Table of Contents

The Trump Trade frenzy hit a wall last week after Fed Chair Jerome Powell threw a wrench in the current rate-easing cycle bets.

Wall Street hit a wall, as the globe's most powerful central banker displayed no inclination or was in a hurry to ease monetary policy on strong economic data and a resilient labour market.

The S&P 500 has experienced a decline, shedding 50% of its gains from the lowest to highest points since the election, with a 2% drop last week.

The commodities and corporate credit downturn culminated in an overall loss across all asset classes, marking the most significant one-day decline in 13 months, based on a specific metric measuring pan-assets performance.

Investor enthusiasm regarding President-elect Donald Trump's pro-business policies, such as tax reductions and deregulation, is beginning to temper, leading to a more measured perspective.

The top risk is that the Republican party's fiscal agenda could reignite inflation and compel the Fed to cut rates at a slower pace than anticipated.

Inflated asset valuation is another risk.

The existing market conditions allow a minimal margin for mistakes if growth underperforms or inflation resurfaces.

A Bloomberg model that modifies the S&P 500 earnings yield and 10-year Treasury rates for inflation indicates that the valuation of these two highly monitored assets is historically elevated.

Currently, cross-asset valuations in real terms exceed 88% of the time in data dating back to 1962.

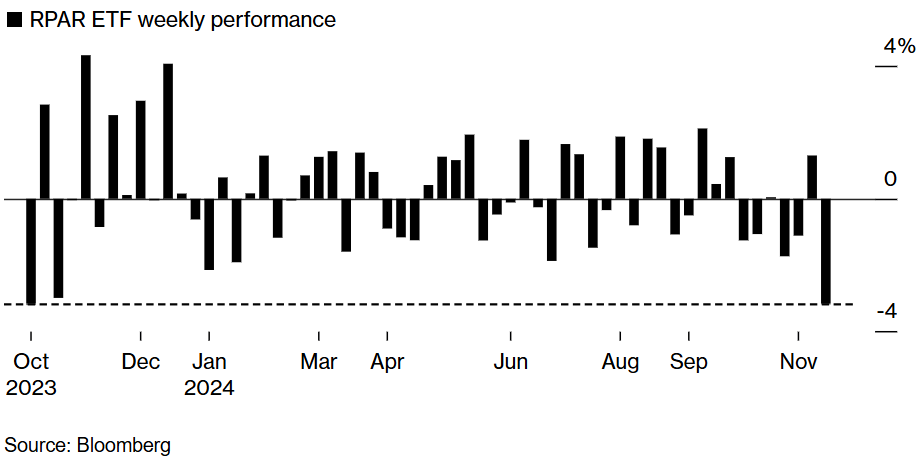

The cross-asset retreat was reflected in a strategy characterized by risk parity, which experienced its most challenging week since October 2023.

The RPAR Risk Parity ETF, which encompasses a diverse range of assets, from Treasuries to stocks and commodities, experienced a decline of 3.2%, marking its steepest drop since October 2023.

Stocks declined as the S&P 500 struggled to maintain its position above the 6,000 threshold.

The Russell 2000 index of small-cap stocks, a significant component of the Trump trade, declined 4%, marking its most substantial weekly drop in over two months.

For the fifth consecutive week, stocks and Treasury yields have diverged, indicating heightened concerns regarding inflation and the central bank's actions.

As the market recalibrates to these new expectations, investors will need to navigate a delicate balance between potential growth and the looming threat of inflation. The Fed's stance and the uncertain trajectory of fiscal policy will likely remain key drivers for the markets in the coming months, making risk management and diversification more crucial than ever.