Table of Contents

A higher-than-expected CPI (consumer price index) number briefly sent shockwaves across the cryptocurrency markets on Wednesday, with the world’s largest cryptocurrency hitting a low of US$19,103 before paring losses.

At the time of writing, Bitcoin (BTC) is trading at US$20,708.69 (+2.14%) while Ethereum (ETH) is trading at US$1,210.35 (+9.01%). Major altcoins such as Solana (SOL), Avalanche (AVAX), and Polkadot (DOT) have been trading in green over the past 24 hours.

Analysts have previously indicated that crypto’s deleveraging cycle is already well advanced, with the market already pricing in high inflation number. This means that any significant downside might be curbed. However, a possible 75 bps rate hike in July could also trigger more sell-offs.

OpenSea cuts 20% of staff

NFT marketplace OpenSea is cutting about 20% of its staff, despite its announcement last month that it will continue “hiring across the board”.

“The reality is that we have entered an unprecedented combination of a crypto winter and broad macroeconomic instability, and we need to prepare the company for the possibility of a prolonged downturn,” chief executive Devin Finzer said in a statement on Twitter.

OpenSea joins a spate of crypto companies in reducing their headcount amid the bear market. Last month, BlockFi Inc said that it will reduce its staff by 20%, while the Singapore-based Crypto.com announced layoffs of about 260 staff, or 5% of its work force.

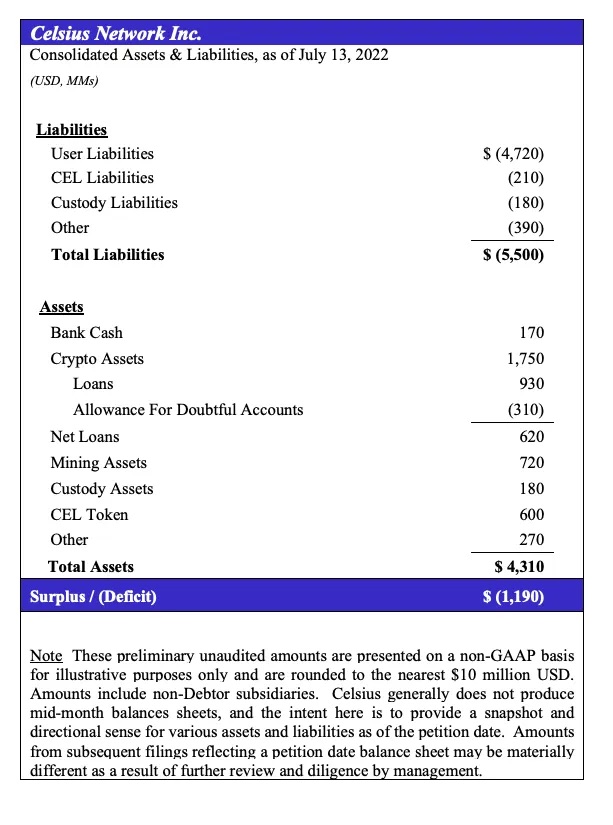

Celsius shortfall

Documents filed in embattled crypto lender Celsius’ chapter 11 bankruptcy, which it declared on Wednesday, have revealed a US$1.2 billion hole in its balance sheet

Documents filed on Thursday by CEO Alex Mashinsky and the company’s law firm Kirkland & Ellis have revealed that the firm has US$5.5 billion in total liabilities (what they owe to users and creditors) and US$4.3 billion in assets, which means that that they are “lacking” US$1.2 billion and is therefore insolvent.

Read more: Celsius Users = Rekt as Platform Joins Voyager in Chapter 11 Club

It was previously rumoured that the shortfall was the reason why cryptocurrency exchange FTX passed on a deal to acquire Celsius.

Blockchain.com Named as Latest 3AC Victim; DeFiance Capital Considers Legal Action

Trouble continues to brew for Three Arrows Capital (3AC) and those attached to it. In the most recent chapter of the 3AC debacle, cryptocurrency exchange Blockchain.com has been revealed as the latest player exposed to the crumbling crypto lender.

According to CoinDesk, Blockchain.com stands to lose US$270 million from lending to 3AC, whose offices remain empty as their founders’ whereabouts are still unknown.

Trading Volume

According to data from CoinMarketCap, the global crypto market cap stands at US$923.15 billion, a 2.44% increase since yesterday. The total crypto market volume over the last 24 hours is US$69.64B, a 4.66% decrease.

Fear & Greed Index

Risk appetites are still sapped – the Crypto Fear and Greed Index currently stands at 15, indicating extreme fear. The index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

The index has stayed at this level (extreme fear) for numerous weeks now, and it seems like it will remain at this level for some time to come as investors grow skittish over a looming recession.