Table of Contents

Hey there! Just a quick note to let you know that this edition of the Blockhead Business Bulletin is brought to you by our sponsor, Franklin Templeton. They're a global investment management organisation with over 75 years of investment experience. Being a California-based company, they offer value by leveraging its Silicon Valley roots and relationships with countless fintech, blockchain, and AI companies to bring insights directly to their clients. So, please sit back, relax, and enjoy today's news, knowing that it's made possible by our friends at Franklin Templeton.

The events of a year ago will remain fresh in the minds of many professional cryptocurrency traders. A year on from then, the crypto business world is fundamentally different yet strikingly familiar.

Bitcoin peaked in November 2021 at around $69,000, but the euphoric day traders and excessive leverage that pushed that price are largely gone now. The same goes for well-known shills who promote tokens and memecoins on social media. Regulators are getting tougher so they don't get caught off-guard again.

Financial behemoths like BlackRock are also getting involved as they anticipate the first Bitcoin exchange-traded fund (ETF) to receive approval from the US Securities and Exchange Commission.

As more investors wager that US EFTs that contain the world's largest cryptocurrency are on the verge of regulatory approval, the price of bitcoin has risen for a fourth consecutive week, hovering just below an 18-month high of $38,000.

Bitcoin gained as much as 2.5% on Friday, reaching a high of $37,465. On Thursday, the price came within a hair of $38,000, the highest level since May 2022.

A year ago, the implosion of Sam Bankman-Fried's FTX exchange was the last domino in a series of disasters across the industry that began with the fall of the TerraUSD stablecoin.

The most obvious sign that the crypto industry has progressed is that Bitcoin has made up for all of its losses since the stablecoin TerraUSD collapsed in May 2022, which triggered a chain reaction of failures that finally led to the demise of FTX.

Still, Bitcoin is only about halfway towards reaching the heights of the 2021 crypto frenzy, when it peaked at close to $69,000. Although short-term predictions in crypto are challenging, analysts think the digital asset's long-term prospects look excellent.

S&P 500 Rally Powers Ahead

With tech stocks rising, bond prices stable, and no significant shocks from the Federal Reserve's speakers, the stock market continued its November gain.

The most important subset of the S&P 500 rose, leading the index to its highest point in seven weeks.

Many technical analysts saw the benchmark for US stocks rising over 4,400 and the 100-day moving average as optimistic signs. With Microsoft setting a new high and Nvidia continuing its ascent into an eighth session, the Nasdaq 100 gained the most since May.

A relatively quiet day in the Treasury market aided Friday's stock market gain. After spiking the day before in response to a poor 30-year bond auction and Jerome Powell's "sterner" tone on policy, rates on the 10-year note were flat. Investors largely shrugged off the Fed Chair's warning of tighter monetary policy on Thursday.

Investors have also softened their emotional reactions to data in recent weeks. The caution that prevailed in equity markets over the past three months has now switched to year-end greed.

MSCI's index of how well global stocks did rose, while Wall Street's main indexes went up 1% or more. For the week, the Dow rose 0.7%, the S&P 500 gained 1.3%, and the Nasdaq advanced 2.4%.

Stock market distortions on an epic scale were on full show last week as the Big Tech hype cycle continued to gather steam, highlighting widening gaps between Corporate America's haves and have-nots.

The Nasdaq 100 rose as Microsoft set records and Nvidia jumped again. Still, the continued celebration in the blue-chip mega caps masks disheartening performance in a wide range of stock investing methods vulnerable to economic cycles.

Since March, the worst performance for equities targeted by short sellers, value stocks, and tiny firms was seen.

There were indications of continuing credit anxiety on Wall Street throughout the chaos.

According to research provided by Goldman Sachs, the strongest companies' balance sheets outperformed their weaker competitors by the largest margin in around four months, while high-yield bonds fell in value.

When seen as a whole, the volatility in the market shows that investors are still determining how the most aggressive interest-rate cycle in four decades will affect their profits, the economy, and the value of their companies.

However, the Big Tech enthusiasm is masking all that anxiety in the headline market cap-weighted indices.

Meanwhile, Asian stocks fell on Friday as fears about China returned to the surface after data showed that the world's second-largest economy was deflated.

That weighed on Asian currencies, too, with the Indian rupee hitting a new all-time low.

Rapid Bond Rally Looks Fragile

The devastating bear market in US government bonds looked to be on its final legs for a brief while last week.

By Friday, concerns about the Fed and gigantic auction sizes were back in force, highlighting the fragility of any gains.

A dismal auction of 30-year Treasury notes Thursday sent long-maturity rates rising as investors sought extra compensation for sustaining a mounting budget deficit.

