Table of Contents

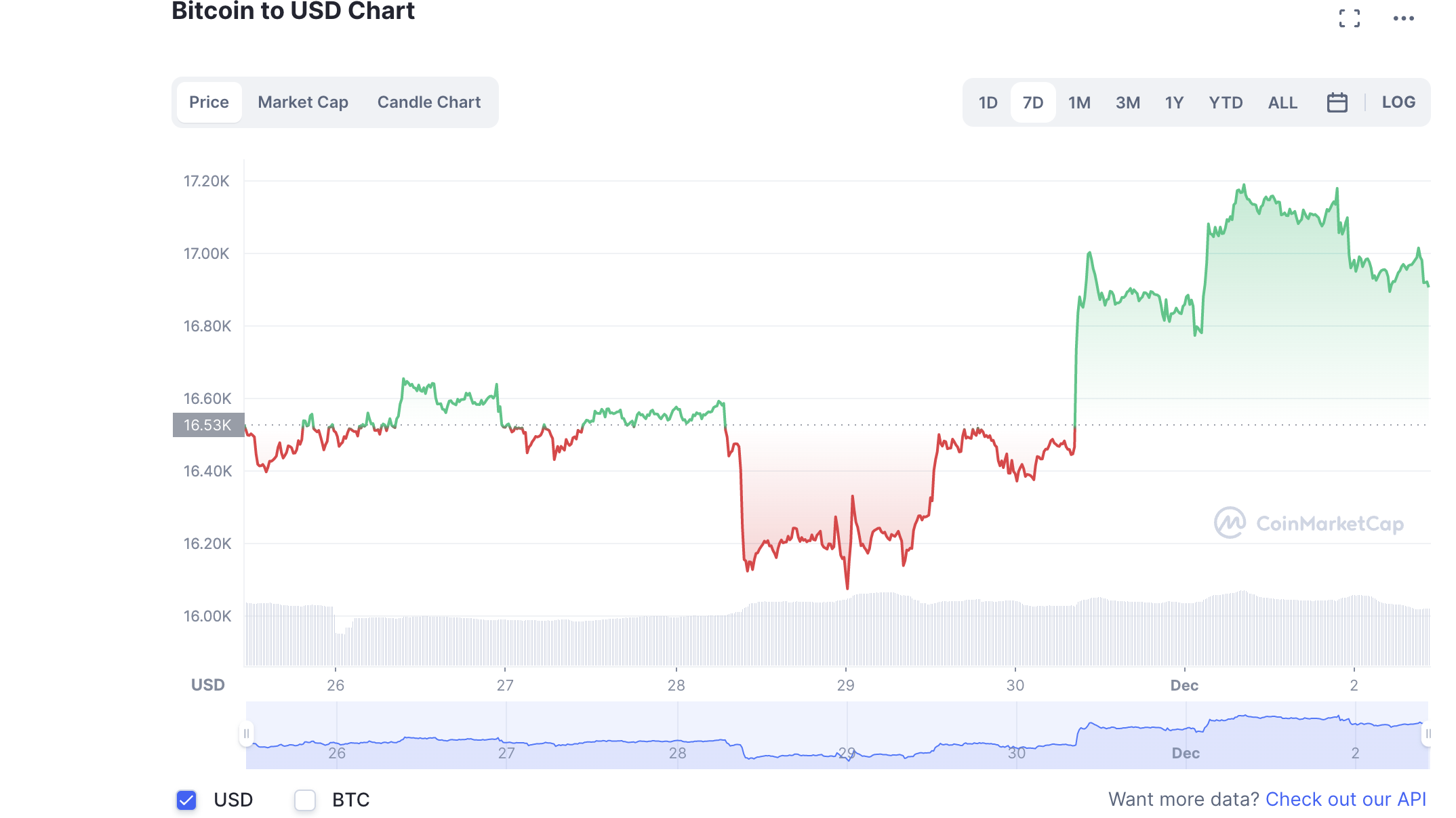

Bitcoin and other cryptocurrencies posted slight gains throughout the week despite news of BlockFi‘s Chapter 11 bankruptcy, with the world’s largest cryptocurrency surpassing the US$17,000 level before paring gains.

