Table of Contents

Welcome to the Blockhead Business newsletter, your go-to source for industry developments, news and insights into digital assets.

Asia-led and global in scope, we bring you a weekly roundup of the industry's most important business and economic developments, along with expert analysis and commentary from top professionals in the field.

Whether you're a fund manager, professional investor, or simply interested in the world of digital assets, our newsletter is your essential guide to navigating the future of finance.

CAPITAL FLOWS IN GLOBAL MARKETS

Asian markets were relatively quiet on Monday as investors prepared for a busy week of results and central bank meetings expected to result in higher interest rates in Europe and the United States.

The emphasis will be on what Federal Reserve Chair Jerome Powell and European Central Bank (ECB) President Christine Lagarde say about the future since markets have already factored in the expected quarter-point rate rises from both central banks.

The Bank of Japan, however, is expected to maintain its ultra-loose policy when it meets this coming Friday, while some Western institutions are betting on a change to the BoJ's yield curve management attitude.

With a forthcoming Politburo meeting, all eyes in the Chinese financial markets are on the possibility of further government support.

As Beijing attempts to prop up the economy without the type of forceful intervention that may trigger asset bubbles, expectations among global fund managers remain low.

Stocks in China had their worst week in four on Friday, despite repeated promises to stimulate the economy via more consumer spending and corporate activity.

Separately, Reuters reported last week that BOJ officials want to examine additional data to guarantee wage and inflation growth continues before modifying policy. Futures for the S&P 500 and Nasdaq showed little movement before a week that will be dominated by earnings reports.

Companies including Alphabet, Meta, Intel, Microsoft, General Electric, AT&T, Boeing, ExxonMobil, McDonald's, Coca-Cola, Ford, and General Motors will report this week.

The yield on 10-year Treasuries stayed at 3.85%, much below the recent surge high of 4.094%.

After rising 1.3% on Friday after the BoJ data, the dollar remained stable at 141.75 yen on Monday. The advances helped the dollar against all currencies, and the euro is now trading at $1.1128, down from its previous high of $1.1276.

Gold fell to US$1,961 an ounce from last week's high of US$1,987 as the dollar strengthened.

Oil prices, which had risen for four weeks in a row on tighter supply, met with profit-taking early on Monday.

Hey there! Just a quick note to let you know that this edition of the Blockhead Business Bulletin is brought to you by our sponsor, Franklin Templeton. They're a global investment management organisation with over 75 years of investment experience. Being a California-based company, they offer value by leveraging its Silicon Valley roots and relationships with countless fintech, blockchain, and AI companies to bring insights directly to their clients. So, sit back, relax, and enjoy today's news knowing that it's made possible by our friends at Franklin Templeton.

Bitcoin's Whiplash

Supported by cryptocurrency projects involving prominent corporations from the conventional financial industry like Citadel Securities and BlackRock, Bitcoin's low in the middle of June sparked a rally.

Earlier this month, Bitcoin hit a new annual high, but its current narrow trading range has observers questioning the sustainability of the recent upswing.

The largest cryptocurrency has had a 9 day, 27% increase in June, and is now trading between US$29,500 and US$31,500.

Bitcoin has been trading towards the bottom of the congestion zone after a period of back-and-forth filling during which Bitcoin tried but failed to break above US$30,000.

THE WEEK AHEAD

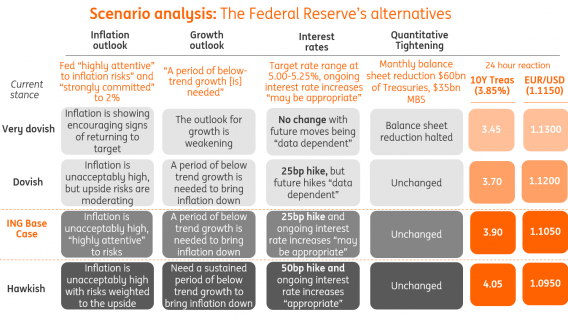

Global markets remain on tenterhooks as investors prepare for this week's important central bank policy meetings from the BOJ, the Federal Reserve, and the European Central Bank (ECB).

Despite falling US inflation, the Fed is expected to raise rates by another 25 basis points (bps) this week as the labour market remains tight and economic activity continues robust.

