XRP Soars While Market Falters - Here's Why

2024 ended on a high but now mid-way through January, there seems to be no clear indication of which way the market will head next. With many an "I told you so" being exchanged over the holiday period as Bitcoin surpassed $100,000, bulls were rejoicing in (over) confidence.

But as Bitcoin struggles to retain this momentum, one surprising altcoin has surpassed all expectations, outperforming many of the market's heavyweights: XRP.

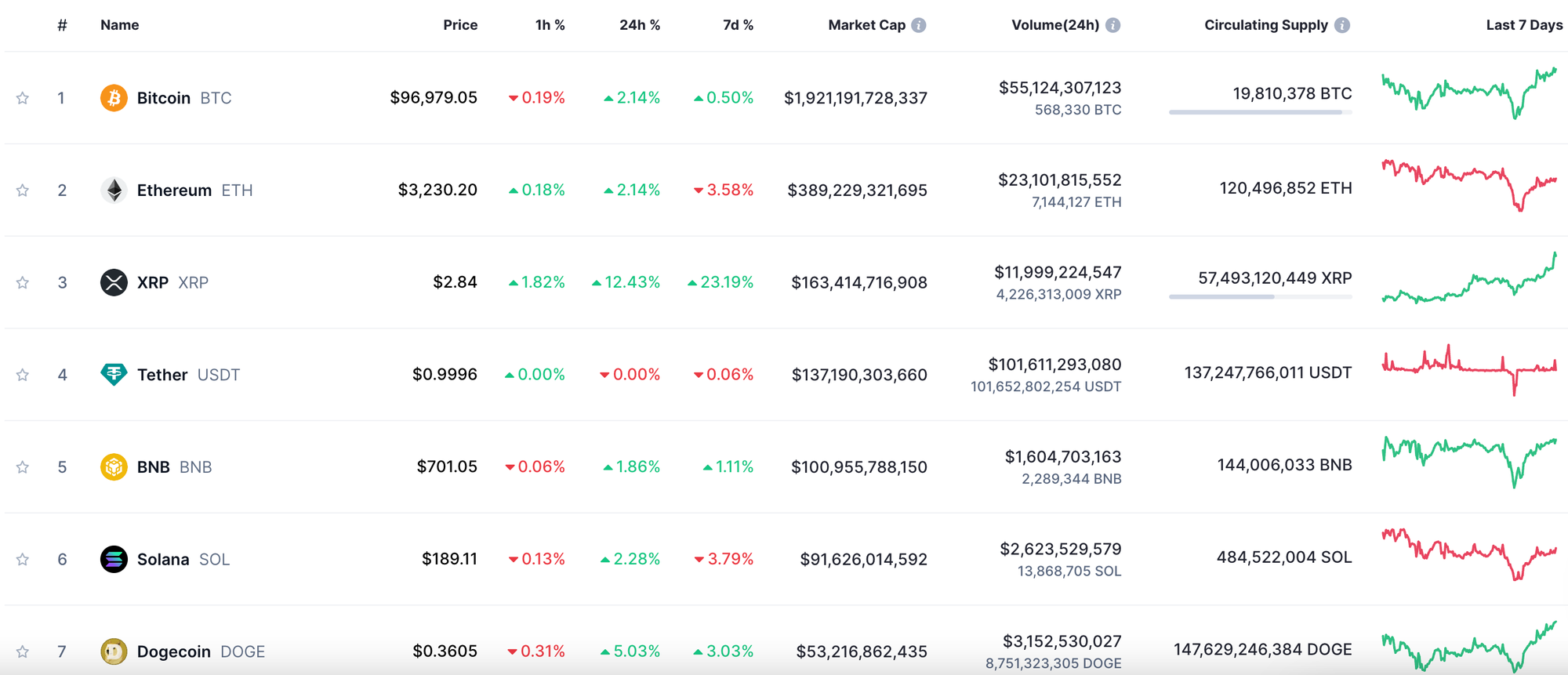

The Ripple-related cryptocurrency, which isn't really Ripple-related (don't ask us, ask them), is up more than 23% over the week and more than 12% over the last 24 hours.

Meanwhile, Bitcoin has struggled to stay green over the week with a 0.5% increase and Ethereum is in the red by 3.6%.

Even more impressively, XRP is up almost 400% from its January 2024 price while Bitcoin is up only 130%, despite hogging all the limelight.

Election Ripples

Taking a look at the graph above, it would seem that a significant catalyst hit XRP in November 2024. ICYMI or you were in a coma for the last few months, Donald Trump won the US elections that month in a landslide victory, ushering in a more welcoming environment for the crypto industry.

Earlier this month, Trump sat down for dinner with Ripple CEO Brad Garlinghouse and the firm's Chief Legal Officer, Stuart Alderoty.

"Great dinner last night with Donald Trump & Stuart Alderoty," Garlinghouse wrote. "Strong start to 2025!"

“And to top it off, the beef bourguignon was really good," Aldertoy said in a retweet.

Great dinner last night with @realDonaldTrump & @s_alderoty.

— Brad Garlinghouse (@bgarlinghouse) January 8, 2025

Strong start to 2025! pic.twitter.com/UjM6lahUG4

…and to top it off, the beef bourguignon was really good https://t.co/YKoyMuKFVo

— Stuart Alderoty (@s_alderoty) January 8, 2025

Since Trump's win, Garlinghouse has signalled a shift in Ripple's hiring business deals. Approximately 75% of current open positions are now located in the US, a shift from the past four years when most hires were based internationally. Furthermore, more U.S. deals were finalized in the last six weeks of 2024 than in the previous six months combined.

