Table of Contents

Bitcoin and other cryptocurrencies continued to trade sideways throughout the weekend, with the world’s largest cryptocurrency barely hovering above its familiar US$16,000 perch for now.

At the time of writing, Bitcoin (BTC) is trading at US$16,144.22 (-2.21%) while Ethereum (ETH) is trading at US$1,165.25 (-4.01%). Major altcoins such as Solana (SOL), Avalanche (AVAX), and Polkadot (DOT) have also been trading in red within the same period.

Over to the meme side of crypto (essentially what the entire industry is right now), Dogecoin has become an unlikely outperformer, with the popular Elon Musk-fuelled coin climbing by nearly 25% since last week. At the time of writing, DOGE is trading at US$0.095, and is enjoying quite the “Santa Claus rally” despite the downcast mood in the overall crypto markets.

Elsewhere, data from blockchain analytics firm Arkham suggests that cryptocurrency trading firm Alameda Research, FTX’s sister company, withdrew US$204 million in a variety of crypto assets from eight different addresses of FTX US just days before its eventual collapse on November 6th.

According to Arkham, US$116 million (57.1% of the withdrawals) were in stablecoins pegged to the US dollar, including USDT, USDC, BUSD, and TUSD. US$49.49 million (24.2% of the withdrawals) of the funds was in ETH, and US$38.06 million (18.7% of the withdrawals) was in Wrapped Bitcoin (wBTC).

Huobi denies Poloniex merge rumours

Seychelles-based crypto exchange Huobi has denied rumours of a potential merge with fellow exchange Poloniex.

“We would like to state for the record that rumors stating Huobi will soon merge with Poloniex are categorically untrue,” Huobi said in an emailed statement, adding that the two entities are “operating independently now”.

Earlier today, crypto reporter Colin Wu tweeted that Poloniex will merge with Huobi, citing sources familiar with the matter. However, Justin Sun, who has ties to both Huobi and Poloniex, told media outlets that the two companies are independent and “haven’t had any plan to merge yet.” However, Sun also said that a deal “could be” possible in the future.

Related: Tron Founder Justin Sun on the Emerging Trends, Challenges, and Opportunities Shaping Crypto

Last month, Sun denied claims that he was the buyer of Huobi, and said he is only an advisor to the exchange, despite being a core investor of the Hong Kong-based investment company About Capital Management which purchased Huobi Global.

According to data from The Block, Huobi is currently the fourth-largest crypto-only exchange by volume, while Poloniex is the sixth-largest. Last month, Huobi had a trading volume of about US$16 billion while Poloniex recorded around US$1 billion.

Amber Group co-founder passes away

Former Morgan Stanley trader and co-founder of crypto firm Amber Group Tiantian Kullander has passed in his sleep on November 23 at the age of 30, according to the company website.

Kullander co-founded Amber Group in 2015 alongside Michael Wu, Wayne Huo, Tony He, and Thomas Zhu. Prior to this, Kullander worked in structured credit trading at Goldman Sachs and as an emerging markets trader at Morgan Stanley.

According to Amber Group, Kullander also sat on the Board of Fnatic and founded KeeperDAO.

US state regulators launch investigation into Genesis

According to a report by Barron’s, several US state regulators are looking into whether crypto trading firm Genesis Global Capital may have violated securities laws.

The report mentioned that state regulators, including the Alabama State Securities Commission, are investigating whether Genesis persuaded residents of their states to invest in crypto securities without having the proper registrations.

Read more: GIC Predicts “Volatility” From Genesis Exposure

Genesis Global Capital is believed to tethering on the edge of bankruptcy, despite the firm clarifying on November 22 that it has no plans to “file bankruptcy imminently”.

Howevere, according to a New York Times article that cited three people familiar with situation, Genesis has hired investment bank Moelis & Company to explore options including a potential bankruptcy. Earlier this month, the company informed its clients that it would halting withdrawals due to liquidity issues as a result of FTX’s collapse.

Matrixport seeks US$100 million funding

Matrixport, one of Asia’s largest crypto lenders, is seeking to raise US$100 million despite the current market downturn, according to a Bloomberg report on Friday which cited anonymous sources.

The new funding, if successful, would value the Singapore-based firm at US$1.5 billion, an increase from its current valuation of over US$1 billion achieved during its Series C funding round in August 2021.

“Matrixport routinely engages with key stakeholders, including investors, as part of its normal course of business. Plans to seek funding were already in place before the onset of the bear market which has meant a longer engagement cycle,” Ross Gan, head of public relations at Matrixport, told Blockhead.

“The funding commitments to date represent the confidence in our ability to capture new opportunities with recent industry developments. We’re excited and look forward to engaging on similar terms with participants in the other half of the funding round,” he added.

According to Matrixport, which holds licenses in Hong Kong and Switzerland, it currently counts more than US$5 billion in average monthly trading volumes and has US$10 billion in assets under management and custody along with US$700 million in outstanding loans.