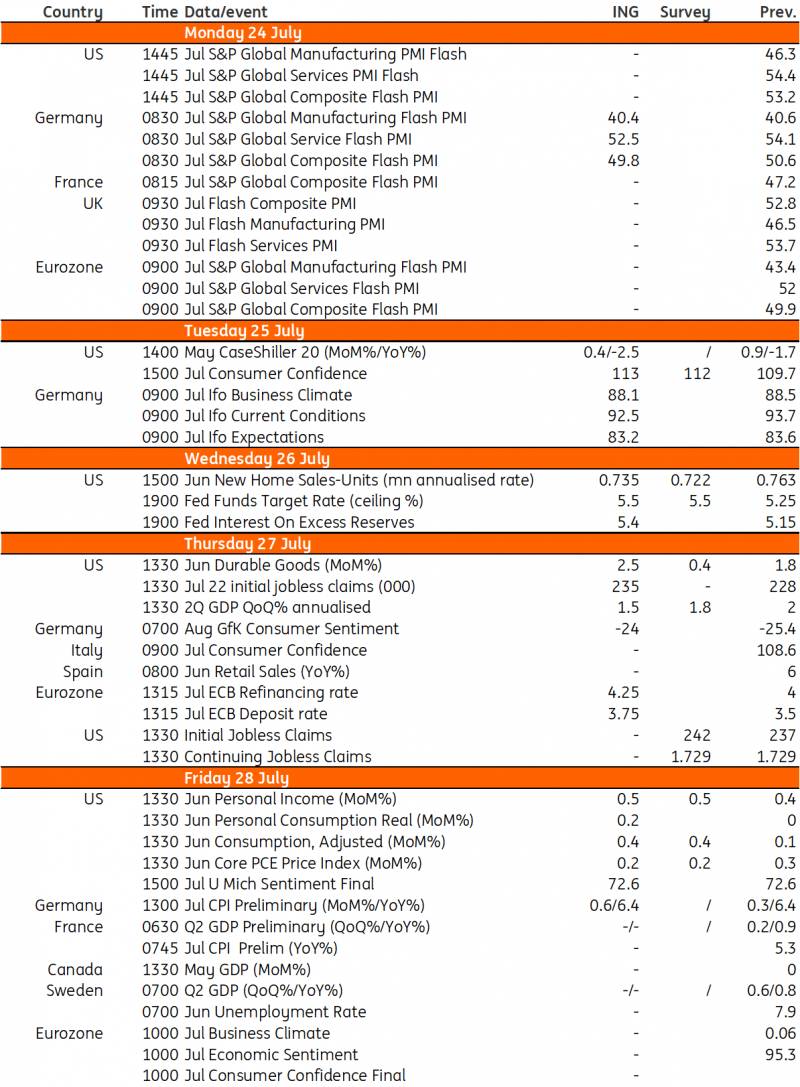

Macro Calendar: Key Events in Developed Markets

US: Fed to Hike

After 15 months and 10 consecutive rate rises, the US central bank kept the Fed Funds target rate at 5.25-5.5% in June.

The central bank, however, sees this as more of a slowing down than a halt and has predicted two more rate increases for the second half of 2023.

Although inflation has fallen since then, the labour market tightness and overall economic activity have remained stable. As a result, the Fed will likely raise rates again on July 26.

This would push the target range for Fed funds to between 5.25 and 5.5%.

In the following news conference, markets expect officials to say that they are encouraged by recent inflation data but don't want to take any risks that may speed up price increases.

Investors also anticipate that the option for more policy tightening later in the year will be maintained.

The GDP growth rate in the second quarter will be the most interesting statistic. Consumer spending drove a robust 2% annualised growth rate in the first quarter. Second-quarter growth is expected to fall to around 1.5%, with inventories being the primary driver of the slowdown.

Meanwhile, strong numbers from Boeing, which got 304 aircraft orders in June, up from May's 69, might boost durable goods orders.

Since the ISM manufacturing new orders series has been in the contraction zone for the previous 10 months, the data will be weaker in sectors outside of transportation. The core personal consumption expenditure deflator, the Fed's preferred inflation indicator, will also be released in June.

Like the CPI data, markets anticipate a strong deceleration as additional indicators suggest deflation.

Eurozone: ECB to Hike Too

This week will be marked by the Fed and European Central Bank (ECB) policy-setting meetings.

The market expects both central banks to raise their main interest rates by 25 basis points. Thus, market movement is increasingly dependent on signals sent for future meetings.

