Table of Contents

- Top Stories (In No Particular Order)

- XRP Soars While Market Falters - Here's Why

- SEC Predictably Appeals Ripple Ruling, XRP Continues to Surge

- SEC Delays Bitwise 10 Crypto Index ETF Decision By Almost Two Months

- Malaysia PM Chats to Changpeng Zhao About Introducing Crypto Legislation

- Thailand Considers First Local Bitcoin ETF Approval

- Litecoin Price Surges Amid Growing Speculation of Imminent ETF Approval

- VanEck Files Onchain Economy ETF Application With SEC

- CFTC Considers Crypto.com Probe for Super Bowl Bets

- HKMA Launches Supervisory Incubator for Responsible Adoption of DLT in Banking

- Sony Debuts Singapore-Based Public Blockchain Platform Soneium

- Sygnum Nets $58 Million in Funding, Achieves Unicorn Status

- Events

- It's All Happening on LinkedIn

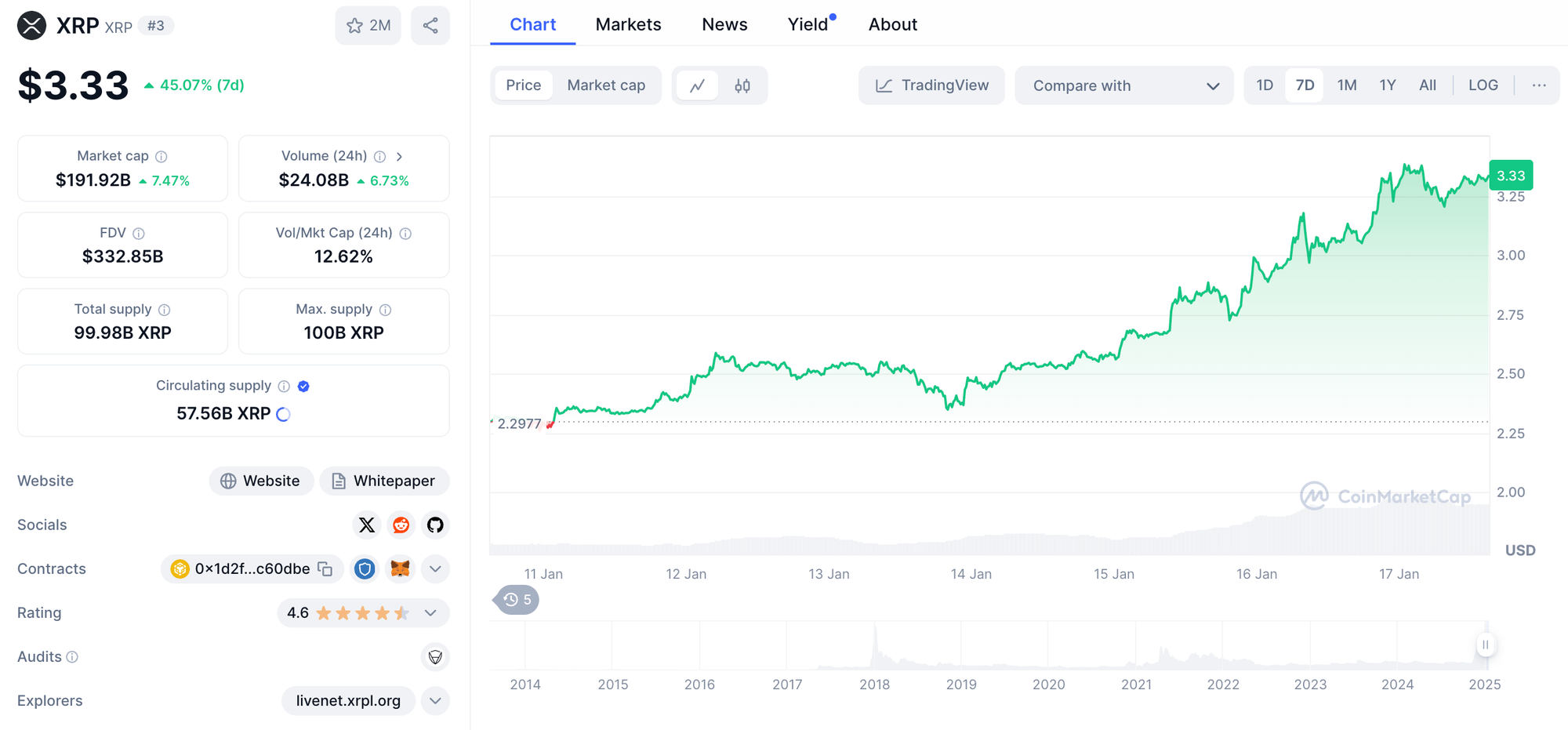

As weeks go, it's been a rather mild and uneventful one in crypto... Unless you're one of the rare XRP holders out there. While the industry was busy pitching Solana against Ethereum while rejoicing in Bitcoin surpassing $100K, XRP stealthily emerged from the shadows and is now the third largest cryptocurrency by market cap.

Almost feeling like a memecoin moment, the Ripple-associated (but actually not associated) coin has been enjoing its time in the spotlight to the fullest, suprassing its all-time high and muscling the likes of Tether and Solana out of the Top Three spot.

Up over 44% this week alone, XRP has more than cleared its 2018 high of $2.70, now comfortably sitting at over $3.30.