2025 is here and the Trump bull market is real. For Ripple, this is even more personal after Gensler's SEC effectively froze our business opportunities here at home for years. The optimism is obvious and very deserved.

— Brad Garlinghouse (@bgarlinghouse) January 5, 2025

Today:

✅75% of Ripple’s open roles are now US-based, while…

SEC You Later

The longstanding legal battle between Ripple and the US Securities and Exchange Commission (SEC), which dates back to December 2020, could finally be coming to a close (again).

In October, the SEC pushed back against Judge Analisa Torres's August ruling in which Ripple was fined $125 million. Garlinghouse described Toress's ruling as a "victory for Ripple."

The figure was just a sliver of what the Ripple community had potentially faced. Initially, the regulator sought $1 billion in disgorgement and prejudgment interest and $900 million in civil penalty.

Instead, Judge Torres ordered Ripple to pay $125 million in civil penalties and imposed an injunction against future securities law violations. Torres found that 1,278 institutional sale transactions by Ripple violated securities law.

In a statement at the time, an SEC spokesperson said, "We believe that the district court decision in the Ripple matter conflicts with decades of Supreme Court precedent and securities laws and look forward to making our case to the Second Circuit."

The SEC now faces a critical deadline, with its petition set for dismissal unless it files an opening brief against Ripple by January 15. Legal experts widely believe the SEC will meet the deadline.

Attorney Jeremy Hogan, said, “I’ve been getting some Qs about the January 15 SEC filing deadline in the Ripple v. SEC appeal. Don’t be surprised when the SEC’s brief IS filed timely and don’t be dismayed. This is still Gensler’s SEC. The filing on January 15 has NO effect on whether the case will be settled (I think likely) or dismissed by the new administration.”

However, Gary Gensler's tenure as SEC Chairman is set to conclude on January 20, following political pressure from former President Donald Trump, who vowed to replace him immediately upon returning to the White House.

The SEC's new leader, Paul Atkins—Trump’s nominee—has previously expressed a pro-crypto stance. This change in leadership has sparked optimism within the XRP community, with many hopeful for a less confrontational regulatory approach toward the cryptocurrency sector.

XRP ETF FTW

Bitcoin ETFs have proven to be highly lucrative products for the TradFi industry and now Wall Street wants a similar product for XRP. In October, Bitwise filed XRP exchange-traded fund (ETF) after registering a trust entity named "XRP ETF" in Delaware.

"At Bitwise, we believe blockchains will usher in new, apolitical monetary assets and permissionless applications for the 21st century,” said Bitwise CEO Hunter Horsley. “It’s why for the past seven years we’ve helped investors access the opportunities in the space, and we’re excited to continue that work with our filing for a Bitwise XRP ETP.”

Ripple has backed Bitwise's Physical XRP ETP (GXRP), previously called the European XRP ETP, which provides European investors with direct exposure to XRP.

"With the U.S. regulatory environment for crypto finally becoming more clear, this trend is poised to accelerate, further driving demand for crypto ETPs, such as the Bitwise Physical XRP ETP," Ripple CEO Brad Garlinghouse said in a press release.

"As one of the most valuable, liquid, and utility-driven digital assets, XRP is at the forefront of this momentum, standing out as a cornerstone for those seeking access to assets that are resilient and have real-world utility."

One month later, WisdomTree followed suit by registering for an XRP ETF entity in Delaware.

A filing shared on X shows that WisdomTree registered the entity titled "WisdomTree XRP Fund" in the state of Delaware on 25 November.

Bitwise also filed to create a ETF based on its 10 Crypto Index Fund, which includes XRP.

Bitcoin, Ethereum, Solana, XRP, Cardano, Avalanche, Chainlink, Bitcoin Cash, Polkadot, and Uniswap are all represented in the fund, making it the most diversified and extensive crypto ETF in the US.

The index's value is tied to the performance of the ten largest cryptocurrencies by market capitalization and has been maintained by Bitwise since 2018.

Although the SEC pushed back its decision on the Bitwise 10 Crypto Index ETF, from January 17, 2025 to March 3, 2025, the market remains optimistic.

BRN Says

If you're looking for validation about XRP's strength, BRN is here for you. Analyst Valentin Fournier explains, "XRP has experienced a recent surge amid speculation surrounding a potential ETF approval during Trump’s presidency. The token had struggled in previous years due to ongoing legal disputes with the SEC. Today marks the final day for the SEC to submit an appeal against the ruling that classified XRP as a non-security asset. This decision has not only allowed exchanges to relist XRP but also opened the door for a potential XRP ETF approval."

"Such an ETF could potentially attract $4–8 billion in inflows, representing around 5% of XRP’s current market cap. These optimistic expectations have driven a 12% price increase over the past 24 hours, signaling heightened investor excitement and greedy behavior."

Elsewhere

Events

Consensus (Hong Kong, 18-20 February)

Consensus is heading to Hong Kong, bringing together the industry’s most important voices from East and West for pivotal conversations and deal-making opportunities.

Consensus Hong Kong convenes global leaders in tech and finance to debate pressing issues, announce key developments and deals, and share their visions for the future.

Use promo code BLOCKDESK20 at checkout for a 20% discount on tickets here.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!