Table of Contents

As two US regulatory proposals work their way through Washington, it is worth looking at what we can learn from the nature of the debate.

The "Financial Innovation and Technology for the 21st Century Act" is an attempt to allocate regulatory responsibilities among various parts of the US government and is colloquially known as the "market structure bill."

The other as-yet-unnamed bill deals with stablecoin rules. These are serious attempts at legislation and, while they are drafts, are written sufficiently clearly that they could function as laws.

As there is a sufficient level of detail to dig in, let us grab some shovels.

Stablecoin Supervision

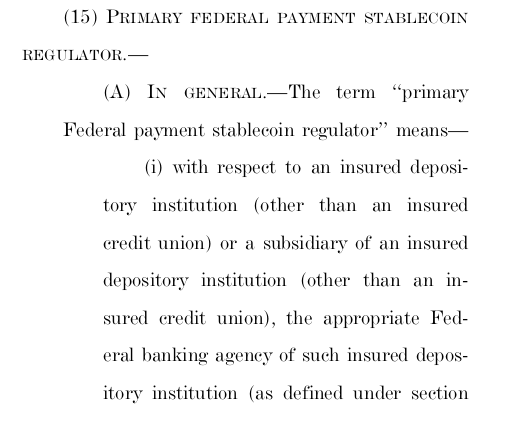

The stablecoin bill is admirably clear about who regulates stablecoin issuers:

So if you are already regulated as a bank, or credit union, or something else bank-like then it's your current regulator. And if you are new here then the Fed (Board refers to "Federal Reserve Board") is your regulator.

Therefore you'd expect the rules imposed on stablecoin issuers by the Fed to look a lot like the rules imposed on banks. And in fact the bill makes clear that the "Bank Secrecy Act" will apply as usual here:

This law is decades-old and has been both challenged as unconstitutional (unsuccessfully) and amended several times. It is a well-known part of the US financial regulation space. And it contains the following passage:

After reading all of these pieces together it is fairly clear the Fed will regulate these things and stablecoins will be treated as "monetary instruments" under existing rules. From a legal perspective sending someone stablecoins will look the same as sending someone a wire transfer. This is not, and will not be, a permissionless system.

Is There an End Run?

In addition to the federal regulation discussed above the bill also offers this policy option:

So individual states are also able to set up stablecoin regulatory regimes and keep those products outside the Fed's supervision.

This is eerily reminiscent of the sorts of state crypto regimes that have been set up in Wyoming, Nevada and elsewhere. In Wyoming a bank set up under that regime was explicitly denied access to the Fed's payment system. And Nevada has played around with providing blockchain-based systems exemptions from certain types of taxes. Generally these efforts result in headlines but no large businesses.

The US legal system is complex in that most everybody is subject to a mixture of state and federal laws and the way those systems interact can be messy. What we have here looks like an attempt to find a way to exempt certain types of businesses from AML/KYC provisions of federal law. That might work at least on a small scale. But it is difficult to see how a reasonable-sized financial institution within the US is going to escape federal government supervision.

It is also nigh-impossible to see how the regulators –who will surely comment in public on these draft bills – are going to say anything nice about such a scheme.

Defining Decentralization

The market structure bill is similarly clear when it lays out a definition for "decentralized." The context here is that, for financial instruments that do not have an issuer in the traditional sense, the existing securities registration regime is unwieldy. When people ask rhetorically "who would submit the paperwork on behalf of Bitcoin or Ether?" they have a point. There is nobody to do that. So this bill lays out conditions under which almost anyone can ask for a certification something is decentralized sufficiently to be exempt from traditional securities rules.

Roughly those conditions are:

- Nobody has unilaterally controlled the network in the past 12 months.

- No single entity has controlled over 20% of the tokens in the past 12 months.

- All sales to end users of the platform happened programmatically within the platform for the past 12 months.

- For the past 3 months nobody has contributed IP or features beyond bug fixes, or marketed the product as an investment.

What you need to qualify is to somehow have an already-existing and already-deployed system with diffuse ownership and a stable feature set. This absolutely does not allow you to fundraise for building a new product under the exemption. You need a working system for over a year before you can even apply.

This, even more than the stablecoin bill, looks to have an agenda. What products qualify for the exemption? Only existing established large projects. This bill does not "foster innovation" so much as it helps entrench the incumbents.

There is a deep irony here whether this is the intended effect of the bill's supporters or not. If this bill passes it is not clear how one would launch a competitor to the current large layer-1 chains. Certainly any new challengers would need to be self-funded or somehow cover the higher compliance costs of securities registration.

Anti-Permissionless

Both of these bills are deeply flawed from the perspective of helping to build a permissionless financial system. Both would seem to introduce government-sanctioned permissioning schemes.

Want to run a permissionless stablecoin? Go find a US state with rules you like and secure a license there. Only then are you going to be able to get banking and avoid future legal problems.

Launching a new layer-1 (or layer-2) is even more difficult. Unless you can self-fund the development it is probably not even worth trying. The space of blockchain designs will probably remain fixed if this passes. Certainly there will be less innovation as exchanges are less likely to list non-compliant new protocols when all the incumbents have an official seal of approval.

Backwards Procedures

And even stranger the market structure bill puts the onus on the SEC to work out within 30 days if a candidate decentralized product is in fact so. This passage is strange:

Regulators normally collect info from applicants, consider that info, and enter into a discussion to resolve whatever issues they have. Not so under this bill. Under the system proposed here, a 30-day countdown starts as soon as someone asks to be certified as decentralized. And then the government races to rebut the presumption the application is telling the truth.

Do we want the SEC hiring a legion of blockchain experts to analyze applicants? Who is going to pay for that? Should the government need to run investigations as part of a process that is intended to replace (some of) securities registration?

And this play is also easy to read. The simplest thing for an exchange to do to secure exemptions is to file hundreds (or thousands!) of them at once and overwhelm the regulators.

None of this feels like a fair system. In fact it looks like a setup for a classic strategy in American football: flooding the zone. The idea here is to send a large number of players into a small area of the field to confuse/overwhelm any sort of conventional defense. With 30 day limits to stop projects and time to find some state, any state, with a friendly regime to secure an exemption from the rules this sure looks like a setup. And none of it feels likely to pass in the current form.