on Wednesday, JP Morgan CEO Jamie Dimon laid heavily into crypto, “I’ve always been deeply opposed to crypto, Bitcoin, etc.,” Dimon said. “If I was the government, I’d close it down.”

“The true use case for it [crypto] is criminals, drug traffickers, money laundering, tax avoidance,” Dimon added.

Dimon has taken an unwavering stance against digital assets over the years. In 2017, he said governments would "crush" Bitcoin and those "stupid enough to buy it would pay the price."

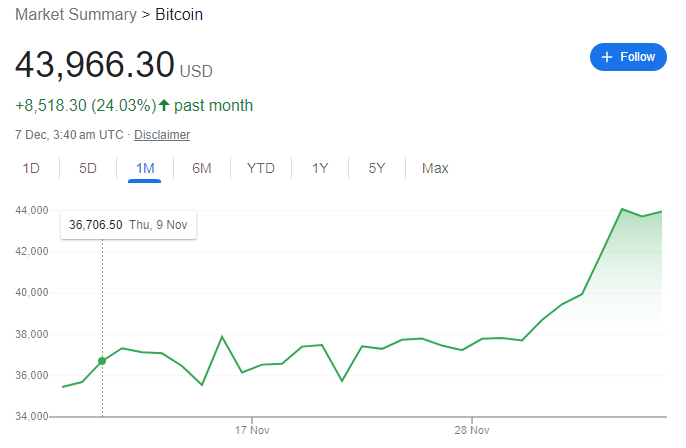

It's a message carried by JP Morgan itself too. In November, analysts from the firms said the crypto rally looks "rather overdone." At the time of the report, Bitcoin was priced at $36,706. It now sits at $43,966.

Bitter on Bitcoin ETFs

Dimon's disdain for Bitcoin has been longstanding but his unwavering stance could be turning into bitterness as his TradFi peers join the dark side. As recently as December 2022, chief executive of HSBC, Noel Quinn said the bank is "not getting into the crypto world, crypto trading, crypto exchanges."

“I do worry about the sustainability of the valuations of crypto and I have done for a while. I’m not going to predict where it will go in the future," Quinn stated.

Fast forward a few months and HSBC is launching crypto ETF support, making it the first bank in Hong Kong to do so.

Let's also not forget how BlackRock CEO Larry Fink was the poster child for crypto naysayers. He likened Bitcoin to "money laundering" and dismissed it as an "index of money laundering."

Now with BlackRock filing for Bitcoin ETFs, Fink has drastically changed his tune. “I think the rally today is about a flight to quality,” Fink said in October 2023, putting crypto in the same category as Treasuries and gold. (Fink has previously stated that he cannot use "bitcoin" because of the ongoing ETF filing, and uses "crypto" to mean the same.)

He added that the rally was "an example of the pent-up interest in crypto.” “We are hearing from clients around the world about the need for crypto,” Fink added.

Yet, Dimon and JP Morgan remain unmoved, claiming to be unconvinced by the Bitcoin ETFs phenomenon. JP Morgan analyst Nikolaos Panigirtzoglou went as far as saying Bitcoin ETFs could put downward pressure on Bitcoin.

“The argument being that a significant amount of GBTC shares has been bought in the secondary market this year at deep discounts to NAV in anticipation of its conversion to ETF and these speculative investors would take profit once GBTC gets converted to an ETF and the discount to NAV gets arbitraged away,” Panigirtzoglou explained. “We estimate that around $2.7bn could come out of GBTC.

"In terms of market impact, if this $2.7bn exits completely the bitcoin space then such an outflow would of course put severe downward pressure on bitcoin prices," he said.

“If instead most of this $2.7bn shifts into other bitcoin instruments such as the newly created spot bitcoin ETFs post SEC approval, which is our best guess, then any negative market impact would be more modest. Nevertheless, the balance of risks for bitcoin prices is skewed to the downside in our opinion as some of this $2.7bn is likely to completely exit the bitcoin space,” the analyst added.

Thus far, Bitcoin ETFs are propelling Bitcoin's price. Additionally, with Bitcoin mining set for April 2024, Bitcoin's upward price trajectory seems to be extending. Perhaps Dimon's stance is one of FOMO rather than disbelief.