Table of Contents

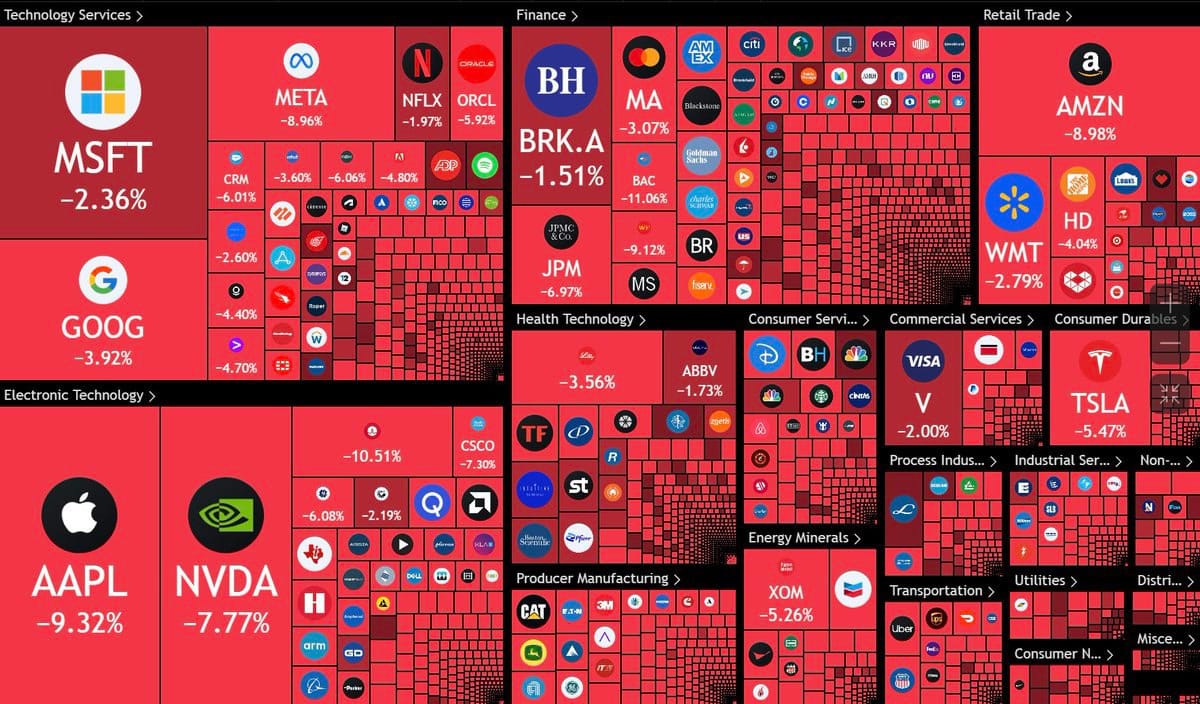

The crypto market braces for uncertainty in sentiment, as does every asset class, due to the effects of US President Donald Trump's global trade wars amid huge and scandalous reciprocal tariffs on the entire world.