XRP's rally is even more impressive considering the US Securities and Exchange Commission (SEC) still isn't playing ball with Ripple. On Wednesday, the SEC filed an appeal to a July 2023 court ruling that partially dismissed claims against the company.

In response to the latest filing, Ripple chief legal officer Stuart Alderoty said the appeal was "expected" but also "just noise."

"As expected, the SEC’s appeal brief is a rehash of already failed arguments –and likely to be abandoned by the next administration. We’ll respond formally in due time. For now, know this: the SEC’s lawsuit is just noise. A new era of pro-innovation regulation is coming, and Ripple is thriving," he said on X.

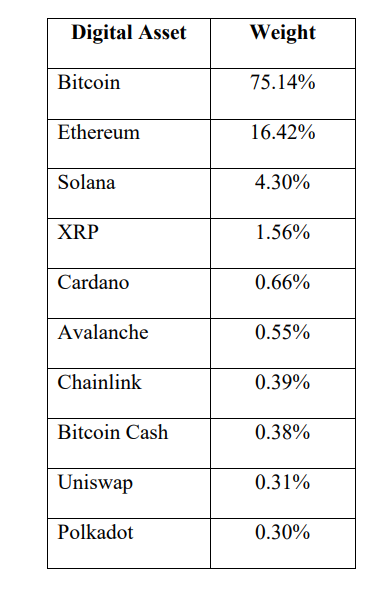

It's not just the Ripple that the SEC isn't entertaining either. Earlier in the week, the regulator pushed back its decision on the Bitwise 10 Crypto Index ETF, setting a new deadline of March 3, 2025 instead of January 17, 2025.

In a filing, the regulator said the extension allows additional time to evaluate the application, which is based on Bitwise's 10 Crypto Index Fund (BITW).

Bitcoin, Ethereum, Solana, XRP, Cardano, Avalanche, Chainlink, Bitcoin Cash, Polkadot, and Uniswap are all represented in the fund, making it the most diversified and extensive crypto ETF in the US. Yet another blow to XRP.s

But by this point, the crypto industry has built up resilience to the SEC and its ways. Now, the industry is counting down the days archnemesis Gary Gensler steps down on 20 January as the US ushers in a more crypto-friendly SEC and an even more crypto-friendly President.