Another interest rate rise to combat inflation is still feasible, Powell told reporters at an International Monetary Fund meeting in Washington an hour later, sending short-term rates soaring.

A look at the Bloomberg Treasury Index shows that Friday was the worst day for the index in over six months.

Investors and traders planning for the conclusion of the Fed's unusually aggressive tightening cycle caused long-dated Treasury rates to drop to their lowest levels in more than a month only the day before.

As the cumulative effect of the Fed's rate rises since March 2022 weighs on the economy, investors continue to view another hike as improbable and predict a Fed switch to cuts next year. After hearing Powell's comments, however, investors began pricing in a July launch instead of a June one.

Meanwhile, the bond auction showed buyers had a low tolerance for yield decreases. The auction yielded 4.769%, down from last month's 4.837% (the highest since 2007) due to the market rise leading up to the sale.

Dollar Relents Despite Fed Warning

A calmer session in the Treasury market followed a rapid yield surge on Thursday.

That pushed the US dollar to ease somewhat against most major currencies.

Traders who bought a lot of long dollar bets in anticipation of a "hawkish" Fed are quickly getting out of one of the most crowded trades this year.

But the greenback gained on the yen.

Investors also bet on a possible intervention as the yen holds close to a one-year low against the greenback.

But Goldman Sachs sees a resilient US economy tempering a dollar decline next year.

Goldman Sachs strategists led by Kamakshya Trivedi predict that the dollar's outlook will worsen in 2024 but that the strong US economy and high yields will likely support the currency's value.

Despite falling from its 2023 highs, hit last month, the dollar is still up roughly 1.6% so far this year. With the Fed suggesting it plans to maintain interest rates high for a lengthy term to manage inflation, it's on course for a third consecutive yearly gain.

Iraq Backs More Cuts From OPEC+, Boosts Oil

As a result of Iraq's support for OPEC+'s oil reduction and the fact that some speculators closed big short positions ahead of the weekend's uncertainty, oil prices rose by around 2% on Friday.

Still, crude prices ended the week down 4%, the third consecutive weekly decrease.

For the second week in a row, energy companies in the United States have reduced the number of oil rigs in operation to a level not seen since January 2022, according to data from Baker Hughes.

Brent futures jumped $1.42, or 1.8%, to $81.43 per barrel, while WTI crude from the United States rose $1.43, or 1.9%, to $77.17 per barrel. Brent and WTI saw three consecutive weekly losses for the first time since May despite moving out of technically oversold territory.

Last week's weak Chinese economic data added to concerns about waning demand. China, the top oil importer of Saudi Arabia, the largest exporter in the world, has requested a reduction in shipments for December.

Higher interest rates can reduce oil demand by slowing economic growth.

All eyes will be on the meeting on November 26th, OPEC and its allies, which include Russia. Iraq's oil minister has stated that Baghdad will abide by the OPEC+ agreement on output levels.

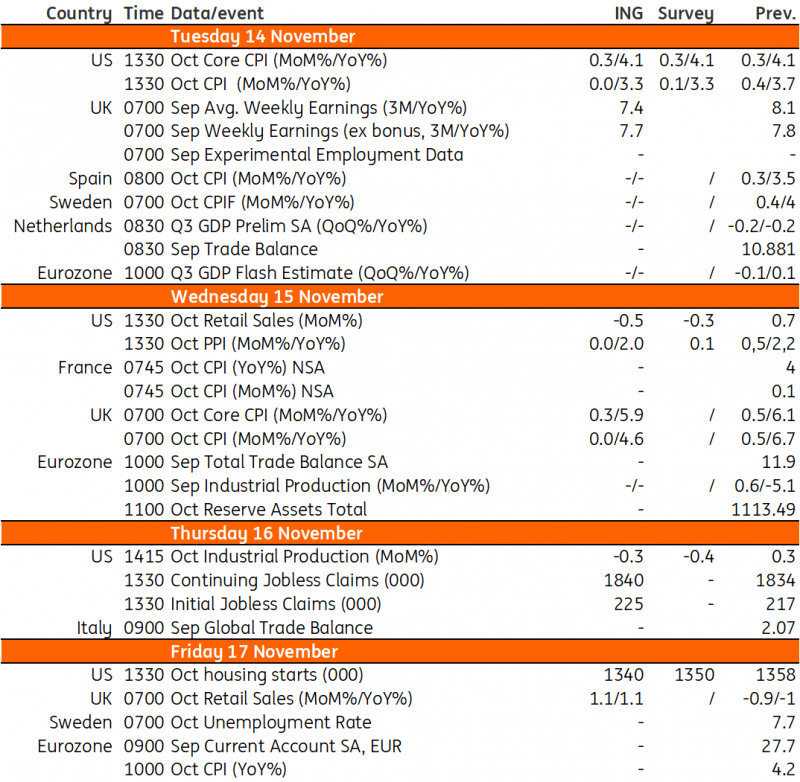

THE WEEK AHEAD

US inflation data will be in focus after Federal Reserve Chair Jerome Powell again acknowledged last week that monetary policy is "restrictive" but remains unsure whether it's restrictive enough for inflation to return sustainably to 2%.

