Table of Contents

Bitcoin and other cryptocurrencies enjoyed decent gains throughout the week, with the world’s largest currency currently changing hands at US$22,955.55 after climbing 12% over the last 7 days.

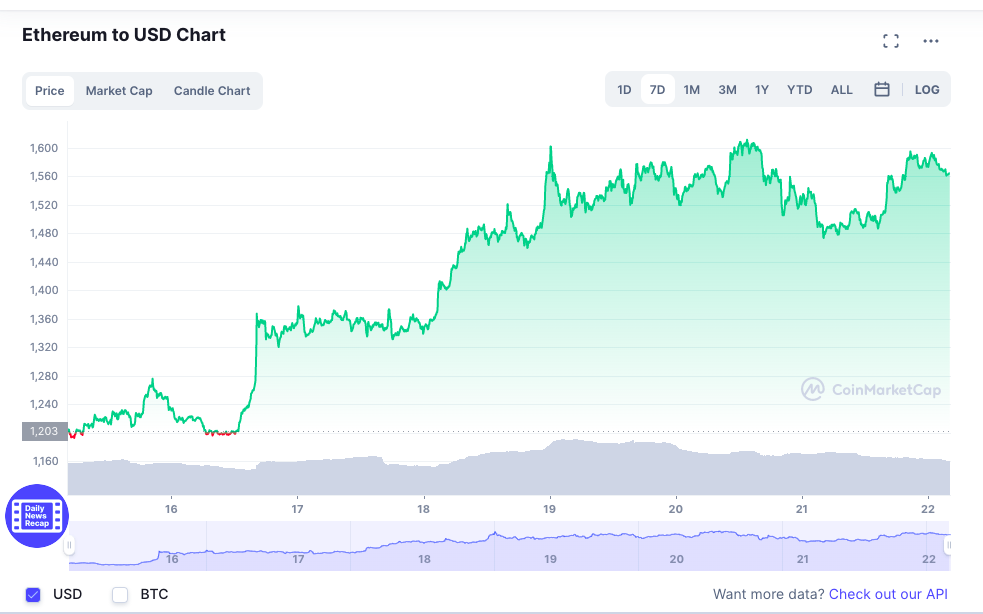

But it’s the sudden growth of Ethereum (ETH) that has turned heads. The coin has risen by more than 30% in the past week to reach US$1,562.81 at the time of writing, providing the beleaguered crypto space with some much-needed optimism.

The simple reason put across by most observers is this is due to news about Ethereum’s long-awaited “Merge”, which has now been given a tentative date of September 19. This shift will significantly improve the blockchain’s scalability and reduce the network’s overall carbon footprint.

But is Ethereum’s recent rally just a sentiment-driven one that driving a feedback loop of “buy the news”?

Read more: Ethereum’s Up 40% in a Week – What’s Going On?

JP Morgan has weighed in on the recent rally, with its analysts reiterating that crypto’s deleveraging cycle is already well-advanced.

“The extreme phase of backwardation seen in May and June, the most extreme since 2018, appears to be behind us,” the bank said, adding that demand has been largely driven by retail investors due to an increase in BTC and ETH balances in smaller wallets.

Diminishing fears of a recession may also have contributed to the market recovery. On Friday, the Federal Reserve officials indicated that they will likely proceed with a 75 bps rate hike instead of a full 100 bps hike at their July 26-27 meeting, despite data released earlier this week showing inflation had bloomed to an annual rate of 9.1% in June.

But can the Federal Reserve really cool inflation without a triggering a recession? Let’s wait and see.

3AC’s Deribit Exposure Could Be Overvalued

A dispute about the valuation of an indirect stake in crypto options exchange Deribit is playing out behind the scenes of the Three Arrows Capital (3AC) liquidation proceedings.

According to a leaked affidavit by Teneo, 3AC’s court-appointed liquidator, the embattled hedge fund’s remaining assets include shares of Grayscale Bitcoin Trust, cryptocurrencies like BTC, AVAX and NEAR, and shares of Deribit – which according to the court documents are valued at approximately US$500 million.

However, a source with knowledge of the matter has told media outlets that the value of 3AC’s remaining assets is overestimated, with the firm’s Deribit shares valued closer to US$25 million rather than US$500 million, which means that creditors might be left in the lurch.

Tesla’s $100M Bitcoin Loss Could Inspire More Institutional FUD

Even Elon is fed up with bitcoin. After months of bleakness in the crypto market, the Tesla CEO has decided to dump the majority of the company’s digital asset holdings.

In its Q2 2022 earnings report, Tesla revealed that it sold 75% of its BTC position, which added US$963 million in cash to its balance sheet.

Tesla had purchased the bitcoin for just over US$1.1 billion towards the start of last year, resulting in a loss of over US$100 million. Around US$300 million worth of BTC still sits on the company’s balance sheet.

On Tesla’s earnings call, Musk cited uncertainty surrounding lockdowns and COVID in China for the sale.

[UPDATED] Babel Exposure Might Have Caused Zipmex’s Downfall

Zipmex has announced that it will re-enable withdrawals and deposits later this evening. “We are extending our maintenance period and will re-enable withdrawals and deposits for your Trade Wallet on 21 July 2022 at 18:00 (GMT+7). Trading will remain disabled until further notice,” the firm tweeted.

The exchange had sent an email to customers on Wednesday, citing “volatile market conditions” and financial difficulties of key business partners.

According to a report by Coindesk, which cited two industry executives briefed on the matter, Zipmex’s difficulties link back to troubled crypto lender Babel Finance, which is staring down a nine-figure loss amid crashing crypto prices.

Trading Volume

According to data from CoinMarketCap, the global crypto market cap stands at US$1.05 trillion, a 1.33% increase since yesterday. The total crypto market volume over the last 24 hours is US$76.64 billion, a 18.62% decrease.

Fear & Greed Index

Risk appetites are still sapped – the Crypto Fear and Greed Index currently stands at 33, indicating fear. The index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

This is a stark improvement from last month, where the index fell to as low as 6 (extreme fear) in the wake of the Terra implosion. Finally some light at the end of the tunnel?