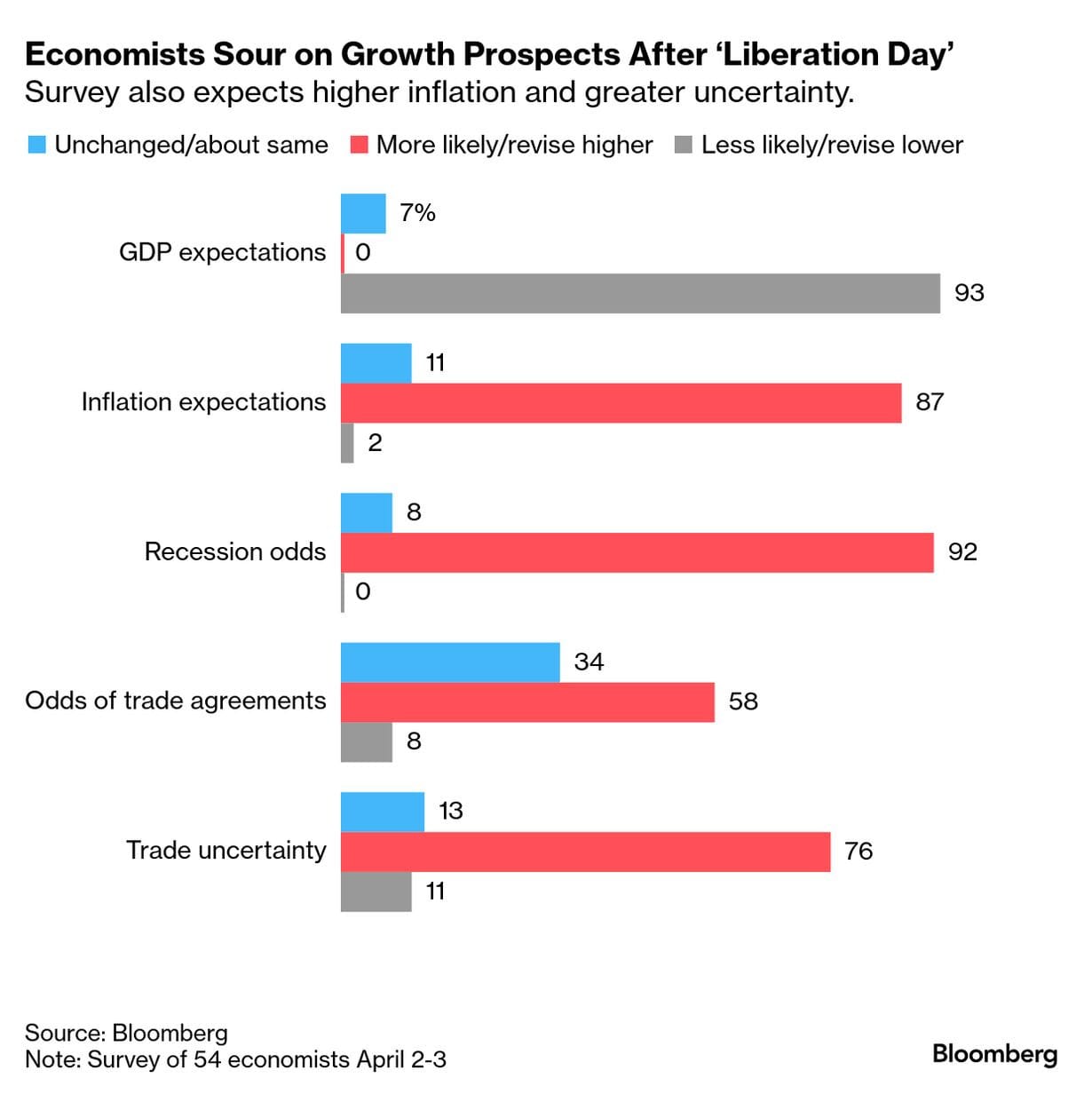

Compared to a week earlier, 92% of economists polled by Bloomberg agreed that Trump's tariff plan increases the likelihood of a US recession.

The fear of a recession is quickly becoming the consensus.

JP Morgan gives a 60% chance, a bet that high has not been seen since the financial crisis of 2008, after Lehman's collapse.

On Polymarket, a crypto-based prediction platform, the odds of a US recession in 2025 surged to a new high of 62%.

That number was under 40% just a few days ago.

For crypto markets, a recession warning is offset by investor pullback from stocks to digital assets from a pro-administration's policies.

Still, for broader markets, recession bets are fueling more selloffs.

Jim Cramer, the host of CNBC's Mad Money, expressed his thoughts without holding back. He said, "This is a man-made obliteration."

During Friday's show, he warned viewers that the setup eerily resembles the three-day decline leading into the 1987 crash, and he added, "We'll know by Monday."

Billionaire investor Bill Ackman echoed those sentiments and, on X, noted that he wouldn't be surprised to see a presidential announcement on Monday delaying the tariffs.

In addition, he warned, "The risk of not doing so is that the massive increase in uncertainty drives the economy into a recession, potentially a severe one."

One would have to imagine that President @realDonaldTrump’s phone has been ringing off the hook. The practical reality is that there is insufficient time for him to make deals before the tariffs are scheduled to take effect.

— Bill Ackman (@BillAckman) April 5, 2025

I would therefore not be surprised to wake up Monday…

A Little History

The "move fast and break things" mentality that underpins "Trumponomics" has, among other things, introduced risky levels of uncertainty into the world's financial markets.

But the doubt that Trump is sowing isn't fresh, and it's also not going anywhere.

Modern economic stability is eroding at its predictable foundations. In today's world, the economy is always unpredictable. Soak it up.

The backdrop is not unfamiliar at this point.

We have just experienced a decade of enormous economic upheaval, including a pandemic, trade conflicts, and the return of populism, which has revived and, more recently, muddled real-war geopolitics.

In the wake of existential concerns raised by climate change and artificial intelligence, we are also confronting the dissolution of a decades-old order.

Eventually, this current wave of uncertainty will fade away.

However, as we can see from the past, eras of uncertainty tend to build upon one another.

The Great Depression was exacerbated and prolonged by the Smoot-Hawley tariffs of 1930, which collapsed world trade and negatively impacted German exports.

According to William Shirer's "The Rise and Fall of the Third Reich," that factored toward the depression that allowed Adolf Hitler to overcome a poor start in German politics.

The thought of bringing that past situation into the present day is terrifying.

However, it serves as a timely reminder that the true mystery surrounding this week's events lies in the effects of Trump's tariffs on American and global economies and their potential effects on American strength and influence abroad.

One obvious consequence is the recent upsurge in anti-Americanism in countries like Canada. Instead of stabilizing the world's biggest economy, what if it starts to wobble?

Is China going to step in?

Can anybody?

Each shock will be more difficult to traverse due to the interregnum between global orders and epochal issues such as climate change and artificial intelligence.

A world-saving committee, if one exists, is likely operating in secret.

It is difficult to predict who will spearhead the rescue effort the moment a financial market slump turns into a crash and triggers a severe and protracted economic catastrophe.

Elsewhere