At the time of writing, Bitcoin (BTC) is trading at US$16,904.57 (-1.41%) while Ethereum (ETH) is trading at US$1,272.34 (-1.21%). Major altcoins such as BNB, Avalanche (AVAX) and Polkadot (DOT) have also been trading in red within the same period.

The broader financial markets continue to be some what encouraged by the US Federal Reserve’s intention to slow future rate hikes, with the Dow Jones Industrial Average climbing 20% since its September low. However, what seemed to be a hopeful rally has fizzled out ahead of today’s labour market report, as investors continue to seek assurance that inflation is really easing. It’s also unlikely that the crypto markets will see a sustained rally in the coming months, as the full extent of the damage caused by FTX’s demise remains unclear.

On that note, crypto’s man of the hour Sam Bankman-Fried has emerged from the shadows (maybe just his gaming chair), with the former billionaire CEO turned crypto runaway speaking to a number of media outlets about FTX’s spectacular collapse.

In recent days, Bankman-Fried spoke to crypto whistleblower Tiffany Fong, the New York Times, and IBC group founder Mario Nawfal, covering a range of topics including how Alameda allegedly dipped into FTX users’ funds to finance its own trading, and whether he felt remorseful for the whole fiasco. Our favourite SBF quote from these interviews remain: “sh*t’s complicated… it is what it is”.

Read more: “It Is What It Is”: SBF Opens Up About FTX Debacle

Huobi and Poloneix finally admit partnership

Crypto exchanges Huobi and Poloneix on Wednesday announced a “strategic partnership”, despite reports of their potential merger being previously denied by Huobi.

According to a press release, both exchanges will “progressively cooperate” on Huobi’s HT coin ecosystem development, connectivity, liquidity sharing, and global compliance. Starting from this month, the Huobi Advisory Board will also evaluate all projects on Poloniex on a monthly basis.

In an emailed statement last week, Huobi said: “We would like to state for the record that rumours stating Huobi will soon merge with Poloniex are categorically untrue. It also maintained that the two entities were “operating independently now”.

Last month, Tron founder Justin Sun denied claims that he was the buyer of Huobi, and said he is only an advisor to the exchange, despite being a core investor of the Hong Kong-based investment company About Capital Management which purchased Huobi Global.

Kraken cuts 30% of workforce

Another crypto firm has succumbed to the winter chill. On Wednesday, crypto exchange Kraken announced that it will be cutting down its global workforce by 30%, in a bid to survive the ongoing crypto winter.

According to Kraken CEO Jesse Powell, the company initially tripled its workforce due to the booming crypto ecosystem during the bull market, but the current job cuts means that the company’s headcount will return to where it was 12 months ago.

In June, at the start of the current crypto winter, Coinbase extended its hiring freeze and rescinded several job offers already accepted by prospective workers, citing “current market conditions and ongoing business prioritisation efforts”.

North Korean hackers also “victims” of FTX

According to Troy Stangarone, senior director at the Korea Economic Institute of America (KEI), the FTX collapse will make it more difficult for North Korean hackers to steal cryptocurrencies as exchanges are set to beef up security. Regulators are also expected to heavily scrutinise the industry, and the decline in cryptocurrency prices will also make hacks less profitable.

According to Reuters, who cited a confidential United Nations report, North Korea has been using profits from its hacks on crypto exchanges to fund its missile programs. In September, blockchain analytics firm Chainalysis reported that North Korean hackers was responsible for the theft of roughly US$1 billion worth of cryptocurrencies from DeFi protocols in the first two quarters of 2022.

Trading Volume

According to data from CoinMarkerCap, the global crypto market cap stands at US$850.61 billion, a 1.22% decrease since yesterday. The total crypto market volume over the last 24 hours is US$42.83 billion, a 12.15% decrease.

Fear & Greed Index

Risk appetites are sapped – the Crypto Fear and Greed Index currently stands at 29, indicating “ fear” – a sign that investors are still skittish. The index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

Sentiment climbed to reach 40 on 6 November, but it has remained in the low to mid 20s for the past month.