Table of Contents

As thrilling as a bull run and but equally as short-lived one, Blockhouse has come and gone far too quickly. Back for its second year running, Blockhouse returned in true Blockhead fashion to deliver the most off-the-wall Token2049 side event.

Going on live for our first panel on entrepreneurship - Founder Stories by @SGBuilders

— Blockhead | BLOCKHOUSE 12th Sept (@blockhead_co) September 12, 2023

No Penthouse party like the Blockhouse 🙌 @AirfoilStudio @alphalabscapital @HQ_xyz @thiswasetta pic.twitter.com/lpECONxyD0

Featuring five edgy, alternative panels hosted by SG Builders, Dezy, Coinbase and Worldcoin, Blockhouse filled the ever-elegant Etta Penthouse throughout the day. Attendees were treated to industry insights, learnings and engaging discussions, as well as an exquisite spread of fresh pizza from Lucali.

The stress was worth it 😂 Turning this into reality with @HQ_xyz @sgbuidl @blockhead_co with so much attendees at 11am, and lots more coming throughout the whole day till 5PM!

— Noel | HQ.xyz (@NarwhalTan) September 12, 2023

Amazing conversations with amazing people.

Fun fact: 40% of the room are founders! pic.twitter.com/JGbPJBw6BC

Hats off to our partners SG Builders, Headquarters (HQ.xyz), Worldcoin, Alchemy, Tokenize Xchange and Dezy too. The closest thing to a Web3 Avengers, this group of superheroes banded together to pull off what some are calling the best event this week. Sure, we've still got half of the week to go but bring on the competition.

Later that evening, Blockhouse transformed into the exclusive, prestigious BlockClub. Swapping degen energy for dapper vibes (we put blazers on), BlockClub catered to a more chic crowd. Doubling down on Etta Penthouse's bougie feels, BlockClub dimmed the lights, lit the candles and turned up the sexy (in a classy way, not a pervy one).

Welcoming market movers, high-net-worths and institutions, BlockClub presented a bespoke panel with experts from Franklin Templeton, Whampoa Group, Independent Reserve and Binance on market strategies, moderated by ex-Bitgo MD, APAC, Steve Bowman. The second panel, moderated by Martixport's head of research and strategy/crypto, Markus Thielen, offered an exploration into the intricate facets of tokenizing real-world assets with Defactor Labs, Franklin Templeton and Coinbase.

Read more about the panel here.

What's it like navigating the market cycles in a world of digital assets?

— Blockhead | BLOCKHOUSE 12th Sept (@blockhead_co) September 12, 2023

It's round two with BlockClub ft. @binance @WhampoaDigital @indepreserve @FTI_Global pic.twitter.com/mZ1HI4pw62

We'd sincerely like to thank all those who attended both events, as well as our awesome partners, without whom, none of this would be possible. OK, that's enough cringe, on to more pressing matters.

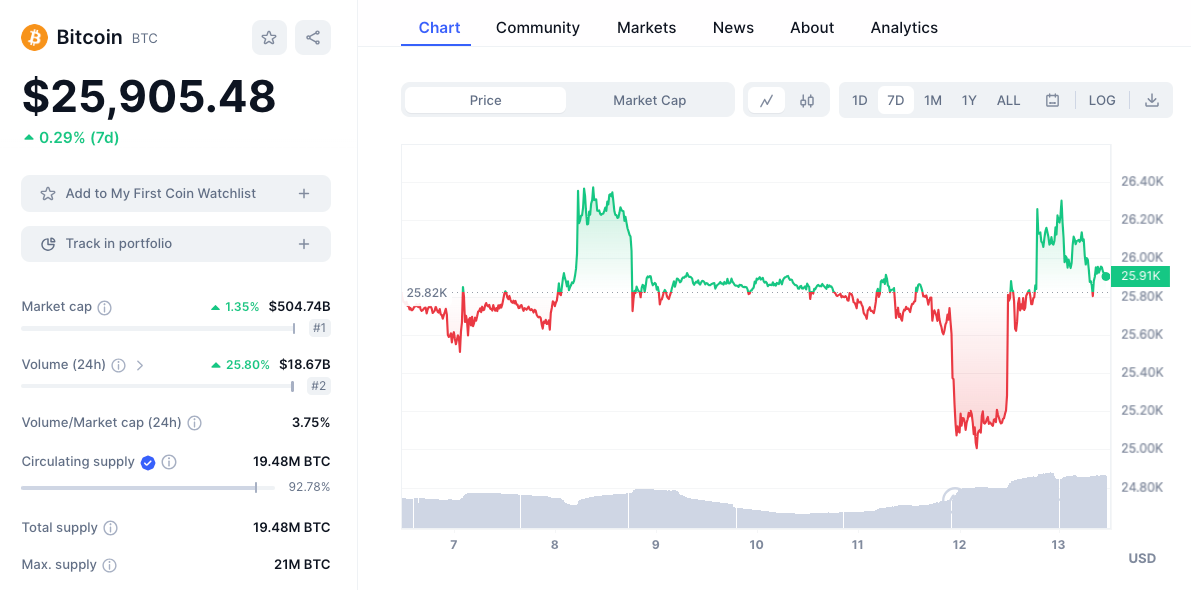

Following both events, Bitcoin jumped from the low $25K range into the $26K price point. We're not saying the two are necessarily correlated but it's quite a convenient coincidence if you ask us.

