Table of Contents

TerraUSD (UST) briefly depegged from the US dollar over the weekend, after the UST-3CRV pool became significantly imbalanced, causing the stablecoin to plunge into freefall. DeFi total value locked fell by 6.7% over the weekend.

Market participants have since reacted drastically, making large movements that could result in unsettling consequences.

On Saturday, UST fell to US$0.987 before bouncing back, whilst its sister token Luna dropped 10% to touch US$60. Although this is not the first time one of the crypto economy’s biggest stablecoins has depegged, it did mark the first depeg since the Luna Foundation’s pledge to significantly increase its Bitcoin and Avalanche reserves.

Co-founder Do Kwon had recently said Terra would accumulate $10 billion worth of Bitcoin (BTC) to add to its reserves.

Read More: Luna Surges as Terra’s UST Becomes Third-Largest Stablecoin

According to CoinDesk, Saturday’s chaos was triggered by a series of major withdrawals from the Anchor Protocol, causing the lending platforms’s UST deposits to fall from US$14 billion to US$11.2 billion.

DeFi protocol Curve also saw significant UST withdrawals from liquidity pools, including a US$150 million withdrawals from Terraform Labs (TFL).

Almost US$3 billion was wiped out of the Terra ecosystem over the weekend, marking one of its largest outflows ever.

“Amusing morning”

Amid the anarchy, Do Kwon surfaced on Twitter in an attempt to calm the chaos. “I’m up—amusing morning… Anon, you could listen to CT influensooors about UST depegging for the 69th time… Or you could remember they’re all now poor, and go for a run instead… Wyd,” he tweeted.

I’m up – amusing morning

— Do Kwon 🌕 (@stablekwon) May 7, 2022

Anon, you could listen to CT influensooors about UST depegging for the 69th time

Or you could remember they’re all now poor, and go for a run instead

Wyd

“if yall girls are gonna fud, try to do it during my waking hours pls,” he added.

Do Kwon’s emergence and reassuring comments (sexist as they might be) helped UST to recover slightly, but market players took it into their own hands to restablise the ecosystem.

Restabalising the stablecoin

Shortly after Do Kwon’s tweets, the market saw drastic trades from UST backers in an attempt to strengthen the stablecoin.

One wallet began swapping 1,000 ETH to USDT to UST every few minutes. The address has swapped over 60,000 ETH since, accumulating over US$100 million in UST.

Some believe the account belongs to Jump Crypto, which has strong ties to Terra. Jump previously helped refund a US$320 million exploit of Solana’s Wormhole.

Another account deposited US$250 million in USDC to remove UST from the pool.

2 main addresses to support the UST peg (on-chain) have now spent a combined ~$400m to do so.

— mhonkasalo (@mhonkasalo) May 8, 2022

Hero #1 swapped ~60,000 ETH to UST 8 hours ago:https://t.co/BCcJiuKiHH

Hero #2 deposited 250m USDC to remove UST from the pool in the past 2 hours:https://t.co/8eA0ibCNl5

Contagion

Because UST is the mother of all algorithmic stablecoins, its survival is integral to the crypto economy. It is thereby in everyone’s best interest to keep UST alive. In order to do so, actors such as the aforementioned wallet are incentivised to buy UST to restore it.

If worst comes to the worst, whales will behave in the same way as the wallet above – i.e. sell millions if not billions of Ethereum to prop up the Terra ecosystem – effectively sinking the price of Ethereum.

Terra could also bite into their Bitcoin reserves that Do Kwon harped on about earlier this year.

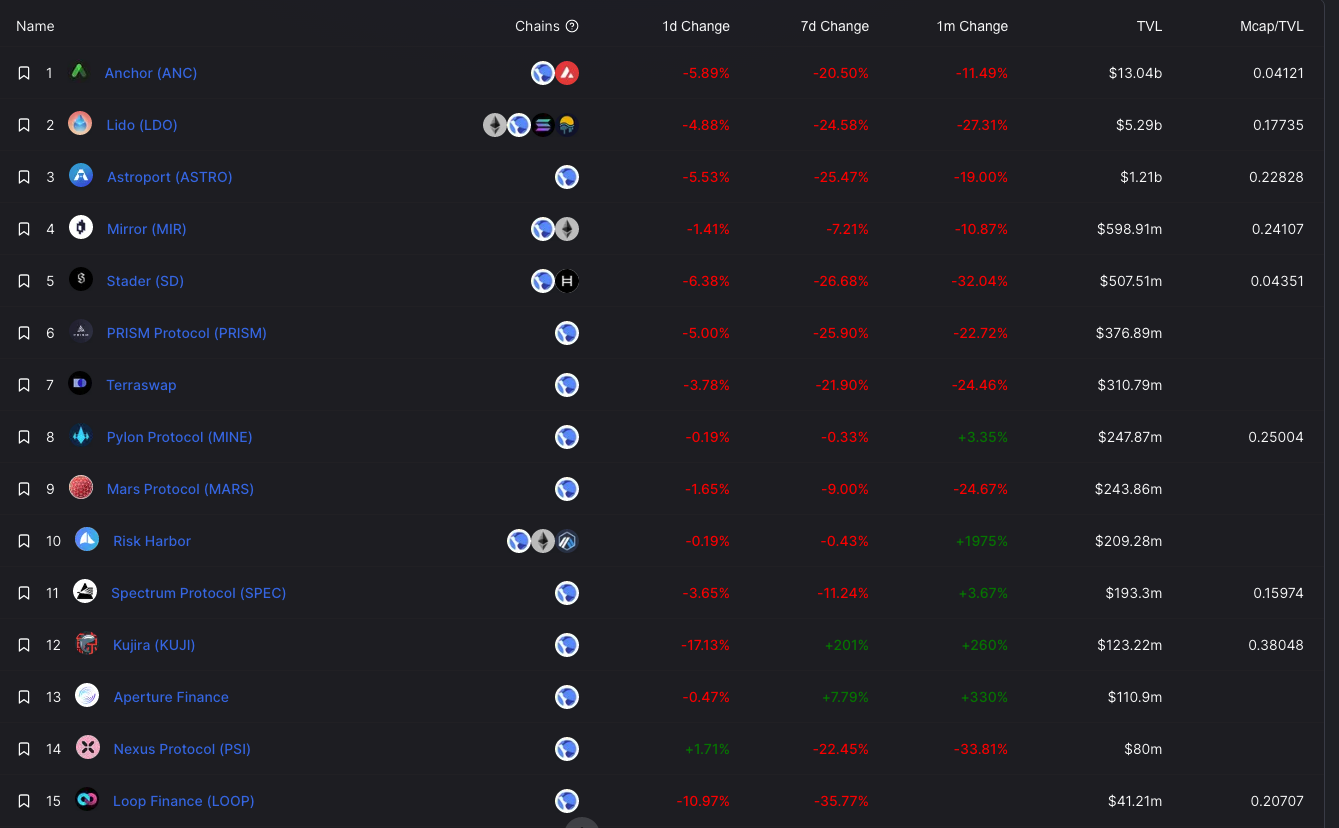

Worse still, the selling might not be over yet. According to Defi Llama, all of Terra’s biggest protocols have fallen drastically.

If whales and/or firms heavily reliant on UST’s survival join in the battle to keep the stablecoin stable, Ethereum and Bitcoin will suffer. If Ethereum and Bitcoin suffer, the entire crypto market will feel the shockwaves.

At the time of writing Ethereum and Bitcoin are at their lowest price ranges of 2022 at US$2,471 and US$33,755 respectively.