Table of Contents

Hey there! Just a quick note to let you know that this edition of the Blockhead Business Bulletin is brought to you by our sponsor, Franklin Templeton. They're a global investment management organisation with over 75 years of investment experience. Being a California-based company, they offer value by leveraging its Silicon Valley roots and relationships with countless fintech, blockchain, and AI companies to bring insights directly to their clients. So, please sit back, relax, and enjoy today's news, knowing that it's made possible by our friends at Franklin Templeton.

Bitcoin, the largest cryptocurrency in circulation, gained very close to a weekly high, and so far this year, it's up over 120%.

Although bitcoin has yet to return to the investing fervour it saw in late 2021, the cryptocurrency market has surged in recent weeks as the anticipated conclusion of central bank rate-hiking cycles draws funds back into high-risk assets.

Bitcoin's Recent Rally Mirrors 2021 Run

The recent flurry of trading in Bitcoin futures has brought back fond memories of the token's historic bull run in late 2021.

Variables such as the cost of perpetual futures contracts and options open interest suggest a recovery of speculative zeal for Bitcoin, which has more than quadrupled in price this year in a partial return from a 2022 collapse.

The first US spot Bitcoin exchange-traded funds may soon receive regulatory approval, letting more investors enter the market.

The amount of money flowing into exchange-traded funds is uncertain, but the hope that demand will increase is enough to encourage risky investments.

Bitcoin perpetual futures are quite popular since they never expire. Exchanges utilise the so-called funding rate to match the contracts to the actual spot price.

A positive rate indicates that traders betting on gains are willing to pay funds to speculators who are short as a cost of holding their positions, which is more common during bullish periods.

CryptoQuant data from a wide variety of digital-asset exchanges shows that the rolling, seven-day average financing rate for Bitcoin perpetual futures through November 15 was near levels last seen in the fourth quarter of 2021 when Bitcoin was soaring towards its pinnacle.

Bitcoin neared $38,000 on Thursday before falling back.

Headline-Maker: Japanese Stocks

The blue-chip Nikkei 225 Stock Average rose for the fifth time in six days, temporarily surpassing its intraday record from June to reach its all-time high in almost three decades early on Monday.

A combination of a cheap yen, robust firm earnings, and corporate governance measures championed by the Tokyo Stock Exchange have led to an almost 30% increase in the index so far this year.

On Monday, it climbed as high as 0.8%, its highest point since March 1990, before giving up most of those gains.

Tokio Marine Holdings reported solid results and a share repurchase, and Panasonic Holdings, which indicated Friday that it is exploring listing its auto-related company, were among the day's top-performing equities.

The stocks of banks also rose.

On Friday, the Nikkei 225 closed with its longest weekly winning run since June.

Following Friday's modest advances on Wall Street, equity prices in Asia rose on the persistent hope that the Federal Reserve will soon end its interest rate hiking cycle.

South Korean and Australian stock markets both saw gains.

US futures were barely changed after the S&P 500 surged above 4,500 on Friday to earn its third straight week of gains – the longest run since July.

US equities showed only minor fluctuations after a $2.7 trillion gain in November on bets the Federal Reserve will end its hiking cycle to avert a recession.

Soft US inflation data fueled the fire, bolstering wagers that the Fed's rapid tightening is ending.

Stock and index derivatives contracts began to expire, increasing volatility.

A revelation that Applied Materials is the subject of a US criminal investigation for allegedly breaking export limits to China sent the stock plunging.

High-quality stocks — those with strong profitability and little leverage — are now far more costly than the market and their poor-quality equivalents.

In addition to the tumultuous years of 2020 and 2008-2009, this is the only other period in recent history in which quality has commanded such substantial value premiums.

During these times, investors fled to the protection of high-quality assets, driving up their prices.

Rapidly rising from "oversold" levels to "overbought" ones, the stock market is now facing cries that it needs to take a break.

The profit recession in the S&P 500 index is ending as earnings season concludes.

With almost 90% of S&P 500 companies having reported results for the third quarter, it is safe to assume that the three-quarter run of profit reductions has ended.

Profits are up 4% year-over-year.

Bank of America, referencing data from EPFR, reported that the week ending November 15 saw $23.5 billion invested in global stock funds, the second largest inflows of the year.

Meanwhile, investors are also monitoring any consequences of the shocking removal of Sam Altman as OpenAI's chief executive officer.

The executives and investors trying to restore him have stalled over differences in the composition and responsibilities of the board.

Dollar Falters & Erases 2023 Gains

The dollar fell to its lowest level in four months on speculation that the currency may have already peaked.

As fears increase over the worsening global economic outlook, the dollar fell below 150 yen on Friday, marking its second-steepest weekly fall vs other major currencies this year.