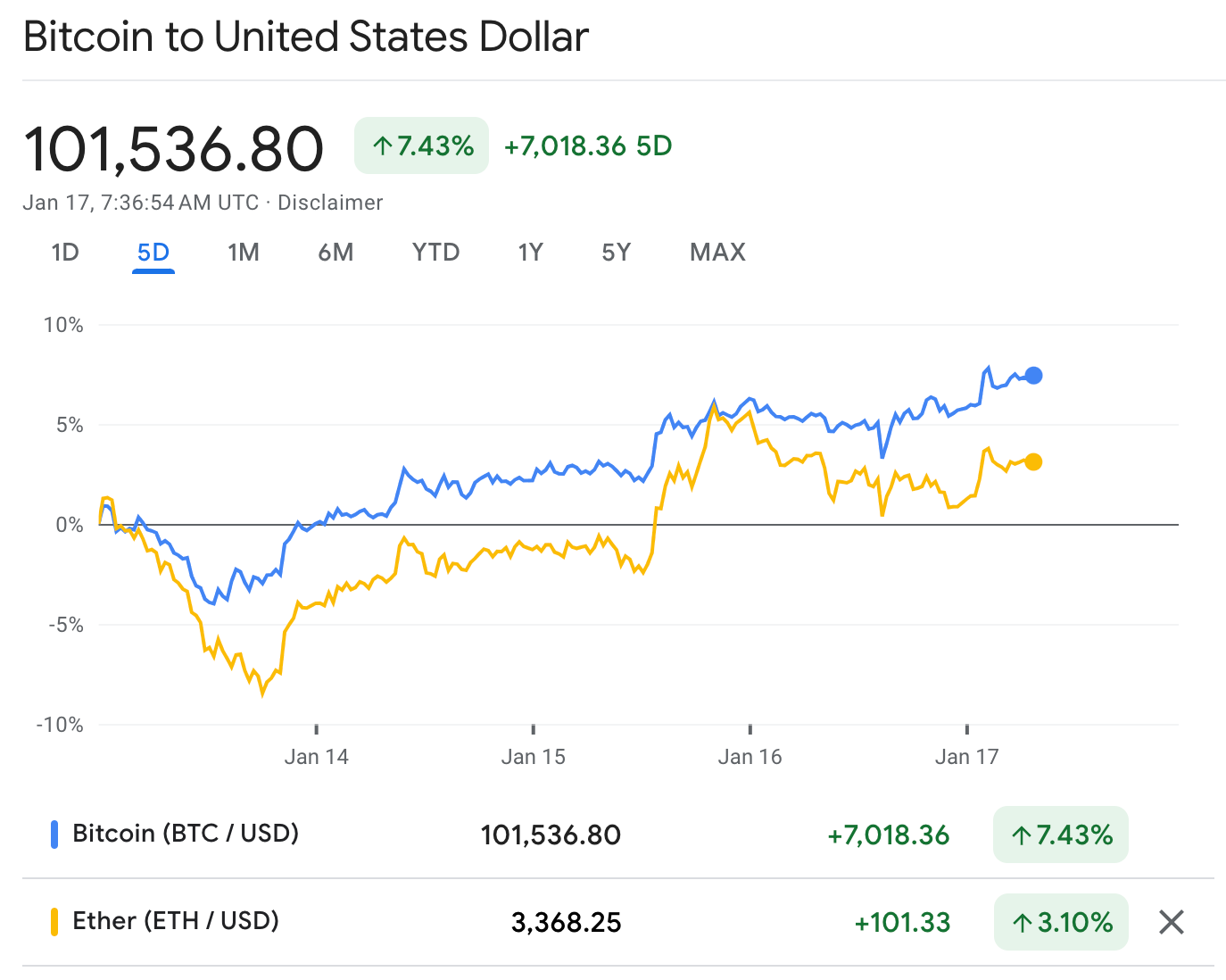

As mentioned, Bitcoin and Ethereum haven't had quite the excitement XRP has enjoyed this week. That said, neither is exactly having a bad week. Bitcoin is up over 7.4% through the week while Ethereum is up around 3.1%. Like we said, not too bad but not quite enjoying the ripples from XRP.

