Speculative Spirits Get a Fed Jolt From Trump's Other Side

There are two sides to Donald Trump 2.0, which already shows even before he takes office.

Bitcoin suffered its first weekly decline since Trump's election win in early November after the Federal Reserve's hawkish pivot on Wednesday to fewer rate cuts next year than predicted earlier. The token fell about 7% last week, marking the biggest drop since just before the Fed's large cut to start its current easing cycle in September.

Federal Reserve chair Jerome Powell's battle-ready central bank is giving investors a stress test ahead of Trump's second term next year. Only a month ago, Trump and his plan to boost the US economy and make it a global crypto hub were the only topics of conversation among market participants.

However, as we enter the Christmas holiday, Powell has returned to the spotlight and is just as formidable as ever. Last week, the Fed chair took a more aggressive stance, reviving investors' fixation with inflation and causing the most significant price moves in both directions since just after the election. On Wednesday, Powell initially expressed diminishing excitement for interest-rate cuts, resulting in the most significant declines in equities, cryptos, and bonds in months.

Subsequently, sentiments markedly enhanced two days later, as the Fed's favoured inflation gauge indicated price pressures below expectations, catalyzing a cross-market rally that mitigated the S&P 500's weekly decline.

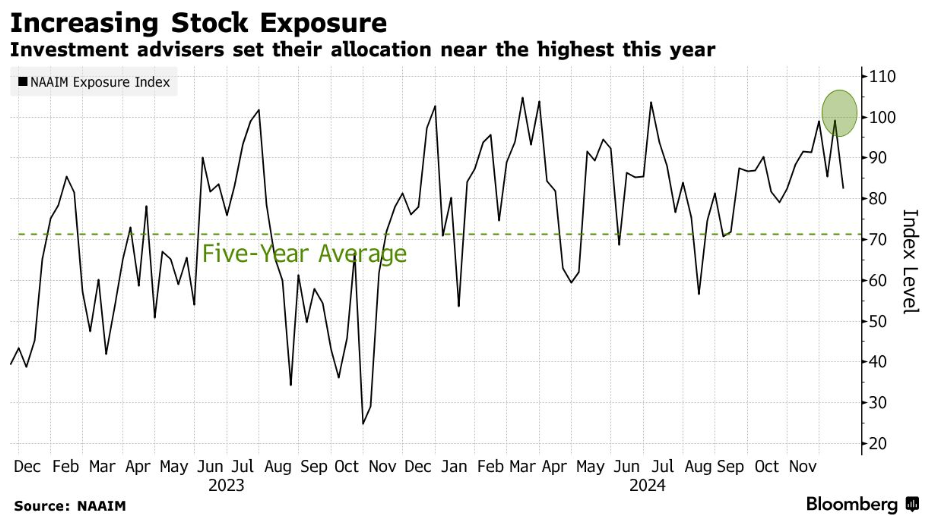

Many investors are placing high-conviction bets on the so-called risk assets, believing the Trump trade still has room to go, which is fueling the extreme movements. A global fund manager survey conducted by Bank of America revealed that allocations to US equities reached an all-time high while cash holdings virtually vanished.

There was a stampede into stock markets, even from systematic investors like volatility-controlled funds.

Cryptos, too, found new interest among portfolio managers, with Blackrock recommending an allocation of up to 2 per cent for digital assets.

Markets that have experienced extreme valuation surges due to hand-over-fist purchases are more susceptible to the direction of inflation and Powell's response.

The latest moves serve as a reminder that Trump has propelled speculative spirits to new heights and that they are at risk despite his embrace.

After the Fed pared rate cut projections, digital assets fell. Bitcoin fell to a low of $95,234 on Friday after surging to a new all-time high above $108,000 last week.

A broader measure of the cryptocurrency market, including smaller tokens like Dogecoin and Ethereum, popular among memes, had a steeper fall of around 10%.

Bloomberg data showed that a group of US Bitcoin ETFs posted a record outflow of $680 million on Thursday, ending a 15-day sequence of consecutive inflows. This highlights the change in mood.

However, analysts blame last week's fall on year-end profit-taking after a significant surge rather than a fundamental correction.

Still, technical charts show that the token's momentum is slowing after last week's record outflow from ETFs.

The original coin was trading at about $94,344, almost $14,000 lower than its record high on December 17. Still, the token has been up over 37% since the election results on November 5.

With the year coming to a close, the crypto market is expected to witness the largest options expiry event in its history on December 27.

This might lead to more volatility amid low liquidity as the holiday season begins.

Despite the market's extreme activity, signs of exhaustion were visible. The Trump euphoria-inducing straight-up trajectory of Bitcoin lost momentum, causing Michael Saylor's MicroStrategy to fall by almost 10%.

As Trump prepares to enter office and threatens tariffs on US allies and rivals, the cryptocurrency markets are likely to remain uncertain during the holiday season.

Now that the Fed is expected to ease up on monetary stimulus, the question is how fast established financial institutions will embrace this new asset class.

In 2025, Bitcoin will still be susceptible to macro and crypto-specific catalysts due to the interplay of monetary policy, institutional adoption, and political events.

Elsewhere

Blockcast

In this episode, host Takatoshi Shibayama speaks to Kain Warwick, founder of Infinex, and a renowned figure in the DeFi space, known for his work on the Synthetix protocol.

Warwick argues that the current crypto landscape, dominated by centralized exchanges, is unsustainable and hinders innovation. He outlines Infinex's vision to create a decentralized platform that rivals the convenience and accessibility of centralized exchanges while offering superior functionality and empowering users with true self-custody.

Previous episodes of Blockcast can be found on Podpage, with guests like Peter Hui (Moongate), Luca Prosperi (M^0), Charles Hoskinson (Cardano), Aneirin Flynn (Failsafe), and Yat Siu (Animoca Brands) on our most recent shows.

Events

Consensus (Hong Kong, 18-20 February)

Consensus is heading to Hong Kong, bringing together the industry’s most important voices from East and West for pivotal conversations and deal-making opportunities.

Consensus Hong Kong convenes global leaders in tech and finance to debate pressing issues, announce key developments and deals, and share their visions for the future.

Use promo code BLOCKDESK20 at checkout for a 20% discount on tickets here.

It's All Happening on LinkedIn

Did you know you can now receive Blockhead's juicy daily newsletters directly to your LinkedIn? Subscribe to our LinkedIn newsletters for the latest news and insights in the world of Web3. There also might be the occasional discount code for the industry's hottest events, exclusively for subscribers!