Table of Contents

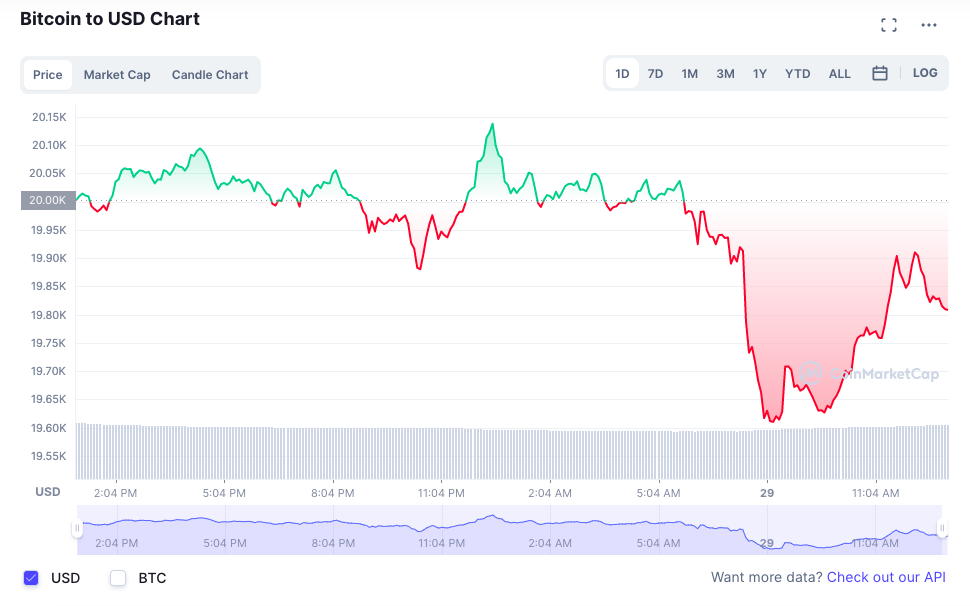

Bitcoin and other cryptocurrencies slumped over the weekend following Jerome Powell’s hawkish remarks, with the world’s largest cryptocurrency slipping below US$20,000 for the first time in a month.

At the time of writing, Bitcoin (BTC) is trading at US$19,811.92 (-0.95%) while Ethereum (ETH) is trading at US$1,452.14 (-2.45%). Major altcoins such as Solana (SOL), Avalanche (AVAX), and Polkadot (DOT) have also been trading in red over the weekend.

On Friday, Powell said that the Federal Reserve will continue to raise rates to curb inflation, and that will likely “bring some pain to households and businesses.” He also added that the Federal Reserve has an “overarching focus right now to bring inflation back down to our 2% goal”.

Investors are now increasingly concerned that a recession is incoming, with US senator Elizabeth Warren adding fuel to the fire by slamming Powell’s comments and adding that she is “very worried that the fed will tip this economy into a recession”.

NFT market primed for growth in Malaysia

Blockhead Malaysia’s editor attended M1nted Asia in Kuala Lumpur, Malaysia and returned with some insights about the country’s growing appetite for NFTs:

- NFT adoption is peaking, however it is likely that it will reach a plateau. A breakthrough state will also be attained once there is a clear regulatory framework.

- NFTs seems to be the easiest method of web3 adoption as compared to DeFi as it’s easier to apply NFTs into building projects. However, the level of knowledge of web3 among the general populace is still relatively low.

- There is outreach from students, artists, musicians and other creators who want to enter the NFT market. The space is undoubtedly being observed, but the talent churn is yet to be determined.

- Foreign talent are coming into Malaysia to build DeFi projects and zero-to-one models. Seasoned Malaysian entrepreneurs (approximately 1-3% of the market) are also hiring global talent to make their mark on the space.

Read more: Blockhead Scopes Out M1nted Asia’s Showcase of Malaysian NFT Projects

For more Malaysia-focused news and insights, join the Blockhead Malaysia Telegram group.

3AC’s Su Zhu accuses liquidator of false representations

According to a Bloomberg report, Three Arrows Capital co-founder Su Zhu has alleged that Teneo, the embattled crypto hedge fund’s liquidator, made “inaccurate and misleading” representations to the High Court of Singapore.

In an affidavit delivered August 19 in Bangkok, Zhu argued that Teneo misled the High Court of Singapore about the hedge fund’s complex corporate structure, and “had not provided an entirely complete or accurate version of events” to the court.

“Su Zhu’s affidavit was made in support of an application by Three Arrows Capital’s former investment manager seeking to set aside orders made by the Singapore court requiring relevant parties in Singapore to cooperate with the liquidators in the sharing of information relating to the affairs and assets of Three Arrows Capital,” Teneo said in response.

The High Court of Singapore granted permission for Teneo to probe the local assets of Three Arrows Capital this week, which means that it recognises the liquidation order originally filed in the BVI (British Virgin Islands).

Thai billionaire doubles down on blockchain tech

Sarath Ratanavadi, Thailand’s second-richest man, is doubling down on his digital-asset plans despite an increase in regulatory crackdowns on the crypto industry in Thailand.

Ratanavadi, who is the chief executive officer of Gulf Energy Development, said his company will increase investments in blockchain projects in order to create additional earnings sources.

Read more: Regulatory Issues Scuppers SCB’s Takeover of Thai Exchange Bitkub

According to Ratanavadi, blockchain-based platforms and cryptocurrencies will be “key drivers for the company’s strongest returns” as the overall market remains robust and has “high potential” for growth, he said. He also added that the company plans to open a crypto exchange in Thailand in partnership with Binance.

Japan tackles crypto brain drain

The Japanese government has proposed a 20% tax on income tax on cryptocurrency gains earned by individual investors, with an alternative to carry forward losses for the next three years from the next year. The move will likely provide relief to digital asset investors in Japan as the tax rate is currently 55%.

The country has been experiencing a brain drain within the crypto industry, with many crypto-baed businesses and startups setting up shop in Singapore and the UAE instead.

Trading Volume

The global crypto market cap stands at US$955.00 billion, a 1.27% decrease since yesterday. The total crypto market volume over the last 24 hours is US$54.49 billion, which makes a 16.09% decrease.

Fear & Greed Index

Risk appetites are sapped – the Crypto Fear and Greed Index currently stands at 24 indicating extreme fear, and significantly down from last Monday, when it hit 29 (fear). The index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.