The dollar index, which measures the greenback against six other major currencies, hit a low not seen since September 1.

Sluggish data internationally has increased fears about economic prospects but implies central banks may be prevailing in their fight against skyrocketing prices.

Bonds Best Since March Faces Stern Test

The Treasury market's rebound faces a bond auction to determine if investors believe 2023's selloff is finished.

Slowing inflation and cooling growth have led traders and investors to stampede into US government paper, believing the Fed would slash interest rates by mid-2024.

That snapped Treasuries' six-month losing skid and boosted the market by 2.6% in November. It's the greatest gain since March when a financial crisis threatened the economy.

The demand at Monday's 20-year auction will indicate if investors think the recent trend will reverse after this month's rally has lowered rates to their lowest levels since September.

The market momentarily fell in the 30-year auction earlier this month as the Treasury had to sell the notes at an exceptionally high yield premium.

The Treasury's 20-year bond has been an albatross for three years, never sold over the holiday-shortened US Thanksgiving week. Therefore, a robust reception would strongly promote the rally.

Traders' faith has been shaken over the past year as the unexpectedly robust economy and persistent inflation have dampened multiple rallies that had begun on the belief that the Fed would halt its interest rate hikes.

The growing government deficit has also contributed since it pressures the market to take on more debt to fund the deficit.

But this month's signals that the labour market is cooling and inflation is being reined in has bolstered opinion that the central bank's monetary policy is adequately restrictive.

However, the supply worries were mitigated by the Treasury's announcement of smaller auction size increases than many bond traders expected, especially for long-maturity issues.

Bearish Bets on Oil

With OPEC gathering later this month to discuss how to prop up oil prices, hedge funds have taken their most pessimistic stance on the commodity in 20 weeks.

Traders on the Intercontinental Exchange Inc. and the US Commodity Futures Trading Commission said bullish bets on Brent and West Texas Intermediate oil were reduced by 18,829 to 252,261 in the week ending November 14.

This was the lowest level since June 27.

Oil closed its fourth consecutive weekly fall Friday as lacklustre trade data from China and fresh concerns about the Fed's monetary path clouded the outlook for demand.

However, supply has been outpacing demand in recent weeks, resulting in a gradual decline in the price of a barrel of oil in the real world.

On Friday, crude prices rose further as traders anticipated positive action from OPEC and its allies at their next meeting on November 26.

As the expiration of the front-month contract approaches, WTI may experience heightened volatility on falling volumes.

On the other hand, as the dollar and Treasury rates declined last week, gold prices remained stable on Friday to mark their largest weekly increase in four weeks.

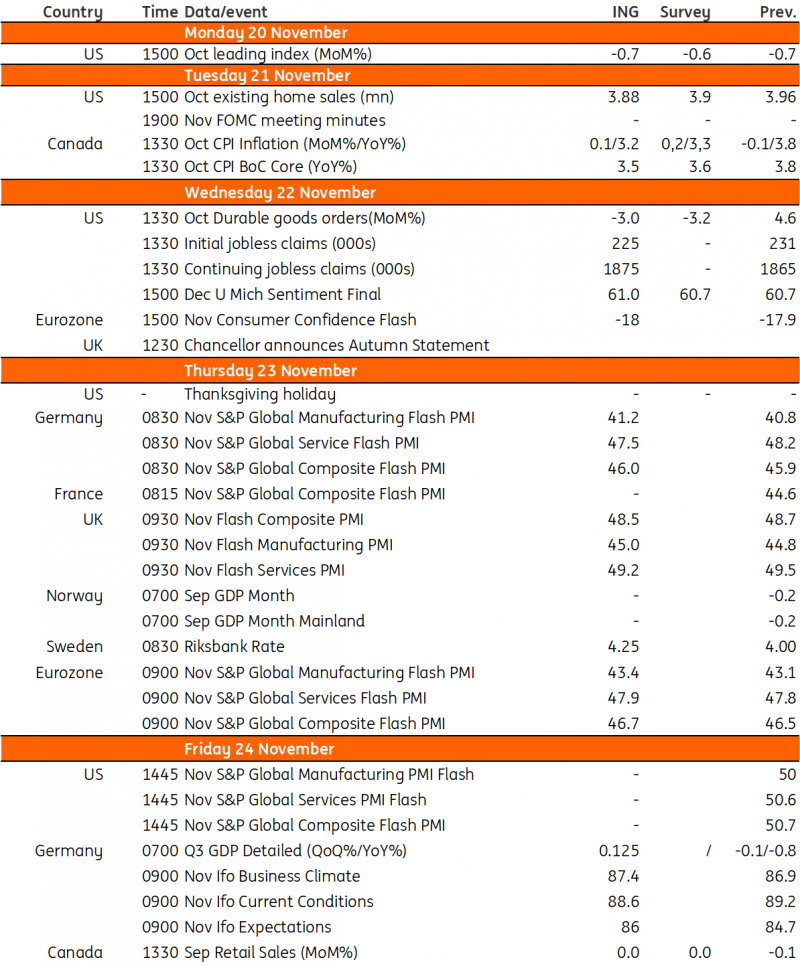

THE WEEK AHEAD

The FOMC minutes from November 1 will be closely watched next week, but they are not expected to have much of an impact on the market.