Trading Volume

According to data from CoinMarketCap, the global crypto market cap stands at US$816.33 billion, a 2.71% decrease since yesterday. The total crypto market volume over the last 24 hours is US$43.63 billion, a 28.23% increase.

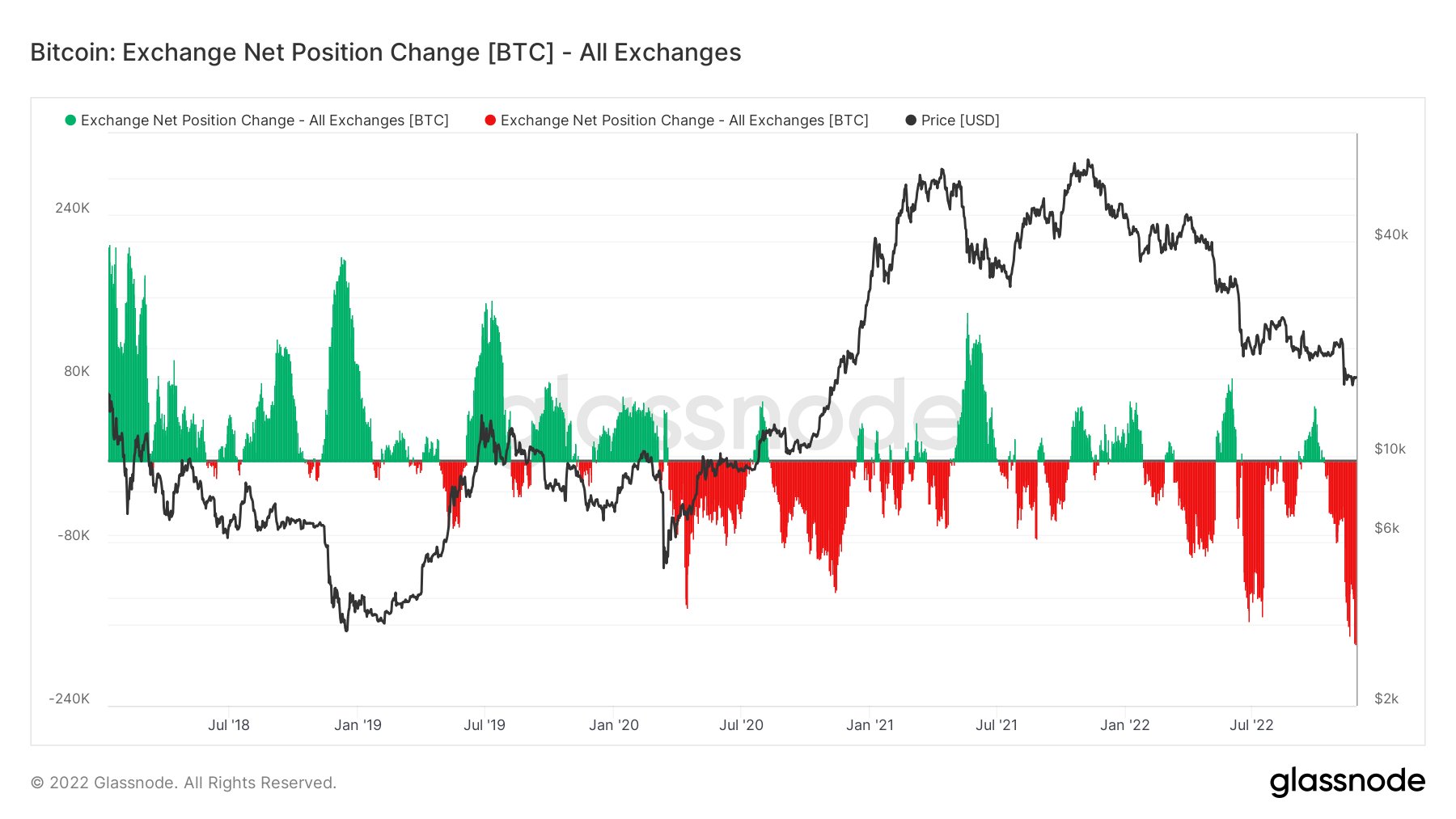

Meanwhile, data from leading analytics firm Glassnode indicates that there is a mass exodus of BTC from crypto exchanges, as more investors rush to self-custody their coins in light of the FTX bankruptcy.

Glassnode’s Bitcoin exchange net position change metric, which tracks the 30-day supply held in exchange wallets, reveals that 179,250 BTC (approximately US$2.8 billion) has flowed out of centralised exchanges in the last month. The current rate of BTC leaving crypto exchanges is believed to be at its highest in over 4 years.

Fear & Greed Index

Risk appetites are sapped – the Crypto Fear and Greed Index currently stands at 28, indicating “ fear” – a sign that investors are still skittish. The index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

Sentiment climbed to reach 40 on 6 November, but it has remained in the low to mid 20s for the past three weeks.