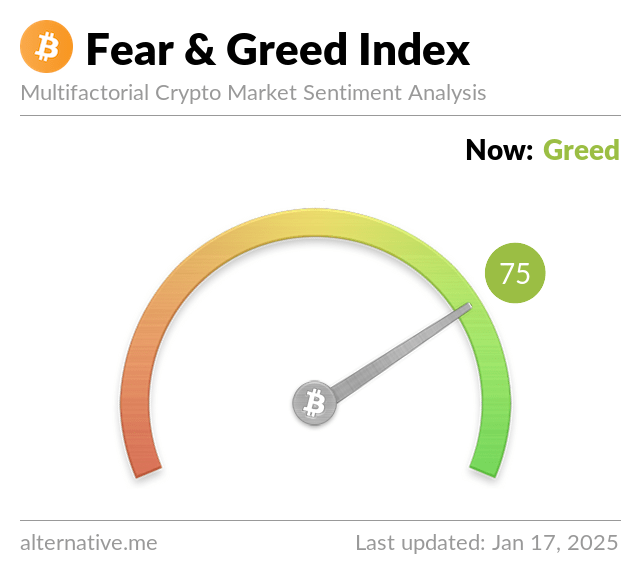

Risk appetites have intensified from last week's 50, "Neutral," to 75, "Greed." The Fear & Greed Index uses 5-6 measurements to assess the current sentiment of the market and then rates that level of emotion on a scale of 1-100 – 1 is extreme fear and 100 is extreme greed.

As always, BRN is here to explain what's really going on. "The macroeconomic backdrop remains supportive, with unemployment trending downward, inflation showing signs of easing, and the market riding a wave of enthusiasm tied to Trump’s inauguration. We maintain a bullish outlook for Q1, though a correction could materialize in the coming week if a detailed action plan is not outlined promptly by the new administration," analyst Valentin Fournier states.

Both Bitcoin and Ethereum ETFs saw significant inflows yesterday, with BTC attracting $626M and Ethereum $166M. This marks a strong return of institutional support, reversing the recent streak of outflows.

— BRN (Blockhead Research Network) (@thebrn_co) January 17, 2025

Top Stories (In No Particular Order)

XRP Soars While Market Falters - Here's Why

2024 ended on a high but now mid-way through January, there seems to be no clear indication of which way the market will head next. With many an "I told you so" being exchanged over the holiday period as Bitcoin surpassed $100,000, bulls were rejoicing in (over) confidence.

But as Bitcoin struggles to retain this momentum, one surprising altcoin has surpassed all expectations, outperforming many of the market's heavyweights: XRP.

The Ripple-related cryptocurrency, which isn't really Ripple-related (don't ask us, ask them), is up more than 23% over the week and more than 12% over the last 24 hours.

SEC Predictably Appeals Ripple Ruling, XRP Continues to Surge

The US Securities and Exchange Commission (SEC) has filed an appeal in the seemingly never-ending Ripple case.

The filing challenges a July 2023 court ruling that partially dismissed claims against the company. In October, the SEC issued an initial notice of appeal Judge Analisa Torres's August ruling in which Ripple was fined $125 million. Garlinghouse described Toress's ruling as a "victory for Ripple."

SEC Delays Bitwise 10 Crypto Index ETF Decision By Almost Two Months

The U.S. Securities and Exchange Commission (SEC) has pushed back its decision on the Bitwise 10 Crypto Index ETF, setting a new deadline of March 3, 2025 instead of January 17, 2025.

In a filing, the regulator said the extension allows additional time to evaluate the application, which is based on Bitwise's 10 Crypto Index Fund (BITW).

Malaysia PM Chats to Changpeng Zhao About Introducing Crypto Legislation

Malaysia is considering developing a digital finance policy that could formally recognize cryptocurrency and blockchain technology.

According to local media, Prime Minister Datuk Seri Anwar Ibrahim said he engaged in discussions with the Abu Dhabi government and Binance to explore the initiative.

Thailand Considers First Local Bitcoin ETF Approval

Thailand is evaluating the possibility of listing Bitcoin exchange-traded funds (ETFs) on local exchanges.

According to Bloomberg, the Securities and Exchange Commission (SEC), led by Secretary-General Pornanong Budsaratragoon, is exploring ways to open Bitcoin ETF investments to both individuals and institutions to offer exposure to Bitcoin.

Litecoin Price Surges Amid Growing Speculation of Imminent ETF Approval

Litecoin has seen a notable price increase, driven by two key factors: substantial accumulation by large holders, and increasing anticipation of a spot Litecoin ETF approval in the United States.