No improvement in PMI data is forecast for the Eurozone, and the UK's Autumn Budget will have little wiggle space for tax cuts.

Key Events:

- US: Home sales to drop to new cycle lows

- Eurozone: No meaningful pickup expected in November's PMI

- UK: Autumn Statement - Limited room for tax cuts

Macro Data Calendar

Due to national holidays in the United States, trading volume is expected to be light this week.

Slowing inflation and weakening labour data have strengthened the perception that the Federal Reserve has finished rising interest rates, with momentum now gathering behind the view that the central bank will be in a position to aggressively slash rates next year.

Nearly 100bp of reductions have been factored in, with May considered as a possible starting date.

The possibility of a further decline in economic activity remains, which might force the Fed to lower interest rates even more than the market expects.

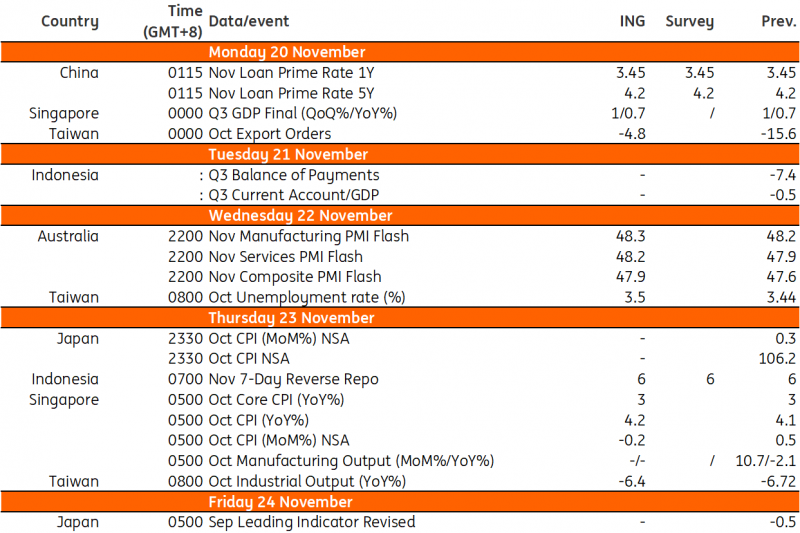

Asia Week Ahead

A quieter data calendar in Asia this week will feature inflation numbers from both Japan and Singapore while Bank Indonesia meets to decide on policy rates. The People’s Bank of China will release its benchmark lending rates.

Key Events in Asia:

- China Loan Prime Rates

- Taiwan’s export orders and industrial production

- Bank Indonesia expected to pause

- Japan inflation

- Singapore inflation edging higher

Macro Data Calendar

Emerging-Market Stocks' Rally Takes a Hit

Large drops in two Chinese e-commerce firms on Friday weighed on the benchmark emerging-market stocks index, denting its greatest monthly gain since January.

The declines in Alibaba Group Holding and its main competitor Tencent Holding, both of which are quoted on the Hong Kong Stock Exchange, trimmed the index's weekly gain to 3% and its monthly gain to 6.7%.

About half of the index's 0.5% fall on Friday may be attributed to Alibaba, which fell 10% after abandoning a proposal to spin out its cloud subsidiary, blaming US limitations on chip exports.

Meanwhile, currencies of developing countries climbed for a fourth day, marking their longest winning run since October 11 and recording their best week since the middle of July.

Investors betting that the Federal Reserve's monetary tightening has ended have pushed emerging market assets higher this week.

On Friday, the Thai baht outperformed its developing market counterparts, while currencies from Latin America, led by the Brazilian real, fared poorly.

Fixed Income & FX Leaders’ Summit APAC

The Largest Gathering of buy-side fixed income & FX trading and investment leaders is returning this November 22-23, 2023, at Raffles City Convention Centre, Singapore!

Blockhead is a proud media partner for FiFX APAC 2023. Subscribers can enjoy 20% off prevailing ticket rates by quoting “BLOCKHEAD20” upon checkout here.