The ECB has been sending signals that a rate rise in September is still on the table, and our analysts expect the ECB to raise rates again after July. Whether or whether this increase will occur in September is less certain, but the market still expects the depo rate to hit 4% this year.

The Fed and the ECB are not expected to announce a halt to their tightening cycles. Still, markets will pay more attention to the nuanced discussions about the relative risks to the central banks' forecasts.

The level of resolve that policymakers may like to communicate may nonetheless be affected by a few pieces of information, particularly those about the ECB.

On Monday, we'll get our hands on the flash PMIs.

On Tuesday, investors will track how well ECB policy is being transmitted thanks to the central bank's quarterly bank lending survey.

We won't receive additional inflation numbers until after the meetings are over.

On Friday, France and Germany will release their preliminary July inflation estimates.

The second quarter GDP data was released the day before, and on the same day, we will receive the June core PCE deflator, the Fed's preferred inflation indicator.

Asia Week Ahead: Key Central Bank Meetings

It's possible that the Bank of Japan vote will be tight, while Bank Indonesia is expected to prolong its hold.

Meanwhile, GDP data from Korea and inflation data from Singapore are set to be released.

Macro Calendar: Key Events in Asia

Australia: Consumer Price Index Crucial for RBA

On Wednesday, Australia will unveil its CPI for the second quarter. The Reserve Bank of Australia (RBA) is considering raising interest rates again in the second half of the year, but they want to know how the inflation forecast is shaping up first.

Despite the recent run of tightening, the improvement in the employment market may indicate sustained economic growth.

So, the second-quarter CPI is expected to be stable but lower than the first-quarter CPI.

Taiwan: Manufacturing Output to Fall

In light of China's weak second-quarter results, industrial production in export-dependent Taiwan is anticipated to have declined last month.

The manufacture of semiconductors is crucial to Taiwan's overall economic success.

According to a recent estimate by TrendForce, annual sales for foundries worldwide would fall by 4% in 2023, with several big companies seeing no meaningful uptick in orders.

South Korea: GDP to Rise

GDP growth in Korea is forecast to go up in the second quarter, from the first quarter's 0.3% to 0.5% quarter-on-quarter after seasonal adjustments.

On the heels of a steep drop in imports and with private consumption growth likely holding steady, it is probable that the increase in net export contributions drove total growth.

Construction and service activity fell in June, suggesting further softness in monthly activity figures.

Japan: The Bank of Japan meeting is Too Close to Call

The recent fluctuations in the FX and Japanese government bond markets reflect market expectations for policy adjustment ahead of Friday's Bank of Japan meeting (BoJ) meeting.

Recent data suggest a stable inflation increase and a durable economic recovery, so it's near, but markets still believe some yield curve control (YCC) modifications are feasible.

Indonesia: Predicted BI Delay

Bank Indonesia (BI) plans to maintain its current stance, with interest rates remaining at 5.75%.

Governor Perry Warjiyo may be persuaded to maintain rates unchanged, although inflation has returned to target due to recent pressure on the Indonesian rupiah (IDR).

BI will wait until the IDR stabilises before deciding whether to decrease rates.

Singapore: Deflation Expected

Singapore's headline and core inflation rates may fall due to favourable base effects and decreasing commodity prices.

As measured by the headline and core measures, inflation may gradually decrease to 4.6% YoY.

When it meets later this year, the Singaporean central bank will consider the positive GDP growth surprise and the brightening pricing outlook.

BLOCK BUSINESS INSIGHTS

More Cheer for Cryptos as SEC Accepts Bitcoin ETF Applications

Are Small Banks the Only Options as Partners for Crypto Firms?

G20 Regulator's Crypto Rules to Avoid "Too Big to Fail" Scenario

Crypto, the Way Forward: Global Hedge Fund Report

FEATURED & EDITORS' PICKS

A Bit of a Meet-up: Asia's First-Ever Bitcoin Ordinals Summit

Malaysia Minute: Chainalysis Finds its Way in the Land of Crypto Scams

Crypto Revolution in Myanmar: Shadow Government Unveils Blockchain Bank

BEYOND THE ARTICLES

Aussie Bitcoin-Slinger Goes Big in Singapore: IR's Decade-Long Crypto Ride

Blockcast 31: New Products at EthCC: UniswapX, Lens V2, Chainlink CCIP & More