Litecoin, created in 2011 with the goal of being a faster and more efficient alternative to Bitcoin, currently ranks as the 25th largest cryptocurrency by market capitalization. The recent price surge has seen it trading around $118.54, marking a 17% increase in the past 24 hours, a move that diverged from the performance of many other altcoins, according to Coinmarketcap data.

VanEck Files Onchain Economy ETF Application With SEC

VanEck has filed for a new exchange-traded fund (ETF) targeting companies involved in building infrastructure for digital assets rather than crypto exposure.

Dubbed the Onchain Economy ETF, the new product aims to allocate at least 80% of its assets to "Digital Transformation Companies" and digital asset instruments.

CFTC Considers Crypto.com Probe for Super Bowl Bets

Crypto.com is potentially coming under fire from the Commodity Futures Trading Commission (CFTC) for allowing investors to bet on major football games, including the Super Bowl.

According to Bloomberg, the commission is voting on a proposal to subject contracts that might violate gaming laws to a 90-day review. However, the CFTC does not have the power to immediately halt trading and its decision would only come after the Super Bowl this year, scheduled for 9 February.

HKMA Launches Supervisory Incubator for Responsible Adoption of DLT in Banking

The Hong Kong Monetary Authority (HKMA) has unveiled a new program, the Supervisory Incubator for Distributed Ledger Technology (DLT), to facilitate its safe and effective integration into the banking sector.

The Incubator is designed to provide banks with a structured environment to explore and implement DLT-based solutions while effectively managing the associated risks, according to a statement last week.

Sony Debuts Singapore-Based Public Blockchain Platform Soneium

Sony has officially launched the mainnet of its Singapore-based Soneium blockchain.

Sony Block Solutions Labs' (Sony BSL) Ethereum Layer 2 blockchain solution went live following its testnet debut in August 2024, which saw 15.4 million active wallet addresses and over 50 million total transactions to date.

Sygnum Nets $58 Million in Funding, Achieves Unicorn Status

Swiss-Singapore digital asset bank Sygnum has announced the successful completion of a $58 million strategic growth funding round, propelling its valuation beyond the $1 billion mark and earning it the coveted "unicorn" status.

This substantial investment underscores the growing institutional interest in regulated digital asset services and positions Sygnum for significant expansion in the coming year.

Mango Markets Shuts Down Following SEC Settlement... And Hack

Mango Markets is ceasing operations following a settlement with the Securities and Exchange Commission (SEC) and its $117 million exploit in 2022, the DeFi trading platform has announced.

The shutdown process will commence on 13 January 2025 at 8PM UTC. "Mango Markets will be shutting down," Mango Markets tweeted. "It is time for users to close their positions Mango v4 & Boost are winding down. Most borrowing on Mango will be economically unviable going forward."

Meta Shareholders Call for Bitcoin Reserve to Combat Inflation

Meta shareholders are asking for the company to establish a Bitcoin reserve in an effort to fight inflation.

Ethan Peck, a Meta shareholder, called for a formal evaluation of the company's financial strategy, after expressing concerns about its cash holdings being devalued.

Events

BRN Joins Money FM 89.3's 'Money Matters: The Wealth Tracker' (5:10 pm SGT on 23 January)

BRN analyst Valentin Fournier will discuss how the crypto markets are expected to shape up in 2025 on Money FM 89.3's Wealth Tracker segment.

The discussion will explore the dynamic landscape of digital assets in 2024, focusing on key growth periods in March and November and their influence on investor expectations for 2025.

Speaking to host Hongbin Jeong, Fournier will evaluate whether opportunities remain for investing in digital assets, alongside key picks and associated risks for navigating this evolving market.

Tune in here.

Consensus (Hong Kong, 18-20 February)

Consensus is heading to Hong Kong, bringing together the industry’s most important voices from East and West for pivotal conversations and deal-making opportunities.

Consensus Hong Kong convenes global leaders in tech and finance to debate pressing issues, announce key developments and deals, and share their visions for the future.

Use promo code BLOCKDESK20 at checkout for a 20% discount on tickets here.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!