The Bank of England is set for another hold decision in the UK, barring any enormous data surprises.

Macro Data Calendar

US Inflation in Focus

Reiterating the Fed's rhetoric sentiment last week, Powell admitted that monetary policy is "restrictive" but expressed uncertainty about whether it is restrictive enough to bring inflation back to the 2% target level steadily.

Markets anticipate that the Fed will stop raising interest rates at this time. Upcoming data, including consumer and producer price inflation, retail sales, and industrial output figures for October, should provide weight to this perspective.

Petrol price drops will have a significant impact, possibly causing headline CPI and PPI to be flat on the month while decreasing retail sales values to the point where we get a negative month-on-month reading.

We already know that auto sales were down for the month and that credit card spending has also been muted, pointing to a weaker expenditure number.

The ISM manufacturing index is currently in a deep contraction zone, so there is an additional negative risk to industrial production.

Meanwhile, housing starts appear to be expected to decline based on the long-run association with house builders' attitudes. Recent increases in mortgage rates to around 8% have hurt this, causing a significant drop in interest from potential buyers.

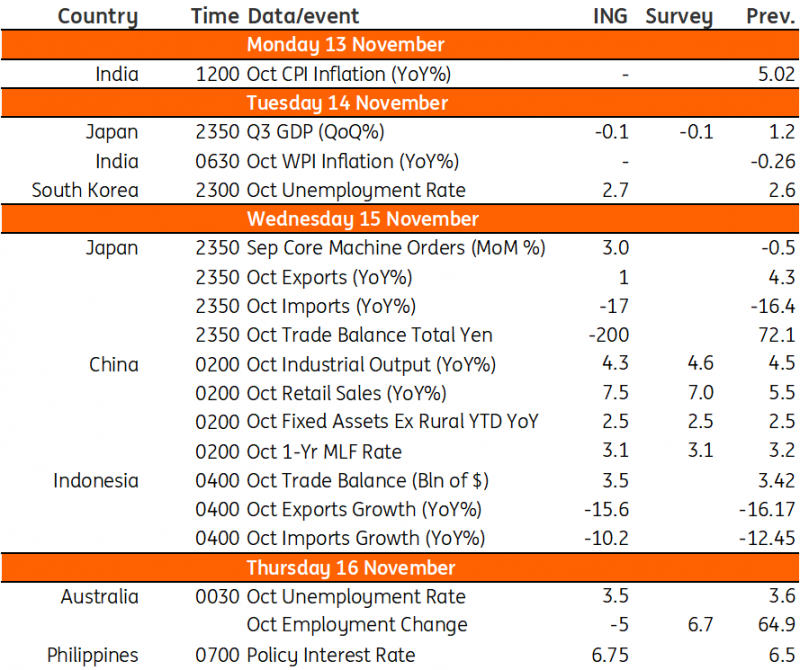

Asia Week Ahead

This week features a data deluge with retail sales and industrial output for China, as well as inflation data for India. Meanwhile, Japan reports GDP, and Australia releases jobs numbers.

Key Events in Asia:

- Onion prices leading India's inflation

- China's industrial output growth & retail sales

- Australian unemployment could edge lower

- Japan GDP release for Q3 and October trade data

- Korea's unemployment rate edges slightly

- BSP to hike again next week?

Macro Data Calendar

Upcoming events

15–17 Nov: Singapore Fintech Festival

Next week, Singapore takes center stage in the FinTech universe! Blockhead is proud to be a media partner at the 8th Singapore FinTech Festival. As a Blockhead reader, snag your ticket with a 20% discount! Use our exclusive link here.

22-23 Nov: Fixed Income & FX Leaders’ Summit APAC

The Largest Gathering of buy-side fixed income & FX trading and investment leaders is returning this November 22-23, 2023, at Raffles City Convention Centre, Singapore! Blockhead is a proud media partner for FiFX APAC 2023. Subscribers can enjoy 20% off prevailing ticket rates by quoting “BLOCKHEAD20” upon checkout here.