Elsewhere:

- Fireblocks Inks Deal With Banking Giant: HSBC has reportedly entered into a collaboration with cryptocurrency custody technology company Fireblocks. The firm has previously partnered with major banks, having been chosen as the custody technology provider for BNY Mellon in early 2021 and also collaborates with BNP Paribas. While HSBC has shown interest in the crypto space, allowing its Hong Kong branch customers to trade in bitcoin (BTC) and ether (ETH) exchange-traded funds, it remains publicly cautious about the broader crypto industry.

- Fund Giant Franklin Templeton Eyes Bitcoin ETF Market: Franklin Templeton, which oversees nearly $1.5 trillion in assets, has announced its intention to launch a spot bitcoin ETF, marking its entry into the rapidly growing digital asset space. The proposed Franklin Bitcoin ETF aims to reflect the performance of bitcoin's price, with its shares backed by bitcoin held by Coinbase Custody Trust Company. This move comes amid a surge in applications for bitcoin ETFs in the US, from asset management powerhouses like BlackRock, Fidelity, Invesco, and Bitwise

- FTX to Reverse Celebrity Payments: FTX, is looking to reclaim millions of dollars paid to celebrities for promoting the exchange before its bankruptcy. In a court filing, FTX's financial advisers provided a list of payments made to individuals and businesses for marketing purposes. The exchange hopes to reverse these payments under bankruptcy rules. Among the names are Shaquille O'Neal ($750,000), Naomi Osaka ($300,000+), David Ortiz ($270,000+), and Trevor Lawrence ($200,000+). Payments to sports teams including the Golden State Warriors and Miami Heat.

- Ripple Expands Enterprise Crypto Portfolio: Blockchain giant Ripple is set to acquire Fortress Trust, a subsidiary of Fortress Blockchain Technologies, enhancing its enterprise crypto offerings. This move follows Ripple's recent $250M purchase of Metaco in 2023. With Fortress Trust's expertise in Web3 financial infrastructure, Ripple said it aims to solidify its position in the crypto market, offering enhanced payment and liquidity solutions. The deal, which builds on Ripple's prior investment in Fortress Blockchain Technologies in 2022, awaits regulatory approvals.

- Coinbase Clarifies Stance on India Operations Amidst Media Reports: Contrary to recent media reports suggesting Coinbase's imminent exit from the Indian market, the crypto giant has clarified its stance. A TechCrunch article from Sept. 11 indicated that Coinbase had warned its Indian users via email about discontinuing services by Sept. 25. However, Coinbase has stated that this notice was targeted only at users who violated the exchange's updated standards. However, Cointelegraph notes that Coinbase has redirected Indian users attempting to sign up for its exchange to download the Coinbase Wallet instead. This move aligns with the company's past challenges in India, including the suspension of UPI payment services just three days post-launch due to regulatory pressures. Currently, Indian users on Coinbase can only withdraw existing crypto assets from their accounts.

- RockX Partners with Amber Group to Boost Institutional Crypto Staking in Asia: RockX's Bedrock platform, an institutional-grade Ethereum liquid staking solution, has secured a significant 5,000 ETH stake from Amber Group's WhaleFin. This collaboration marks a pivotal shift in Asia's institutional staking landscape. Chen Zhuling, CEO of RockX, emphasized the partnership's role in driving institutional digital asset adoption. Meanwhile, Thomas Zhu of Amber Group highlighted RockX's credibility as a key factor in their collaboration. With innovations like Distributed Validator Technology and Permissionless Exit on the horizon, Bedrock is positioned to lead the next wave of institutional crypto staking.

- Singapore's Startale Labs to Develop Blockchain Infrastructure for Sony: Entertainment giant Sony and Startale Labs, announced a joint venture to develop a blockchain aimed at becoming the foundation of global web3 infrastructure. This collaboration will leverage both companies' expertise, networks, and resources. The newly formed entity, named "Sony Network Communications Labs Pte. Ltd.", will be headquartered in Singapore. The venture aims to address the increasing demand for web3 applications and services. Jun Watanabe, President of Sony Network Communications, expressed enthusiasm about the partnership, highlighting the potential for innovation in the web3 era.